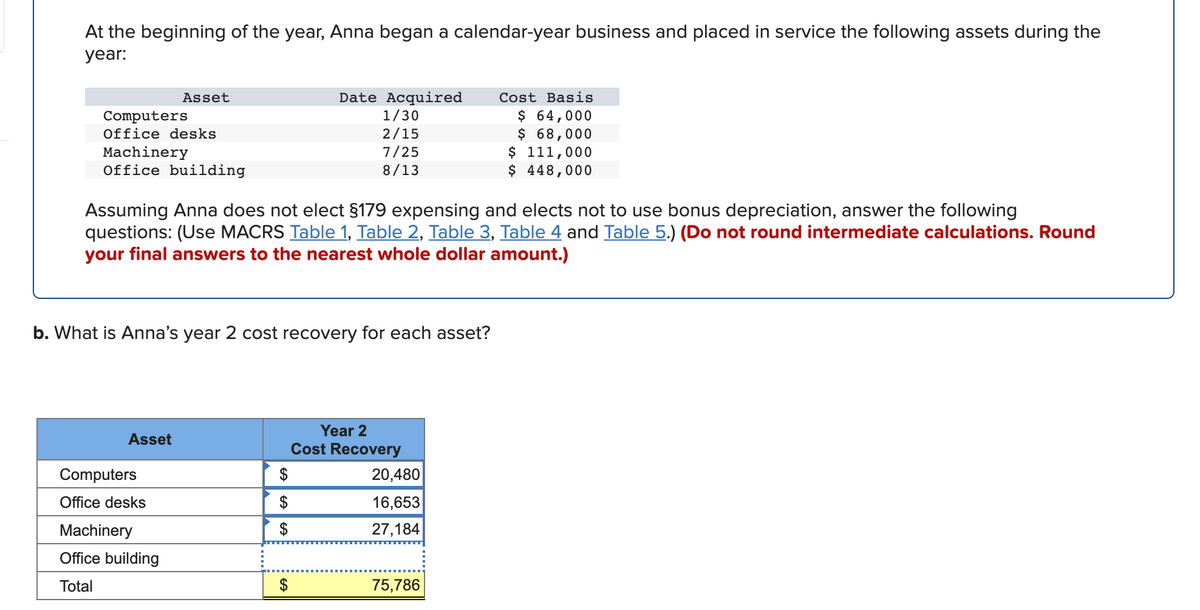

At the beginning of the year, Anna began a calendar-year business and placed in year: Date Acquired 1/30 2/15 7/25 8/13 Asset Cost Basis $ 64,000 $ 68,000 $ 111,000 $ 448,000 Computers Office desks Machinery Office building Assuming Anna does not elect §179 expensing and elects not to use bonus depr questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not ro your final answers to the nearest whole dollar amount.) at is Anna's year 2 cost recovery for each asset?

At the beginning of the year, Anna began a calendar-year business and placed in year: Date Acquired 1/30 2/15 7/25 8/13 Asset Cost Basis $ 64,000 $ 68,000 $ 111,000 $ 448,000 Computers Office desks Machinery Office building Assuming Anna does not elect §179 expensing and elects not to use bonus depr questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not ro your final answers to the nearest whole dollar amount.) at is Anna's year 2 cost recovery for each asset?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter17: Business Tax Credits And The Alternative Minimum Tax

Section: Chapter Questions

Problem 7CE

Related questions

Question

100%

Transcribed Image Text:At the beginning of the year, Anna began a calendar-year business and placed in service the following assets during the

year:

Asset

Date Acquired

Cost Basis

$ 64,000

$ 68,000

$ 111,000

$ 448,000

1/30

Computers

Office desks

2/15

7/25

Machinery

Office building

8/13

Assuming Anna does not elect §179 expensing and elects not to use bonus depreciation, answer the following

questions: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round

your final answers to the nearest whole dollar amount.)

b. What is Anna's year 2 cost recovery for each asset?

Year 2

Asset

Cost Recovery

Computers

$

20,480

Office desks

16,653

Machinery

$

27,184

Office building

Total

75,786

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning