At Wayne Chemical Corporation, a multi-national company that employs 10,000 people, the plant manager in Dearborn is paid a bonus based on the plant's profitability. To increase their bonus the plant manager decides to defer replacing the roof (saving $200,000), hoping it will last another year. Unfortunately the roof leaks, damaging equipment and inventory at a cost of $10 million This situation is an example of which of the following? O Sole proprietorship O Dupont identity Fisher effect O Agency problem O Protective covenant The preferred stock of Z Company pays dividends of $3.00 per share quarterly. The dividend will not grow. Using a required rate of return of 12.00% what is the value of the preferred stock? $25.00 $4.00 O $40.00 $100.00

At Wayne Chemical Corporation, a multi-national company that employs 10,000 people, the plant manager in Dearborn is paid a bonus based on the plant's profitability. To increase their bonus the plant manager decides to defer replacing the roof (saving $200,000), hoping it will last another year. Unfortunately the roof leaks, damaging equipment and inventory at a cost of $10 million This situation is an example of which of the following? O Sole proprietorship O Dupont identity Fisher effect O Agency problem O Protective covenant The preferred stock of Z Company pays dividends of $3.00 per share quarterly. The dividend will not grow. Using a required rate of return of 12.00% what is the value of the preferred stock? $25.00 $4.00 O $40.00 $100.00

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 46P

Related questions

Question

answer the questions

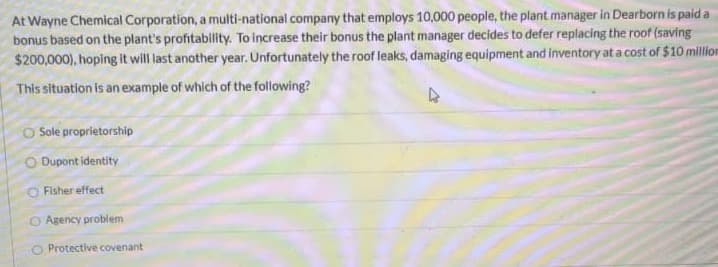

Transcribed Image Text:At Wayne Chemical Corporation, a multi-national company that employs 10,000 people, the plant manager in Dearborn is paid a

bonus based on the plant's profitability. To increase their bonus the plant manager decides to defer replacing the roof (saving

$200,000), hoping it will last another year. Unfortunately the roof leaks, damaging equipment and inventory at a cost of $10 million

This situation is an example of which of the following?

O Sole proprietorship

O Dupont identity

Fisher effect

O Agency problem

O Protective covenant

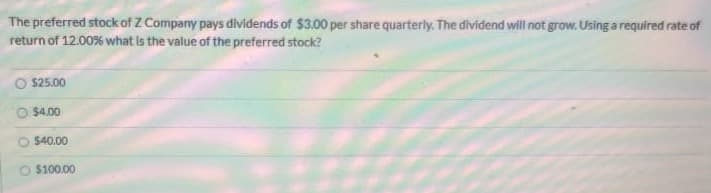

Transcribed Image Text:The preferred stock of Z Company pays dividends of $3.00 per share quarterly. The dividend will not grow. Using a required rate of

return of 12.00% what is the value of the preferred stock?

$25.00

$4.00

O $40.00

$100.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College