ATIQ, a small global jewellery and crafts marketing company, is beginning to expand into other markets in North America outside of “la Belle Province”. Its financial statements are as follows: ATIQ plans to make monthly outgoings of $2,000 in year N+1, in order to meet its financial commitments. These outgoings are made at a relatively regular rate during the year. It generally invests its liquidity (cash) in treasury bills at an average rate of return of 20%. A transaction to buy or sell treasury bills costs the firm $50. ATIQ has the privilege of being among the first customers served by the supplier. Sales of jewellery and accessories average 120 units annually. The cost of an order is $10 and the cost of holding one unit of jewellery or accessory is $2. What is the optimal quantity to order?

ATIQ, a small global jewellery and crafts marketing company, is beginning to expand into other markets in North America outside of “la Belle Province”. Its financial statements are as follows: ATIQ plans to make monthly outgoings of $2,000 in year N+1, in order to meet its financial commitments. These outgoings are made at a relatively regular rate during the year. It generally invests its liquidity (cash) in treasury bills at an average rate of return of 20%. A transaction to buy or sell treasury bills costs the firm $50. ATIQ has the privilege of being among the first customers served by the supplier. Sales of jewellery and accessories average 120 units annually. The cost of an order is $10 and the cost of holding one unit of jewellery or accessory is $2. What is the optimal quantity to order?

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.10P: Twenty metrics of liquidity, solvency, and profitability The comparative financial statements of...

Related questions

Question

ATIQ, a small global jewellery and crafts marketing company, is beginning to expand into other markets in North America outside of “la Belle Province”.

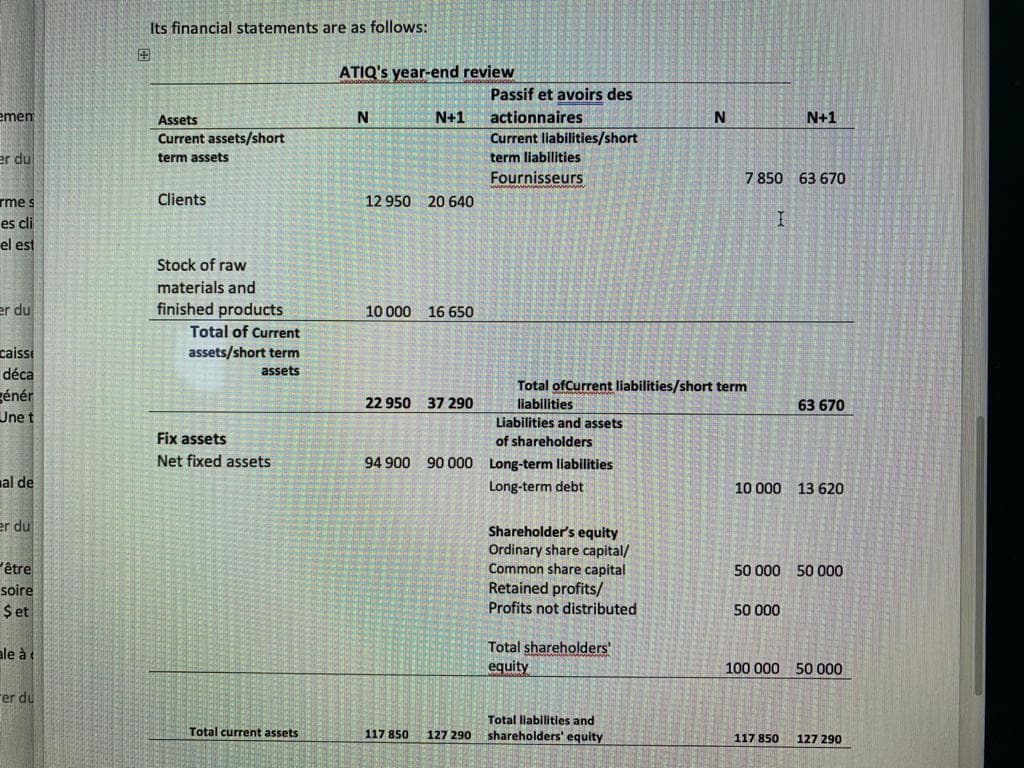

Its financial statements are as follows:

- ATIQ plans to make monthly outgoings of $2,000 in year N+1, in order to meet its financial commitments. These outgoings are made at a relatively regular rate during the year. It generally invests its liquidity (cash) in treasury bills at an average

rate of return of 20%. A transaction to buy or sell treasury bills costs the firm $50. - ATIQ has the privilege of being among the first customers served by the supplier. Sales of jewellery and accessories average 120 units annually. The cost of an order is $10 and the cost of holding one unit of jewellery or accessory is $2. What is the optimal quantity to order?

Transcribed Image Text:Its financial statements are as follows:

国

ATIQ's year-end review

Passif et avoirs des

emen

Assets

N+1

actionnaires

N+1

Current liabilities/short

term liabilities

Current assets/short

er du

term assets

Fournisseurs

7 850 63 670

Clients

12 950 20 640

rme s

es cli

el est

Stock of raw

materials and

er du

finished products

10 000 16 650

Total of Current

caisse

assets/short term

déca

assets

énér

Une t

Total ofCurrent liabilities/short term

liabilities

Liabilities and assets

22 950

37 290

63 670

Fix assets

of shareholders

Net fixed assets

900

90 000

Long-term liabilities

al de

Long-term debt

10 000 13 620

er du

Shareholder's equity

Ordinary share capital/

Common share capital

'être

soire

$et

50 000 50 000

Retained profits/

Profits not distributed

50 000

Total shareholders'

equity

ale à

100 000 50 000

rer du

Total liabilities and

shareholders' equity

Total current assets

117 850

127 290

117 850

127 290

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning