(b) Chichi is unsure whether she should use her own car or rent a car to go on an extended cross-country trip for two (2) weeks during the mid-term break. Explain and identify which of the above costs are relevant and which are irrelevant in her decision.

(b) Chichi is unsure whether she should use her own car or rent a car to go on an extended cross-country trip for two (2) weeks during the mid-term break. Explain and identify which of the above costs are relevant and which are irrelevant in her decision.

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 46P

Related questions

Question

Transcribed Image Text:(b) Chichi is unsure whether she should use her own car or rent a car to go on an

extended cross-country trip for two (2) weeks during the mid-term break. Explain

and identify which of the above costs are relevant and which are irrelevant in her

decision.

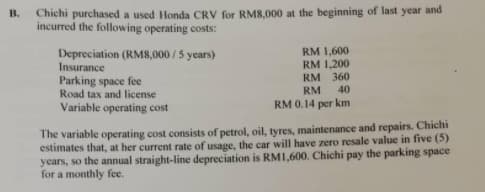

Transcribed Image Text:Chichi purchased a used Honda CRV for RM8,000 at the beginning of last year and

incurred the following operating costs:

B.

RM 1,600

RM 1,200

Depreciation (RM8,000/ 5 years)

Insurance

Parking space fee

Road tax and license

RM 360

40

RM

Variable operating cost

RM 0.14 per km

The variable operating cost consists of petrol, oil, tyres, maintenance and repairs. Chichi

estimates that, at her current rate of usage, the car will have zero resale value in five (5)

years, so the annual straight-line depreciation is RMI,600. Chichi pay the parking space

for a monthly fee.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT