Aug. 1: Received amount owed on June 2 note plus interest at the maturity date. Description Debit Credit Cash Notes Receivable Interest Revenue Aug. 24: Received $7,600 on the Finley account and wrote ofr the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for uncollectible receivables.) Description Debit Credit Bad Debt Expense Allowance for Doubtful Accounts Sept. 15: Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Description Debit Credit Cash Short and Over

Aug. 1: Received amount owed on June 2 note plus interest at the maturity date. Description Debit Credit Cash Notes Receivable Interest Revenue Aug. 24: Received $7,600 on the Finley account and wrote ofr the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for uncollectible receivables.) Description Debit Credit Bad Debt Expense Allowance for Doubtful Accounts Sept. 15: Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Description Debit Credit Cash Short and Over

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

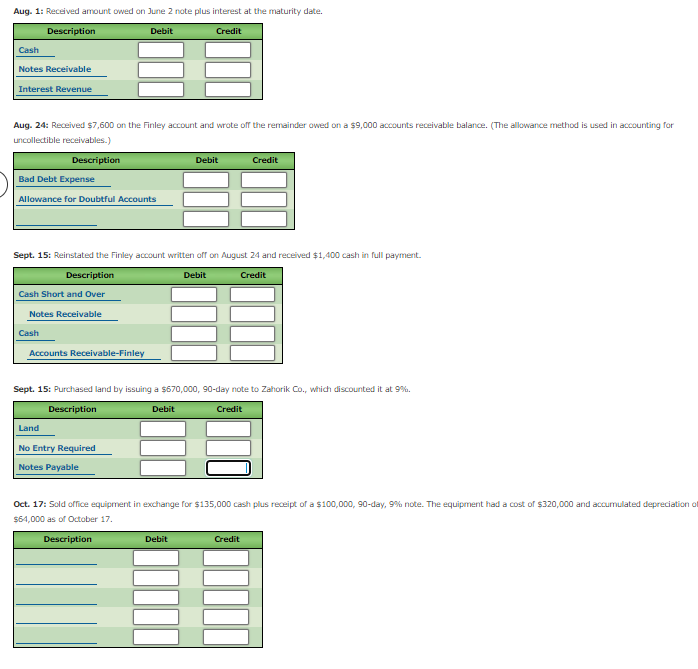

Transcribed Image Text:Aug. 1: Received amount owed on June 2 note plus interest at the maturity date.

Description

Debit

Credit

Cash

Notes Receivable

Interest Revenue

Aug. 24: Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for

uncollectible receivables.)

Description

Debit

Credit

Bad Debt Expense

Allowance for Doubtful Accounts

Sept. 15: Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment.

Description

Debit

Credit

Cash Short and Over

Notes Receivable

Cash

Accounts Receivable-Finley

Sept. 15: Purchased land by issuing a $670,000, 90-day note to Zahorik Co., which discounted it at 9%.

Description

Debit

Credit

Land

No Entry Required

Notes Payable

Oct. 17: Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000, 90-day, 9% note. The equipment had a cost of $320,000 and accumulated depreciation of

$64,000 as of October 17.

Description

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,