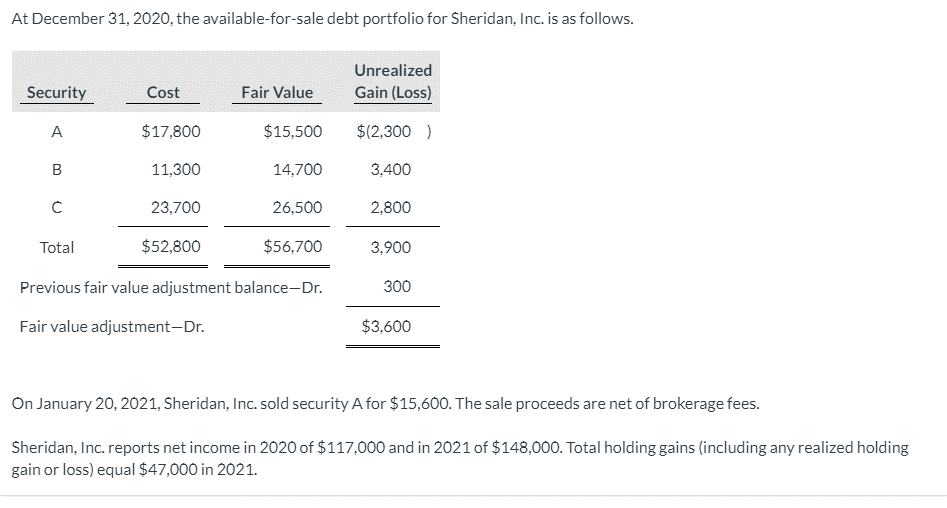

At December 31, 2020, the available-for-sale debt portfolio for Sheridan, Inc. is as follows. Unrealized Security Cost Fair Value Gain (Loss) A $17,800 $15,500 $(2,300 ) 11,300 14,700 3,400 23,700 26,500 2,800 Total $52,800 $56,700 3,900 Previous fair value adjustment balance-Dr. 300 Fair value adjustment-Dr. $3,600 On January 20, 2021, Sheridan, Inc. sold security A for $15,600. The sale proceeds are net of brokerage fees. Sheridan, Inc. reports net income in 2020 of $117,000 and in 2021 of $148,000. Total holding gains (including any realized holding gain or loss) equal $47,000 in 2021.

At December 31, 2020, the available-for-sale debt portfolio for Sheridan, Inc. is as follows. Unrealized Security Cost Fair Value Gain (Loss) A $17,800 $15,500 $(2,300 ) 11,300 14,700 3,400 23,700 26,500 2,800 Total $52,800 $56,700 3,900 Previous fair value adjustment balance-Dr. 300 Fair value adjustment-Dr. $3,600 On January 20, 2021, Sheridan, Inc. sold security A for $15,600. The sale proceeds are net of brokerage fees. Sheridan, Inc. reports net income in 2020 of $117,000 and in 2021 of $148,000. Total holding gains (including any realized holding gain or loss) equal $47,000 in 2021.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 7RE: Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith...

Related questions

Question

100%

Please help it says it is wrong.

Transcribed Image Text:At December 31, 2020, the available-for-sale debt portfolio for Sheridan, Inc. is as follows.

Unrealized

Security

Cost

Fair Value

Gain (Loss)

A

$17,800

$15,500

$(2,300 )

B

11,300

14,700

3,400

23,700

26,500

2,800

Total

$52,800

$56,700

3,900

Previous fair value adjustment balance-Dr.

300

Fair value adjustment-Dr.

$3,600

On January 20, 2021, Sheridan, Inc. sold security A for $15,600. The sale proceeds are net of brokerage fees.

Sheridan, Inc. reports net income in 2020 of $117,000 and in 2021 of $148,000. Total holding gains (including any realized holding

gain or loss) equal $47,000 in 2021.

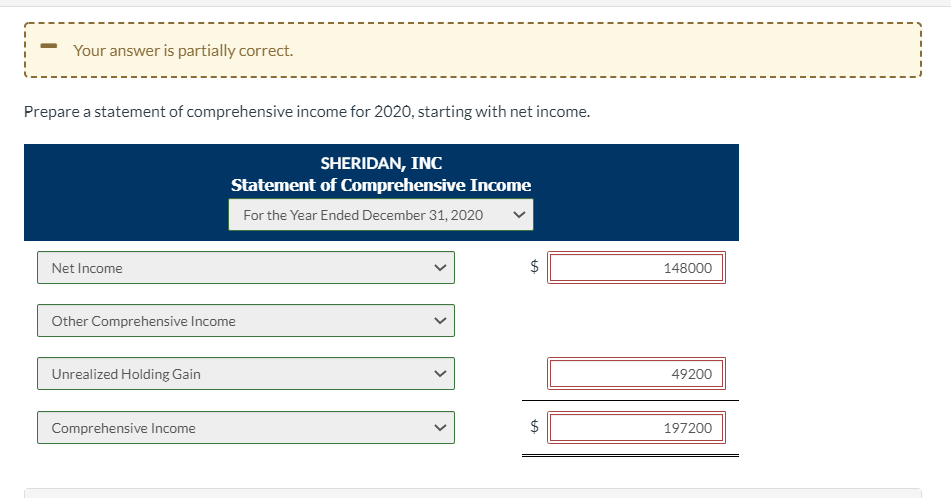

Transcribed Image Text:Your answer is partially correct.

Prepare a statement of comprehensive income for 2020, starting with net income.

SHERIDAN, INC

Statement of Comprehensive Income

For the Year Ended December 31, 2020

Net Income

148000

Other Comprehensive Income

Unrealized Holding Gain

49200

Comprehensive Income

197200

%24

%24

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning