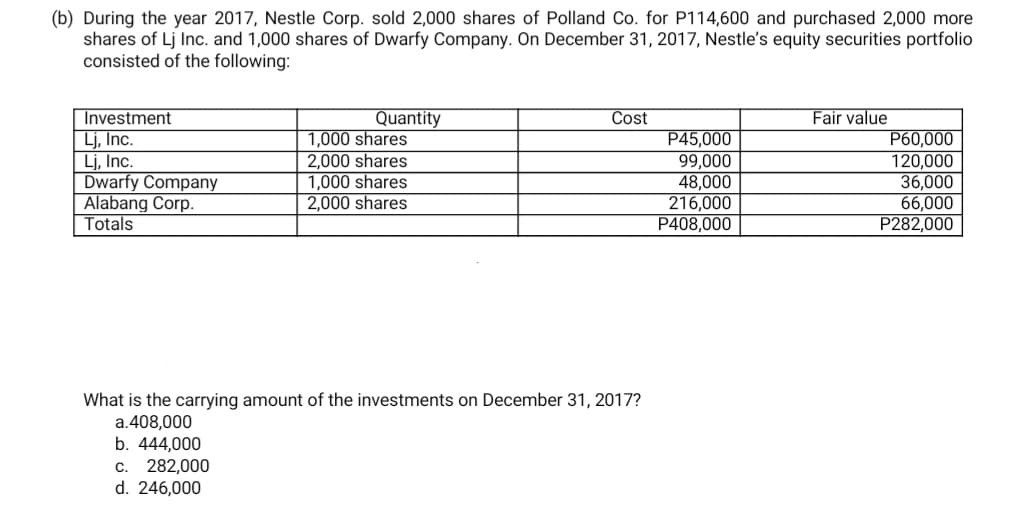

(b) During the year 2017, Nestle Corp. sold 2,000 shares of Polland Co. for P114,600 and purchased 2,000 more shares of Lj Inc. and 1,000 shares of Dwarfy Company. On December 31, 2017, Nestle's equity securities portfolio consisted of the following: Quantity 1,000 shares 2,000 shares 1,000 shares 2,000 shares Fair value Investment Lj, Inc. Lj, Inc. Dwarfy Company Alabang Corp. Totals Cost P45,000 99,000 48,000 216,000 P408,000 P60,000 120,000 36,000 66,000 P282,000 What is the carrying amount of the investments on December 31, 2017? a.408,000 b. 444,000 c. 282,000 d. 246,000

(b) During the year 2017, Nestle Corp. sold 2,000 shares of Polland Co. for P114,600 and purchased 2,000 more shares of Lj Inc. and 1,000 shares of Dwarfy Company. On December 31, 2017, Nestle's equity securities portfolio consisted of the following: Quantity 1,000 shares 2,000 shares 1,000 shares 2,000 shares Fair value Investment Lj, Inc. Lj, Inc. Dwarfy Company Alabang Corp. Totals Cost P45,000 99,000 48,000 216,000 P408,000 P60,000 120,000 36,000 66,000 P282,000 What is the carrying amount of the investments on December 31, 2017? a.408,000 b. 444,000 c. 282,000 d. 246,000

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 15E

Related questions

Question

Transcribed Image Text:(b) During the year 2017, Nestle Corp. sold 2,000 shares of Polland Co. for P114,600 and purchased 2,000 more

shares of Lj Inc. and 1,000 shares of Dwarfy Company. On December 31, 2017, Nestle's equity securities portfolio

consisted of the following:

Fair value

Investment

Lj, Inc.

Lj, Inc.

Dwarfy Company

Alabang Corp.

Totals

Quantity

1,000 shares

2,000 shares

1,000 shares

2,000 shares

Cost

P45,000

99,000

48,000

216,000

P408,000

P60,000

120,000

36,000

66,000

P282,000

What is the carrying amount of the investments on December 31, 2017?

a.408,000

b. 444,000

282,000

d. 246,000

C.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning