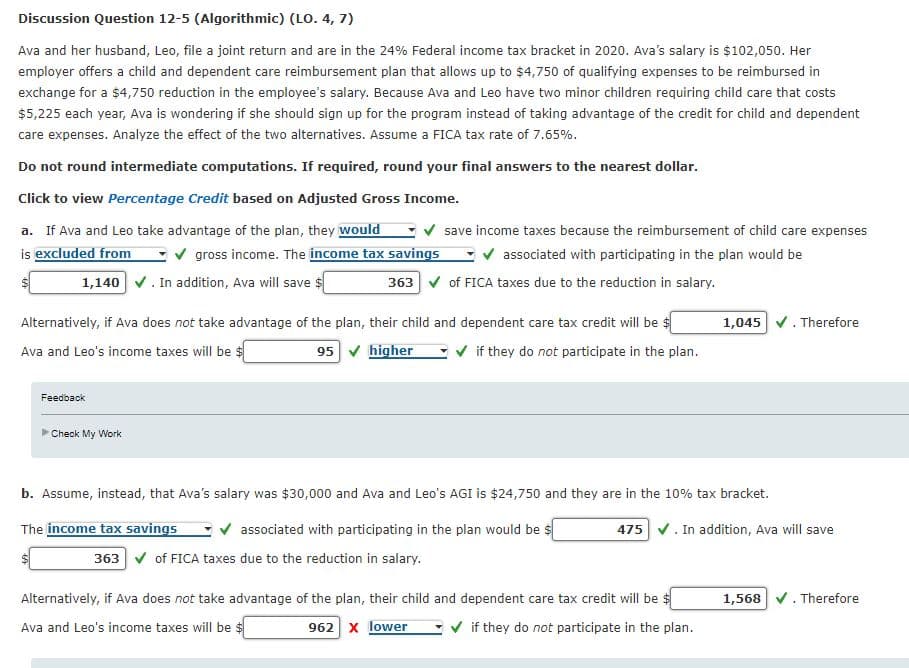

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020. Ava's salary is $102,050. Her employer offers a child and dependent care reimbursement plan that allows up to $4,750 of qualifying expenses to be reimbursed in exchange for a $4,750 reduction in the employee's salary. Because Ava and Leo have two minor children requiring child care that costs $5,225 each year, Ava is wondering if she should sign up for the program instead of taking advantage of the credit for child and dependent care expenses. Analyze the effect of the two alternatives. Assume a FICA tax rate of 7.65%. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Click to view Percentage Credit based on Adjusted Gross Income. a. If Ava and Leo take advantage of the plan, they would save income taxes because the reimbursement of child care expenses is excluded from v gross income. The income tax savings Ev associated with participating in the plan would be 1,140 v. In addition, Ava will save $ 363 v of FICA taxes due to the reduction in salary. 1,045 v. Therefore Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $ 95 v higher Ava and Leo's income taxes will be s v if they do not participate in the plan. Feedback Check My Work b. Assume, instead, that Ava's salary was $30,000 and Ava and Leo's AGI is $24,750 and they are in the 10% tax bracket. The income tax savings associated with participating in the plan would be s 475 v. In addition, Ava will save 363 v of FICA taxes due to the reduction in salary. Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $ 1,568 v. Therefore Ava and Leo's income taxes will be $ 962 x lower v if they do not participate in the plan.

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020. Ava's salary is $102,050. Her employer offers a child and dependent care reimbursement plan that allows up to $4,750 of qualifying expenses to be reimbursed in exchange for a $4,750 reduction in the employee's salary. Because Ava and Leo have two minor children requiring child care that costs $5,225 each year, Ava is wondering if she should sign up for the program instead of taking advantage of the credit for child and dependent care expenses. Analyze the effect of the two alternatives. Assume a FICA tax rate of 7.65%. Do not round intermediate computations. If required, round your final answers to the nearest dollar. Click to view Percentage Credit based on Adjusted Gross Income. a. If Ava and Leo take advantage of the plan, they would save income taxes because the reimbursement of child care expenses is excluded from v gross income. The income tax savings Ev associated with participating in the plan would be 1,140 v. In addition, Ava will save $ 363 v of FICA taxes due to the reduction in salary. 1,045 v. Therefore Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $ 95 v higher Ava and Leo's income taxes will be s v if they do not participate in the plan. Feedback Check My Work b. Assume, instead, that Ava's salary was $30,000 and Ava and Leo's AGI is $24,750 and they are in the 10% tax bracket. The income tax savings associated with participating in the plan would be s 475 v. In addition, Ava will save 363 v of FICA taxes due to the reduction in salary. Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $ 1,568 v. Therefore Ava and Leo's income taxes will be $ 962 x lower v if they do not participate in the plan.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

Transcribed Image Text:Discussion Question 12-5 (Algorithmic) (LO. 4, 7)

Ava and her husband, Leo, file a joint return and are in the 24% Federal income tax bracket in 2020. Ava's salary is $102,050. Her

employer offers a child and dependent care reimbursement plan that allows up to $4,750 of qualifying expenses to be reimbursed in

exchange for a $4,750 reduction in the employee's salary. Because Ava and Leo have two minor children requiring child care that costs

$5,225 each year, Ava is wondering if she should sign up for the program instead of taking advantage of the credit for child and dependent

care expenses. Analyze the effect of the two alternatives. Assume a FICA tax rate of 7.65%.

Do not round intermediate computations. If required, round your final answers to the nearest dollar.

Click to view Percentage Credit based on Adjusted Gross Income.

a. If Ava and Leo take advantage of the plan, they would

is excluded from

а.

save income taxes because the reimbursement of child

are expenses

v gross income. The income tax savings

v associated with participating in the plan would be

1,140 v. In addition, Ava will save $

363 v of FICA taxes due to the reduction in salary.

Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $

1,045 v. Therefore

Ava and Leo's income taxes will be $

95 v higher

if they do not participate in the plan.

Feedback

Check My Work

b. Assume, instead, that Ava's salary was $30,000 and Ava and Leo's AGI is $24,750 and they are in the 10% tax bracket.

The income tax savings

associated with participating in the plan would be $

475 v. In addition, Ava will save

363 v of FICA taxes due to the reduction in salary.

Alternatively, if Ava does not take advantage of the plan, their child and dependent care tax credit will be $

1,568 V. Therefore

Ava and Leo's income taxes will be $

962 x lower

v if they do not participate in the plan.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning