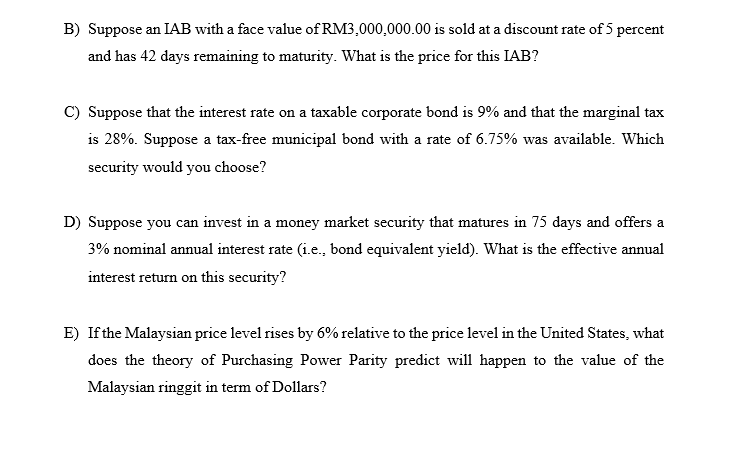

B) Suppose an IAB with a face value of RM3,000,000.00 is sold at a discount rate of 5 percent and has 42 days remaining to maturity. What is the price for this IAB?

B) Suppose an IAB with a face value of RM3,000,000.00 is sold at a discount rate of 5 percent and has 42 days remaining to maturity. What is the price for this IAB?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter11: Determining The Cost Of Capital

Section: Chapter Questions

Problem 16P

Related questions

Question

Transcribed Image Text:B) Suppose an IAB with a face value of RM3,000,000.00 is sold at a discount rate of 5 percent

and has 42 days remaining to maturity. What is the price for this IAB?

Suppose that the interest rate on a taxable corporate bond is 9% and that the marginal tax

is 28%. Suppose a tax-free municipal bond with a rate of 6.75% was available. Which

security would you choose?

D) Suppose you can invest in a money market security that matures in 75 days and offers a

3% nominal annual interest rate (i.e., bond equivalent yield). What is the effective annual

interest return on this security?

E) If the Malaysian price level rises by 6% relative to the price level in the United States, what

does the theory of Purchasing Power Parity predict will happen to the value of the

Malaysian ringgit in term of Dollars?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,