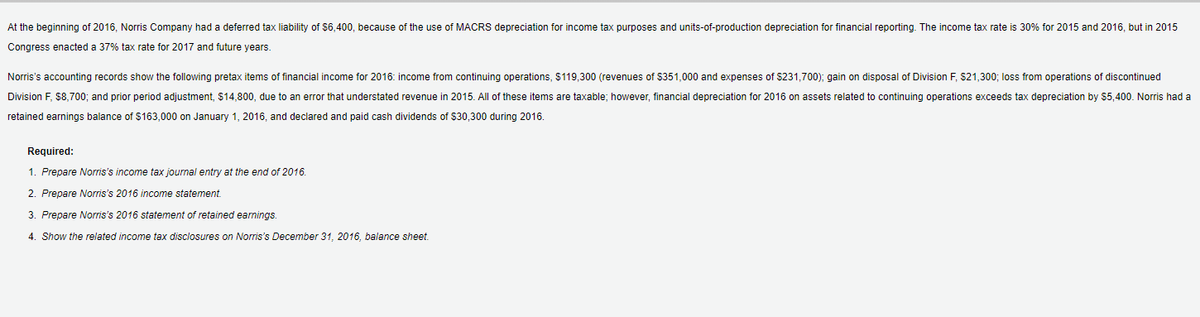

At the beginning of 2016, Norris Company had a deferred tax liability of $6,400, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial reporting. The income tax rate is 30% for 2015 and 2016, but in 2015 Congress enacted a 37% tax rate for 2017 and future years. Norris's accounting records show the following pretax items of financial income for 2016: income from continuing operations, $119,300 (revenues of $351,000 and expenses of $231,700); gain on disposal of Division F, S21,300; loss from operations of discontinued Division F, $8,700; and prior period adjustment, $14,800, due to an error that understated revenue in 2015. All of these items are taxable; however, financial depreciation for 2016 on assets related to continuing operations exceeds tax depreciation by $5,400. Norris had a retained earnings balance of $163,000 on January 1, 2016, and declared and paid cash dividends of $30,300 during 2016. Required: 1. Prepare Norris's income tax journal entry at the end of 2016. 2. Prepare Norris's 2016 income statement 3. Prepare Norris's 2016 statement of retained earnings.

At the beginning of 2016, Norris Company had a deferred tax liability of $6,400, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial reporting. The income tax rate is 30% for 2015 and 2016, but in 2015 Congress enacted a 37% tax rate for 2017 and future years. Norris's accounting records show the following pretax items of financial income for 2016: income from continuing operations, $119,300 (revenues of $351,000 and expenses of $231,700); gain on disposal of Division F, S21,300; loss from operations of discontinued Division F, $8,700; and prior period adjustment, $14,800, due to an error that understated revenue in 2015. All of these items are taxable; however, financial depreciation for 2016 on assets related to continuing operations exceeds tax depreciation by $5,400. Norris had a retained earnings balance of $163,000 on January 1, 2016, and declared and paid cash dividends of $30,300 during 2016. Required: 1. Prepare Norris's income tax journal entry at the end of 2016. 2. Prepare Norris's 2016 income statement 3. Prepare Norris's 2016 statement of retained earnings.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:At the beginning of 2016, Norris Company had a deferred tax liability of $6,400, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial reporting. The income tax rate is 30% for 2015 and 2016, but in 2015

Congress enacted a 37% tax rate for 2017 and future years.

Norris's accounting records show the following pretax items of financial income for 2016: income from continuing operations, $119,300 (revenues of $351,000 and expenses of $231,700); gain on disposal of Division F, S21,300; loss from operations of discontinued

Division F, $8,700; and prior period adjustment, $14,800, due to an error that understated revenue in 2015. All of these items are taxable; however, financial depreciation for 2016 on assets related to continuing operations exceeds tax depreciation by $5,400. Norris had a

retained earnings balance of $163,000 on January 1, 2016, and declared and paid cash dividends of $30,300 during 2016.

Required:

1. Prepare Norris's income tax journal entry at the end of 2016.

2. Prepare Norris's 2016 income statement.

3. Prepare Norris's 2016 statement of retained earnings.

4. Show the related income tax disclosures on Norris's December 31, 2016, balance sheet.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning