At the beginning of July, MedLab Inc. assigned P2,000,000 out accounts reccivable to BPI in consideration of a P1,400,000, 12% loa of the loan principal as scrvice charge. By the end of July, McdLab ce assigned accounts net of a P50,000 sales discount. Also, by the end customer return of merchandise amounting to P60,000. By the end of August, MedLab collected another P700,000 from the a sales discount. The company also wrote-off P80,000 as worthless ac By the cnd of September, MedLab collected another P300,000 without

At the beginning of July, MedLab Inc. assigned P2,000,000 out accounts reccivable to BPI in consideration of a P1,400,000, 12% loa of the loan principal as scrvice charge. By the end of July, McdLab ce assigned accounts net of a P50,000 sales discount. Also, by the end customer return of merchandise amounting to P60,000. By the end of August, MedLab collected another P700,000 from the a sales discount. The company also wrote-off P80,000 as worthless ac By the cnd of September, MedLab collected another P300,000 without

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11RE: On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to...

Related questions

Question

How much is the remittance of MedLab Inc. to the bank by the end of September?

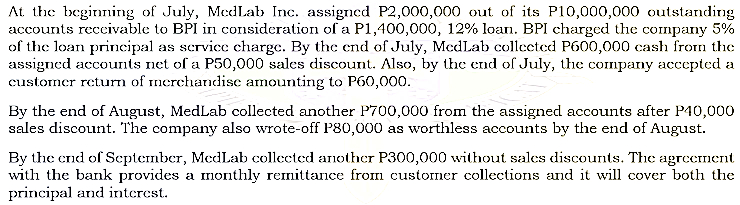

Transcribed Image Text:At the beginning of July, MedLab Inc. assigned P2,000,000 out of its P10,000,000 outstanding

accounts reccivable to BPI in consideration of a P1,400,000, 12% loan. BPI charged the company 5%

of the loan principal as servicc charge. By thc end of July, MedLab collected P600,000 cash from the

assigned accounts net of a P50,000 sales discount. Also, by the end of July, the company accepted a

customer return of merchandisc amounting to P60,000.

By the end of August, MedLab collected another P700,000 from the assigned accounts after P40,000

sales discount. The company also wrote-off P80,000 as worthless accounts by the end of August.

By the end of September, MedLab collected another P300,000 without sales discounts. The agreement

with the bank provides a monthly remittance from customer collections and it will cover both the

principal and interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College