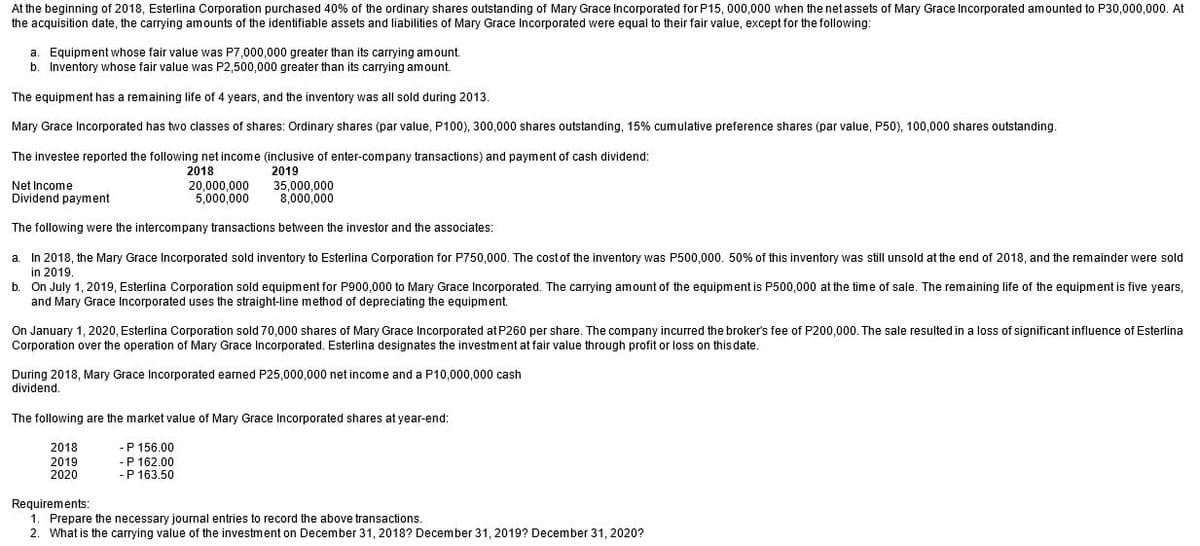

At the beginning of 2018, Esterlina Corporation purchased 40% of the ordinary shares outstanding of Mary Grace Incorporated for P15, 000,000 when the netassets of Mary Grace Incorporated amounted to P30,000,000. At the acquisition date, the carrying amounts of the identifiable assets and liabilities of Mary Grace Incorporated were equal to their fair value, except for the following: a. Equipment whose fair value was P7,000,000 greater than its carrying amount. b. Inventory whose fair value was P2,500,000 greater than its carrying amount. The equipment has a remaining life of 4 years, and the inventory was all sold during 2013. Mary Grace Incorporated has two classes of shares: Ordinary shares (par value, P100), 300,000 shares outstanding, 15% cumulative preference shares (par value, P50), 100,000 shares outstanding. The investee reported the following net income (inclusive of enter-company transactions) and payment of cash dividend: Net Income Dividend payment 2018 20,000,000 5,000,000 2019 35,000,000 ৪,000,000 The following were the intercompany transactions between the investor and the associates: a In 2018, the Mary Grace Incorporated sold inventory to Esterlina Corporation for P750,000. The costof the inventory was P500,000. 50% of this inventory was still unsold at the end of 2018, and the remainder were sold in 2019. b. On July 1, 2019, Esterlina Corporation sold equipment for P900,000 to Mary Grace Incorporated. The carrying amount of the equipment is P500,000 at the time of sale. The remaining life of the equipment is five years, and Mary Grace Incorporated uses the straight-line method of depreciating the equipment. On January 1, 2020, Esterlina Corporation sold 70,000 shares of Mary Grace Incorporated at P260 per share. The company incurred the broker's fee of P200,000. The sale resulted in a loss of significant influence of Esterlina Corporation over the operation of Mary Grace Incorporated. Esterlina designates the investment at fair value through profit or loss on this date. During 2018, Mary Grace Incorporated earned P25,000,000 net income and a P10,000,000 cash dividend. The following are the market value of Mary Grace Incorporated shares at year-end: 2018 2019 2020 -P 156.00 -P 162.00 -P 163.50 Requirements: 1. Prepare the necessary journal entries to record the above transactions. 2. What is the carrying value of the investment on December 31, 2018? December 31, 2019? December 31, 2020?

