ax rate arvalue ond price 0.2500 1,000 962.72 ond maturity in years 15 ond coupon rate ond coupon payment amount umber of compounding periods per year ell for "1" ell for "-1" leld, semi-annual 0.0813 81.25 1 -1 leld, nominal --- annualized ost of long-term debt, semi-annual ost of long-term debt, nominal --- annualized referred stock par value 100 referred stock dividend as percentage 0.0850 referred stock dividend payments per year 1 referred stock perpetuity price 112.00 referred stock dividend ost of preferred stock ommon stock price 25.00 1.10 ommon stock growth rate 0.06 eta isk-free rate Market risk premium 1.2 0.0220 0.0375 ond-yield risk premium ost of equity CAPM ost of equity DCF 0.0400 ost of equity Bond-Yield-Risk Premium verage lotation cost as percentage 0.125 ost of new common equity Weights Costs arget capital debt arget capital preferred arget capital common equity 0.35 0.10 0.55 Weights Costs arget capital debt arget capital preferred arget capital common equity 0.35 0.10 0.55

ax rate arvalue ond price 0.2500 1,000 962.72 ond maturity in years 15 ond coupon rate ond coupon payment amount umber of compounding periods per year ell for "1" ell for "-1" leld, semi-annual 0.0813 81.25 1 -1 leld, nominal --- annualized ost of long-term debt, semi-annual ost of long-term debt, nominal --- annualized referred stock par value 100 referred stock dividend as percentage 0.0850 referred stock dividend payments per year 1 referred stock perpetuity price 112.00 referred stock dividend ost of preferred stock ommon stock price 25.00 1.10 ommon stock growth rate 0.06 eta isk-free rate Market risk premium 1.2 0.0220 0.0375 ond-yield risk premium ost of equity CAPM ost of equity DCF 0.0400 ost of equity Bond-Yield-Risk Premium verage lotation cost as percentage 0.125 ost of new common equity Weights Costs arget capital debt arget capital preferred arget capital common equity 0.35 0.10 0.55 Weights Costs arget capital debt arget capital preferred arget capital common equity 0.35 0.10 0.55

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 9P: Bond Yield and After-Tax Cost of Debt A companys 6% coupon rate, semiannual payment, 1,000 par value...

Related questions

Question

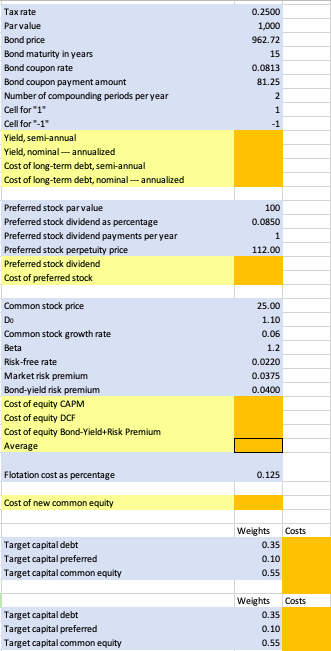

Use data to complet excel chart, please don't only fill in the orange cells with the correct answer, but also show how you got the formula to get the answer!

Transcribed Image Text:Tax rate

0.2500

Parvalue

1,000

Bond price

962.72

Bond maturity in years

15

Bond coupon rate

0.0813

Bond coupon payment amount

81.25

Number of compounding periods per year

2

Cell for "1"

1

Cell for "-1"

-1

Yield, semi-annual

Yield, nominal -- annualized

Cost of long-term debt, semi-annual

Cost of long-term debt, nominal - annualized

Preferred stock par value

Preferred stock dilvidend as percentage

100

0.0850

Preferred stock dividend payments per year

Preferred stock perpetuity price

112.00

Preferred stock dividend

Cost of preferred stock

Common stock price

25.00

Do

1.10

Common stock growth rate

0.06

Beta

1.2

Risk-free rate

0.0220

Market risk premium

0.0375

Bond-yield risk premium

0.0400

Cost of equity CAPM

Cost of equity DCF

Cost of equity Bond-Yield+Risk Premium

Average

Flotation cost as percentage

0.125

Cost of new common equity

Weights

0.35

Costs

Target capital debt

Target capital preferred

0.10

Target capital common equity

0.55

Weights

Costs

Target capital debt

Target capital preferred

0.35

0.10

Target capital common equity

0.55

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning