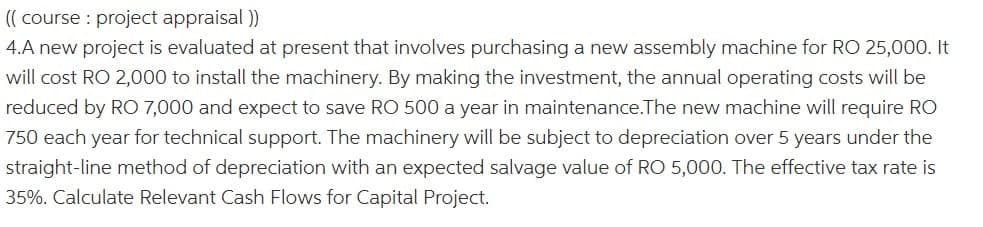

ave RO 500 a year in maintenance.The nev

Q: A man planned of building house. The cost of construction is P500,000 while annual maintenance cost…

A: Capitalized cost refers to the present worth of cash flows which go on for an infinite period of…

Q: A machine needs P15, 000 annually for its maintenance during its perpetual life. Find the present…

A: Annual maintenance cost = P 15,000 Interest rate = 4%

Q: A machine costs £15,000 and its useful economic life is 5 years. After 5 years, the machine’s scrap…

A: GIVEN, cost = 15000 n=5 net cash inflow = 5000 machine scrap = 3000

Q: The first-year maintenance cost for a new car is estimated to be $100, and it increases at a uniform…

A: Today’s worth of dollars at a later date is the Present Value of the dollar. For example, the value…

Q: A TV is costs P90,000. Its estimated scrap value is P10,000 after 8 years. Solve for the constant…

A: Depreciation is decrease in the value of fixed asset due to wear and tear, and passage of time.

Q: The following are the costs for one of the alternatives to construct a new bridge: Construction cost…

A: We are given the costs of an alternative to construct a new bridge. The initial construction cost…

Q: A machine will cost $30,000 to purchase. Annual operating and maintenance costs (O&M) will be…

A:

Q: A special purpose machine toolset costs $20,000. The toolset will be financed through a bank loan of…

A: The question is based on the calculation for benefit of buying a special purpose machine , which is…

Q: A 50-passenger bus can be purchased for $95,000. An annual net profit of $400 per passenger is…

A:

Q: A set of Wire Bond machine costs $500,000. This amount includes freight and installation charges…

A: Depreciation expense for the year = Depreciable cost* ( Remaining useful life)/(Sum of Years…

Q: It costs P500,000.00 at the end of each year to maintain a section of Kenon Road in Baguio city. If…

A: Here, Current Annual Cost is P500,000 Required Annual Cost is P100,000 Interest Rate is 10%

Q: A house and lot can be acquired a down payment of P500000 and a yearly payment of P150000 at the end…

A: Down payment = P 500000 Yearly payment = P 150000 Number of payments = 10 Annual interest rate = 14%

Q: A certain machine costs GH¢25000 and lasts 6 years, after which time it has a scrap value of…

A: A capitalized cost of an asset is the cost incurred on an asset to put it to use. Capitalized cost…

Q: Determine the capitalized cost of an alternative that has a first cost of $55,000 an annual…

A: First cost = $ 55000 Annual cost = $ 12000 Cost every 5 years = $ 20,000 Annual interest rate = 11%

Q: 3% compounded annually, what was the equivalent uniform annual cost for the 12-year period? Include…

A: An item of expenditure on a capital asset that brings back the asset to its working position is…

Q: A concrete bridge was constructed at a cost of P 1,500,000.00. Annual maintenance is P 15,000.00 and…

A: Please refer to the image below.

Q: A bedroom is costs P30,000. Its estimated scrap value is P15,000 after 8 years. Solve for the…

A: Sinking fund is one of the technique for calculating the depreciation. It is the fund maintained…

Q: An engineer invest P3M in concrete making. In return, he receives P235,000.00 per year for 5 years.…

A: Return on investment or rate of return is defined as the return obtained from the investment made.…

Q: Amachine has an initial cost of P 40 000 and an annual maintenance cost of P 5 000. Its useful life…

A: Benefit cost ratio is a method used to determine the relationship between costs and the benefit of a…

Q: Determine the capitalized cost of the building that is worth P50M, with maintenance cost of…

A: First cost (C) = P 50 million Annual cost (A) = P 15000 for 5 years, P 20000 afterwards Once in 5…

Q: rate is 6%,

A: Capitalized cost of house = Cost of construction + Present value of maintenance cost

Q: intenance money for a new building has been sou nake a donation to cover all future expected mainte…

A: In this we need to find out the present value of all cost that would be gift required today.

Q: transport company sets aside funds to maintain its trucks. It anticipates spending $3,000 on repairs…

A: In this we have to calculate present value of expenses and than find out equivalent annual expenses.

Q: A building is to be paid indefinitely at the rate of 6%. The building's price is P1M if paid in…

A: SOLUTION- Compounding is done by the lenders when they provide interest on amount which includes…

Q: A four-stroke motorbike costs P75 000.00. It will have a salvage value of P10 000.00 when worn out…

A: Motorbike costs = P 75000 Salvage value at the end of eight years = P 10000 Interest rate (r) = 5%…

Q: A company estimates that a certain piece of machinery will have to be replaced in five years' time…

A: Future value of growing annuity = [P/(r-g)] *((1+r)^n - (1+g)^n / (r-g)) P = Initial payment = 2000…

Q: A special purpose machine tool set would cost $20,000. The tool set will befinanced by a $10,000…

A: The concept used to determine the effective investment to compare the present value of cash outflows…

Q: If an anset costs $50600 and is expected to have a $4900 salvage value at the end of its 9-year…

A: cash flow statement is a financial statement which provides data of all the cash inflows form…

Q: A project has a first cost of $75,000, operating and maintenance costs of $10,000 during each year…

A: First cost (C) = $75000 Annual cost (A) = $10000 n = 8 years Salvage value (S) = $15000 r = 12%

Q: The purchase price of a property, land and improvement, was Php 16,250,000. You put 20% down payment…

A: Computing the Net Operating Income: The net operating income is calculated as the difference between…

Q: A machine will cost $30,000 to purchase. Annual operating and maintenance costs (O&M) will be…

A: A method of capital budgeting that helps to evaluate the present value of cash flow and a series of…

Q: Air handling equipment that costs P12, 000 has a life of eight years with a P2, 000 salvage value.…

A: calculation of book vale end of year 4 are as follows

Q: A buffing machine is costs P10,000. Its estimated scrap value is P1,000 after 9 years. Solve for the…

A: In sinking Fund method the depreciation is calculated as follows Sinking Fund Method Depreciation =…

Q: A permanent investment has an initial cost of $3.550.000 and an annual income of $234,500. What is…

A: ROR Analysis is also known as Rate of Return analysis which determines the adequate rate of return…

Q: A machine was bought for 500,000.00 with borrowed money at an interest rate of 14%. The annual cost…

A: Machine should be capitalized at purchase cost. The interest payable on borrowed money & annual…

Q: nd spent the following amounts for the maintenance of the machine she bought: PhP 4,000 each yea…

A: Present value of future cash flow is value of money today that is equivalent to future cash flow…

Q: An engineer invest P3M in concrete making. In return, he receives P235,000.00 per year for 5 years.…

A: Total return = Return per year x no. of years = 235000 x 5 years = 1,175,000

Q: A building cost P8.5 million and the salvage value is P50,000 after 23 years. The annual maintenance…

A: The present worth analysis is an analysis where all the present values are calculated. All the…

Q: Annual maintenance costs of a tunnel considered to have an eternal life are $ 500. is worth. The…

A: Capitalization = Initial Investment + Present Value of maintenance cost

Q: ma

A: PW(present worth cost)=P50,000 INT(interest rate) i = 0.12 repair cost P4,000 occurs every 4…

Q: Margaret has a project with a $28 000 first cost that returns $5000 per year over its 10-year life.…

A: Payback Period: Simple Payback Period: The payback period of an investment is the length of time…

Q: Determine the capitalized cost for an asphalt road that will require a construction cost of 10M, 50…

A: The following information has been provided in the question: Construction cost of asphalt road= 10M…

Q: A commercial bldg. can be acquired by a downpayment of P500,000 and a yearly payment of P100,000 at…

A: Down Payment = 500,000 Loan Repayments start after 5 years Time period (N) = 10 years Annual…

Q: Maintenance costs stuff on equipment is 20,000 pesos a year for two years , 40,000 pesos at the end…

A: Interest rate is 10% Compounded annually. To Find: Semi annual amount

Q: A road resurfacing project costs $250,000, lasts 5 years and saves $150,000 annually in patching…

A: The benefit-cost ratio shows the relationship between the relative costs and benefits of the…

Q: Calculate the capital value for the investment below. Basic investment DKK 385,000 Residual value…

A: Capital value: It is the net current worth of cash flows of an investment.

Q: A new airconditioning unit costs P150,000 and will have a salvage value of P15,000 after 5 years.…

A: The question is based on the concept of Annuity and Present value in Financial Management. Annuity…

Q: A bridge that was constructed at a cost of P75,000,000 is expected to last 30 years, at the end of…

A: Capitalized cost refers to the present worth of cash flows that go on for an infinite period of…

Step by step

Solved in 2 steps

- Friedman Company is considering installing a new IT system. The cost of the new system is estimated to be 2,250,000, but it would produce after-tax savings of 450,000 per year in labor costs. The estimated life of the new system is 10 years, with no salvage value expected. Intrigued by the possibility of saving 450,000 per year and having a more reliable information system, the president of Friedman has asked for an analysis of the projects economic viability. All capital projects are required to earn at least the firms cost of capital, which is 12 percent. Required: 1. Calculate the projects internal rate of return. Should the company acquire the new IT system? 2. Suppose that savings are less than claimed. Calculate the minimum annual cash savings that must be realized for the project to earn a rate equal to the firms cost of capital. Comment on the safety margin that exists, if any. 3. Suppose that the life of the IT system is overestimated by two years. Repeat Requirements 1 and 2 under this assumption. Comment on the usefulness of this information.You are also considering another project that has a physical life of 3 years—that is, the machinery will be totally worn out after 3 years. However, if the project were terminated prior to the end of 3 years, the machinery would have a positive salvage value. Here are the project’s estimated cash flows: Using the 10% cost of capital, what is the project’s NPV if it is operated for the full 3 years? Would the NPV change if the company planned to terminate the project at the end of Year 2? At the end of Year 1? What is the project’s optimal (economic) life?Wendys boss wants to use straight-line depreciation for the new expansion project because he said it will give higher net income in earlier years and give him a larger bonus. The project will last 4 years and requires 1,700,000 of equipment. The company could use either straight line or the 3-year MACRS accelerated method. Under straight-line depreciation, the cost of the equipment would be depreciated evenly over its 4-year life. (Ignore the half-year convention for the straight-line method.) The applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%, as discussed in Appendix 11A. The project cost of capital is 10%, and its tax rate is 25%. a. What would the depreciation expense be each year under each method? b. Which depreciation method would produce the higher NPV, and how much higher would it be? c. Why might Wendys boss prefer straight-line depreciation?

- Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?Although the Chen Company’s milling machine is old, it is still in relatively good working order and would last for another 10 years. It is inefficient compared to modern standards, though, and so the company is considering replacing it. The new milling machine, at a cost of $110,000 delivered and installed, would also last for 10 years and would produce after-tax cash flows (labor savings and depreciation tax savings) of $19,000 per year. It would have zero salvage value at the end of its life. The project cost of capital is 10%, and its marginal tax rate is 25%. Should Chen buy the new machine?Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided manufacturing system. The annual net cash benefits and savings associated with the system are described as follows: The system will cost 9,000,000 and last 10 years. The companys cost of capital is 12 percent. Required: 1. Calculate the payback period for the system. Assume that the company has a policy of only accepting projects with a payback of five years or less. Would the system be acquired? 2. Calculate the NPV and IRR for the project. Should the system be purchasedeven if it does not meet the payback criterion? 3. The project manager reviewed the projected cash flows and pointed out that two items had been missed. First, the system would have a salvage value, net of any tax effects, of 1,000,000 at the end of 10 years. Second, the increased quality and delivery performance would allow the company to increase its market share by 20 percent. This would produce an additional annual net benefit of 300,000. Recalculate the payback period, NPV, and IRR given this new information. (For the IRR computation, initially ignore salvage value.) Does the decision change? Suppose that the salvage value is only half what is projected. Does this make a difference in the outcome? Does salvage value have any real bearing on the companys decision?