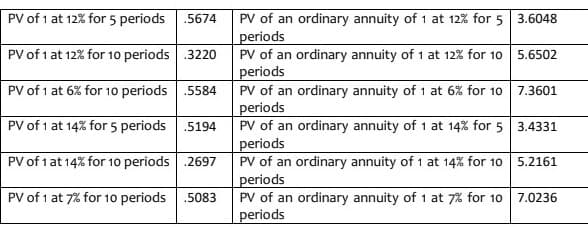

At the beginning of the year, UNIVERSE Company decided to raise additional capital by issuing 8,000 of ₱1,000 face amount 5-year bonds with interest rate of 12% payable semi-annually on June 30 and December 31. To help the sale of the bonds, share warrants are issued – one warrant for each ₱1,000 bond sold. The warrant entitles the holder to purchase five shares at ₱85 per share. The par value of the share is ₱50. It is reliably determined that the value of the warrants is ₱25 each at the time of the issuance of the bonds. The bonds are sold at 110 with warrants. The market rate of interest for similar bonds without the warrants is 14%. On December 1, 2021, half of the warrants are exercised and the rest expired. The following present value factors are made available: Prepare all entries for 2021. Compute or provide the answers for the following: 26. What is the issue price of the bonds without warrants? 27. What is the equity component upon initial recognition? 28. How much is the premium or discount on bonds upon issuance? (In the google form, if discount, put a negative sign before the numerical figure.) 29. How much cash was received upon the exercise of half of the warrants? 30. How much did the shareholders’ equity increase brought about by the transactions involving the bonds with warrants?

At the beginning of the year, UNIVERSE Company decided to raise additional capital by issuing 8,000 of

₱1,000 face amount 5-year bonds with interest rate of 12% payable semi-annually on June 30 and

December 31. To help the sale of the bonds, share warrants are issued – one warrant for each ₱1,000

bond sold. The warrant entitles the holder to purchase five shares at ₱85 per share. The par value of

the share is ₱50. It is reliably determined that the value of the warrants is ₱25 each at the time of the

issuance of the bonds. The bonds are sold at 110 with warrants. The market rate of interest for similar

bonds without the warrants is 14%. On December 1, 2021, half of the warrants are exercised and the

rest expired. The following present value factors are made available:

Prepare all entries for 2021.

Compute or provide the answers for the following:

26. What is the issue price of the bonds without warrants?

27. What is the equity component upon initial recognition?

28. How much is the premium or discount on bonds upon issuance? (In the google form, if

discount, put a negative sign before the numerical figure.)

29. How much cash was received upon the exercise of half of the warrants?

30. How much did the shareholders’ equity increase brought about by the transactions

involving the bonds with warrants?

Trending now

This is a popular solution!

Step by step

Solved in 4 steps