At the beginning of 2018, Esterlina Corporation purchased 40% of the ordinary shares outstanding of Mary Grace Incorporated for P15, 000,000 when the netassets of Mary Grace Incorporated amounted to P30,000,000. At the acquisition date, the carrying amounts of the identifiable assets and liabilities of Mary Grace Incorporated were equal to their fair value, except for the following: a. Equipment whose fair value was P7,000,000 greater than its carrying amount. b. Inventory whose fair value was P2,500,000 greater than its carrying amount. The equipment has a remaining life of 4 years, and the inventory was all sold during 2013. Mary Grace Incorporated has two classes of shares: Ordinary shares (par value, P100), 300,000 shares outstanding, 15% cumulative preference shares (par value, P50), 100,000 shares outstanding. The investee reported the following net income (inclusive of enter-company transactions) and payment of cash dividend: Net Income Dividend payment 2018 20,000,000 5,000,000 2019 35,000,000 ৪,000,000 The following were the intercompany transactions between the investor and the associates: a In 2018, the Mary Grace Incorporated sold inventory to Esterlina Corporation for P750,000. The costof the inventory was P500,000. 50% of this inventory was still unsold at the end of 2018, and the remainder were sold in 2019. b. On July 1, 2019, Esterlina Corporation sold equipment for P900,000 to Mary Grace Incorporated. The carrying amount of the equipment is P500,000 at the time of sale. The remaining life of the equipment is five years, and Mary Grace Incorporated uses the straight-line method of depreciating the equipment. On January 1, 2020, Esterlina Corporation sold 70,000 shares of Mary Grace Incorporated at P260 per share. The company incurred the broker's fee of P200,000. The sale resulted in a loss of significant influence of Esterlina Corporation over the operation of Mary Grace Incorporated. Esterlina designates the investment at fair value through profit or loss on this date. During 2018, Mary Grace Incorporated earned P25,000,000 net income and a P10,000,000 cash dividend. The following are the market value of Mary Grace Incorporated shares at year-end: 2018 2019 2020 -P 156.00 -P 162.00 -P 163.50 Requirements: 1. Prepare the necessary journal entries to record the above transactions. 2. What is the carrying value of the investment on December 31, 2018? December 31, 2019? December 31, 2020?

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 30E

Related questions

Question

Transcribed Image Text:At the beginning of 2018, Esterlina Corporation purchased 40% of the ordinary shares outstanding of Mary Grace Incorporated for P15, 000,000 when the netassets of Mary Grace Incorporated amounted to P30,000,000. At

the acquisition date, the carrying amounts of the identifiable assets and liabilities of Mary Grace Incorporated were equal to their fair value, except for the following:

a. Equipment whose fair value was P7,000,000 greater than its carrying amount.

b. Inventory whose fair value was P2,500,000 greater than its carrying amount.

The equipment has a remaining life of 4 years, and the inventory was all sold during 2013.

Mary Grace Incorporated has two classes of shares: Ordinary shares (par value, P100), 300,000 shares outstanding, 15% cumulative preference shares (par value, P50), 100,000 shares outstanding

The investee reported the following net income (inclusive of enter-company transactions) and payment of cash dividend:

Net Income

Dividend payment

2018

20,000,000

5,000,000

2019

35,000,000

8,000,000

The following were the intercompany transactions between the investor and the associates:

a.

In 2018, the Mary Grace Incorporated sold inventory to Esterlina Corporation for P750,000. The costof the inventory was P500,.000. 50% of this inventory was still unsold at the end of 2018, and the remainder were sold

in 2019.

b. On July 1, 2019, Esterlina Corporation sold equipment for P900,000 to Mary Grace Incorporated. The carrying amount of the equipment is P500,000 at the time of sale. The remaining life of the equipment is five years,

and Mary Grace Incorporated uses the straight-line method of depreciating the equipment.

On January 1, 2020, Esterlina Corporation sold 70,000 shares of Mary Grace Incorporated at P260 per share. The company incurred the broker's fee of P200,000. The sale resulted in a loss of significant influence of Esterlina

Corporation over the operation of Mary Grace Incorporated. Esterlina designates the investment at fair value through profit or loss on thisdate.

During 2018, Mary Grace Incorporated earned P25,000,000 net income and a P10,000,000 cash

dividend.

The following are the market value of Mary Grace Incorporated shares at year-end:

2018

-P 156.00

2019

2020

-P 162.00

-P 163.50

Requirements:

1. Prepare the necessary journal entries to record the above transactions.

2. What is the carrying value of the investment on December 31, 2018? December 31, 2019? December 31, 2020?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub