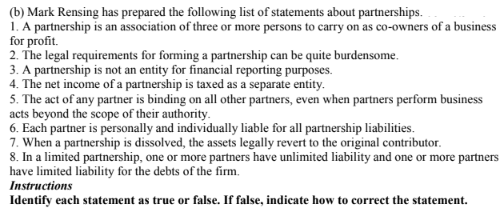

(b) Mark Rensing has prepared the following list of statements about partnerships. 1. A partnership is an association of three or more persons to carry on as co-owners of a business for profit. 2. The legal requirements for forming a partnership can be quite burdensome. 3. A partnership is not an entity for financial reporting purposes. 4. The net income of a partnership is taxed as a separate entity. 5. The act of any partner is binding on all other partners, even when partners perform business acts beyond the scope of their authority. 6. Each partner is personally and individually liable for all partnership liabilities. 7. When a partnership is dissolved, the assets legally revert to the original contributor. 8. In a limited partnership, one or more partners have unlimited liability and one or more partners have limited liability for the debts of the firm. Instructions Identify each statement as true or false. If false, indicate how to correct the statement.

(b) Mark Rensing has prepared the following list of statements about partnerships. 1. A partnership is an association of three or more persons to carry on as co-owners of a business for profit. 2. The legal requirements for forming a partnership can be quite burdensome. 3. A partnership is not an entity for financial reporting purposes. 4. The net income of a partnership is taxed as a separate entity. 5. The act of any partner is binding on all other partners, even when partners perform business acts beyond the scope of their authority. 6. Each partner is personally and individually liable for all partnership liabilities. 7. When a partnership is dissolved, the assets legally revert to the original contributor. 8. In a limited partnership, one or more partners have unlimited liability and one or more partners have limited liability for the debts of the firm. Instructions Identify each statement as true or false. If false, indicate how to correct the statement.

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 21DQ

Related questions

Question

Transcribed Image Text:(b) Mark Rensing has prepared the following list of statements about partnerships.

1. A partnership is an association of three or more persons to carry on as co-owners of a business

for profit.

2. The legal requirements for forming a partnership can be quite burdensome.

3. A partnership is not an entity for financial reporting purposes.

4. The net income of a partnership is taxed as a separate entity.

5. The act of any partner is binding on all other partners, even when partners perform business

acts beyond the scope of their authority.

6. Each partner is personally and individually liable for all partnership liabilities.

7. When a partnership is dissolved, the assets legally revert to the original contributor.

8. In a limited partnership, one or more partners have unlimited liability and one or more partners

have limited liability for the debts of the firm.

Instructions

Identify each statement as true or false. If false, indicate how to correct the statement.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT