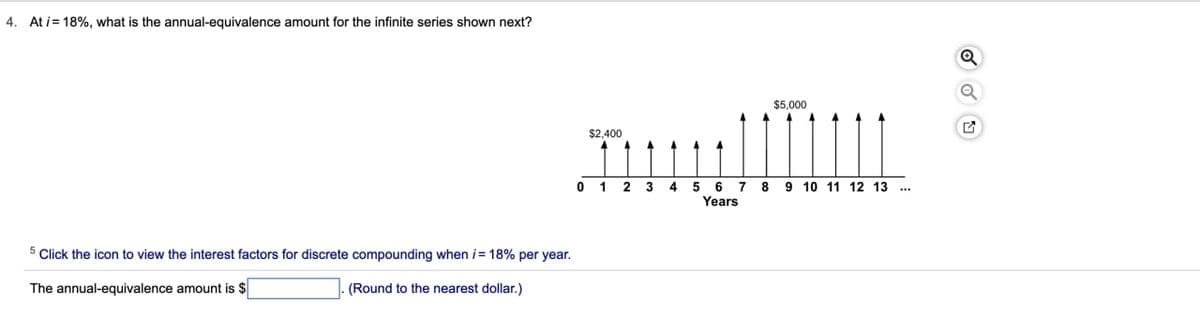

At i = 18%, what is the annual-equivalence amount for the infinite series shown next? 5 Click the icon to view the interest factors for discrete compounding when i= 18% per year. The annual-equivalence amount is $ (Round to the nearest dollar.) $2,400 $5,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Years ***

At i = 18%, what is the annual-equivalence amount for the infinite series shown next? 5 Click the icon to view the interest factors for discrete compounding when i= 18% per year. The annual-equivalence amount is $ (Round to the nearest dollar.) $2,400 $5,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 Years ***

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 9EB: If you invest $15,000 today, how much will you have in (for further instructions on future value in...

Related questions

Question

Transcribed Image Text:4. At i=18%, what is the annual-equivalence amount for the infinite series shown next?

5 Click the icon to view the interest factors for discrete compounding when i= 18% per year.

The annual-equivalence amount is $

(Round to the nearest dollar.)

$2,400

0 1 2 3

4 5 6 7

Years

8

$5,000

9 10 11 12 13

Q

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College