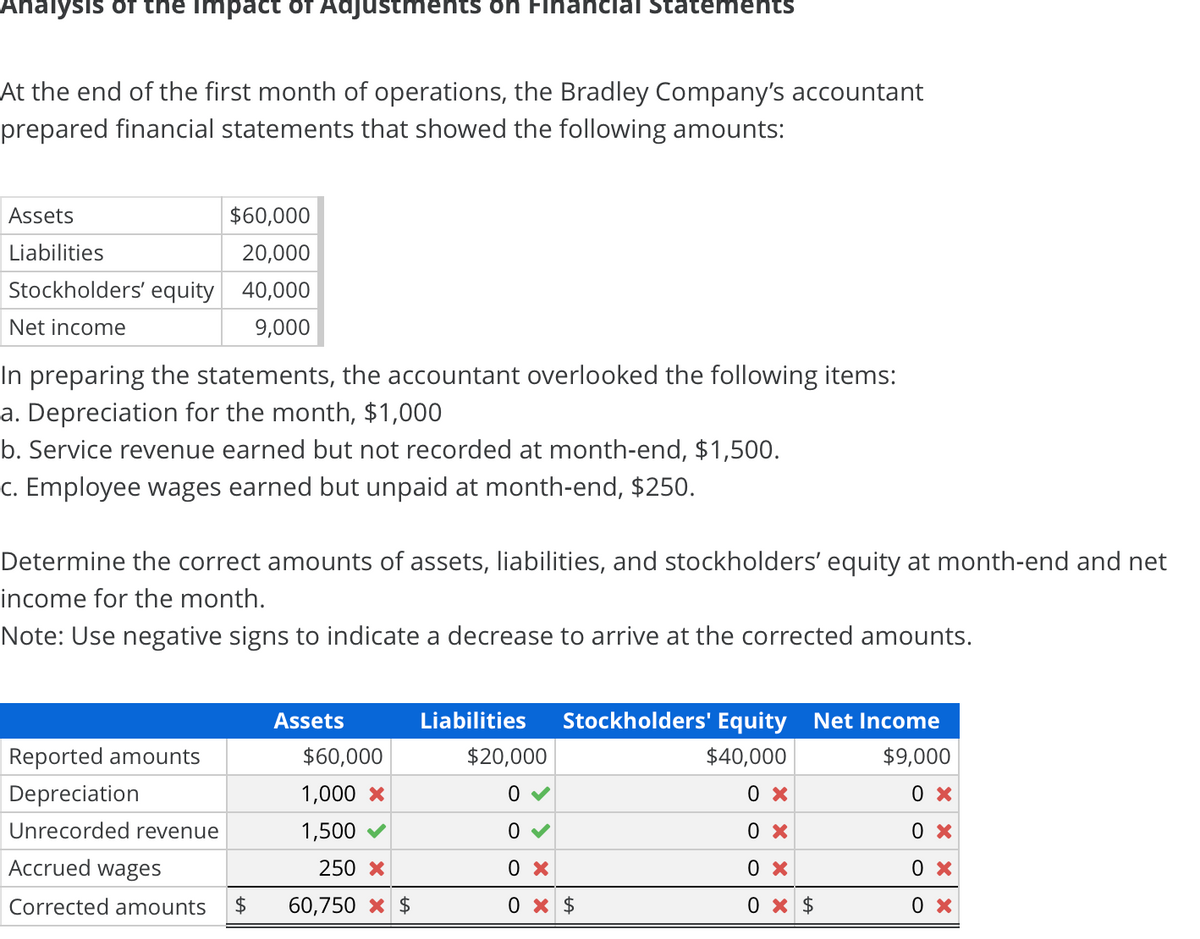

At the end of the first month of operations, the Bradley Company's accountant prepared financial statements that showed the following amounts: Assets $60,000 Liabilities 20,000 Stockholders' equity 40,000 Net income 9,000 In preparing the statements, the accountant overlooked the following items: a. Depreciation for the month, $1,000 b. Service revenue earned but not recorded at month-end, $1,500. c. Employee wages earned but unpaid at month-end, $250. Determine the correct amounts of assets, liabilities, and stockholders' equity at month-end and net income for the month. Note: Use negative signs to indicate a decrease to arrive at the corrected amounts.

At the end of the first month of operations, the Bradley Company's accountant prepared financial statements that showed the following amounts: Assets $60,000 Liabilities 20,000 Stockholders' equity 40,000 Net income 9,000 In preparing the statements, the accountant overlooked the following items: a. Depreciation for the month, $1,000 b. Service revenue earned but not recorded at month-end, $1,500. c. Employee wages earned but unpaid at month-end, $250. Determine the correct amounts of assets, liabilities, and stockholders' equity at month-end and net income for the month. Note: Use negative signs to indicate a decrease to arrive at the corrected amounts.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 6PB: Adjusting entries and errors At the end of August, the first month of operations, the following...

Related questions

Question

Transcribed Image Text:Ahalysis of the Impact of Adjustments on Fihanclal Statements

At the end of the first month of operations, the Bradley Company's accountant

prepared financial statements that showed the following amounts:

Assets

$60,000

Liabilities

20,000

Stockholders' equity 40,000

Net income

9,000

In preparing the statements, the accountant overlooked the following items:

a. Depreciation for the month, $1,000

b. Service revenue earned but not recorded at month-end, $1,500.

c. Employee wages earned but unpaid at month-end, $250.

Determine the correct amounts of assets, liabilities, and stockholders' equity at month-end and net

income for the month.

Note: Use negative signs to indicate a decrease to arrive at the corrected amounts.

Assets

Liabilities

Stockholders' Equity Net Income

Reported amounts

$60,000

$20,000

$40,000

$9,000

Depreciation

1,000 x

Unrecorded revenue

1,500

0 x

0 x

Accrued wages

250 X

0 x

0 x

Corrected amounts

$

60,750 x $

0 x $

0 x $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning