At the end of 2018, the shares of Çatal Ltd, a farming company, traded at $20.50 each. In its 2018 annual report, Catal had reported book value of equity of $4,500 million with 2,300 million shares outstanding. You will use analysts forecasts as your expectations for future earnings. The forecasts for earnings-per-share are $1.50 for fiscal year 2019 and $1.65 for 2020. Çatal pays no dividend. Required: Estimate the per-share value of Çatal Ltd at the beginning of 2019 using the residual earnings model based on the analysts' forecasts, with an additional forecast that residual earnings will grow at the anticipated GDP growth rate of 2 percent per year after 2020. You expect a required return of 9 percent.

At the end of 2018, the shares of Çatal Ltd, a farming company, traded at $20.50 each. In its 2018 annual report, Catal had reported book value of equity of $4,500 million with 2,300 million shares outstanding. You will use analysts forecasts as your expectations for future earnings. The forecasts for earnings-per-share are $1.50 for fiscal year 2019 and $1.65 for 2020. Çatal pays no dividend. Required: Estimate the per-share value of Çatal Ltd at the beginning of 2019 using the residual earnings model based on the analysts' forecasts, with an additional forecast that residual earnings will grow at the anticipated GDP growth rate of 2 percent per year after 2020. You expect a required return of 9 percent.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 13P: Comprehensive The following are Farrell Corporations balance sheets as of December 31, 2019, and...

Related questions

Question

Transcribed Image Text:At the end of 2018, the shares of Çatal Ltd, a farming company, traded at $20.50 each. In its

2018 annual report, Catal had reported book value of equity of $4,500 million with 2,300

million shares outstanding. You will use analysts forecasts as your expectations for future

earnings. The forecasts for earnings-per-share are $1.50 for fiscal year 2019 and $1.65 for

2020. Çatal pays no dividend.

Required:

Estimate the per-share value of Çatal Ltd at the beginning of 2019 using the residual earnings

model based on the analysts' forecasts, with an additional forecast that residual earnings will

grow at the anticipated GDP growth rate of 2 percent per year after 2020. You expect a required

return of 9 percent.

Expert Solution

Step 1

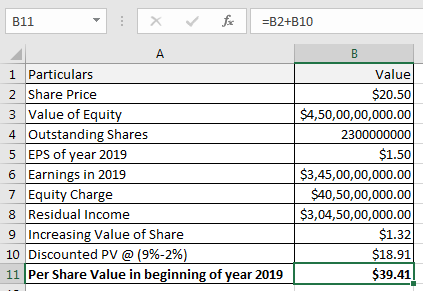

Calculation of Per Share Value at the beginning of the year 2019:

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning