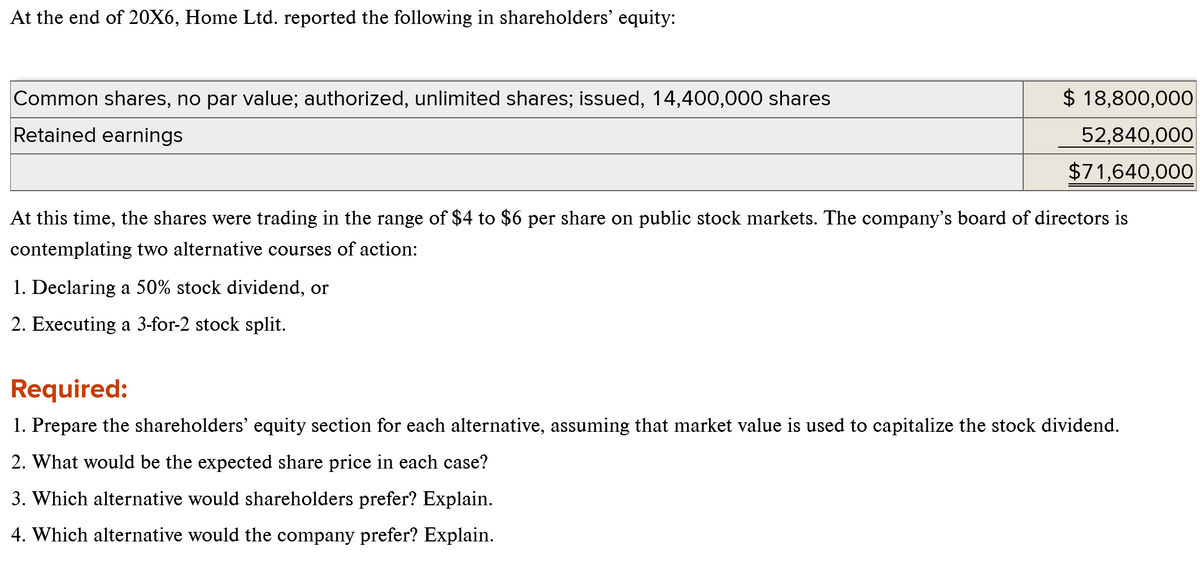

At the end of 20X6, Home Ltd. reported the following in shareholders' equity: Common shares, no par value; authorized, unlimited shares; issued, 14,400,000 shares Retained earnings $ 18,800,000 52,840,000 $71,640,000 At this time, the shares were trading in the range of $4 to $6 per share on public stock markets. The company's board of directors is contemplating two alternative courses of action: 1. Declaring a 50% stock dividend, or 2. Executing a 3-for-2 stock split. Required: 1. Prepare the shareholders' equity section for each alternative, assuming that market value is used to capitalize the stock dividend. 2. What would be the expected share price in each case? 3. Which alternative would shareholders prefer? Explain. 4. Which alternative would the company prefer? Explain.

At the end of 20X6, Home Ltd. reported the following in shareholders' equity: Common shares, no par value; authorized, unlimited shares; issued, 14,400,000 shares Retained earnings $ 18,800,000 52,840,000 $71,640,000 At this time, the shares were trading in the range of $4 to $6 per share on public stock markets. The company's board of directors is contemplating two alternative courses of action: 1. Declaring a 50% stock dividend, or 2. Executing a 3-for-2 stock split. Required: 1. Prepare the shareholders' equity section for each alternative, assuming that market value is used to capitalize the stock dividend. 2. What would be the expected share price in each case? 3. Which alternative would shareholders prefer? Explain. 4. Which alternative would the company prefer? Explain.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter13: Earnings Per Share (eps)

Section: Chapter Questions

Problem 1R: Ponce Towers, Inc., had 50,000 shares of common stock and 10,000 shares of 100 par value, 8%...

Related questions

Question

Transcribed Image Text:At the end of 20X6, Home Ltd. reported the following in shareholders' equity:

Common shares, no par value; authorized, unlimited shares; issued, 14,400,000 shares

Retained earnings

$ 18,800,000

52,840,000

$71,640,000

At this time, the shares were trading in the range of $4 to $6 per share on public stock markets. The company's board of directors is

contemplating two alternative courses of action:

1. Declaring a 50% stock dividend, or

2. Executing a 3-for-2 stock split.

Required:

1. Prepare the shareholders' equity section for each alternative, assuming that market value is used to capitalize the stock dividend.

2. What would be the expected share price in each case?

3. Which alternative would shareholders prefer? Explain.

4. Which alternative would the company prefer? Explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning