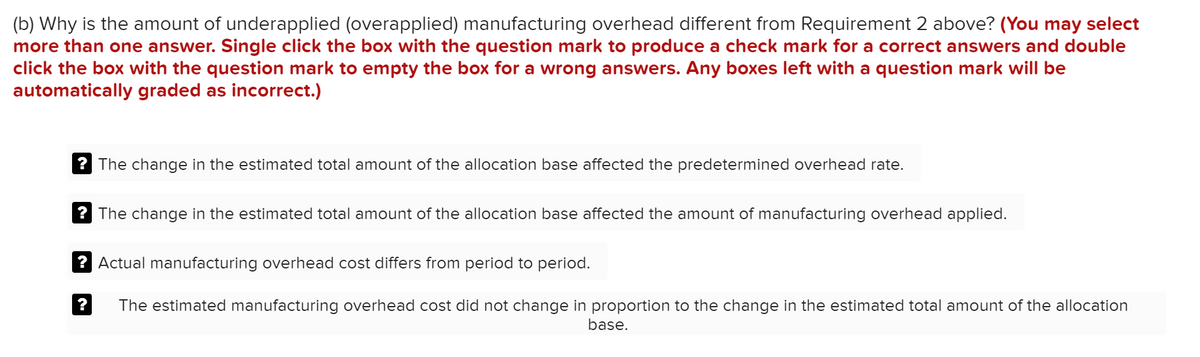

(b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answers. Any boxes left with a question mark will be automatically graded as incorrect.) ? The change in the estimated total amount of the allocation base affected the predetermined overhead rate. ? The change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied. ? Actual manufacturing overhead cost differs from period to period. ? The estimated manufacturing overhead cost did not change in proportion to the change in the estimated total amount of the allocation base.

(b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double click the box with the question mark to empty the box for a wrong answers. Any boxes left with a question mark will be automatically graded as incorrect.) ? The change in the estimated total amount of the allocation base affected the predetermined overhead rate. ? The change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied. ? Actual manufacturing overhead cost differs from period to period. ? The estimated manufacturing overhead cost did not change in proportion to the change in the estimated total amount of the allocation base.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter4: Job-order Costing And Overhead Application

Section: Chapter Questions

Problem 35BEB: Use the following information for Brief Exercises 4-34 and 4-35: Sanjay Company manufactures a...

Related questions

Question

Info in images

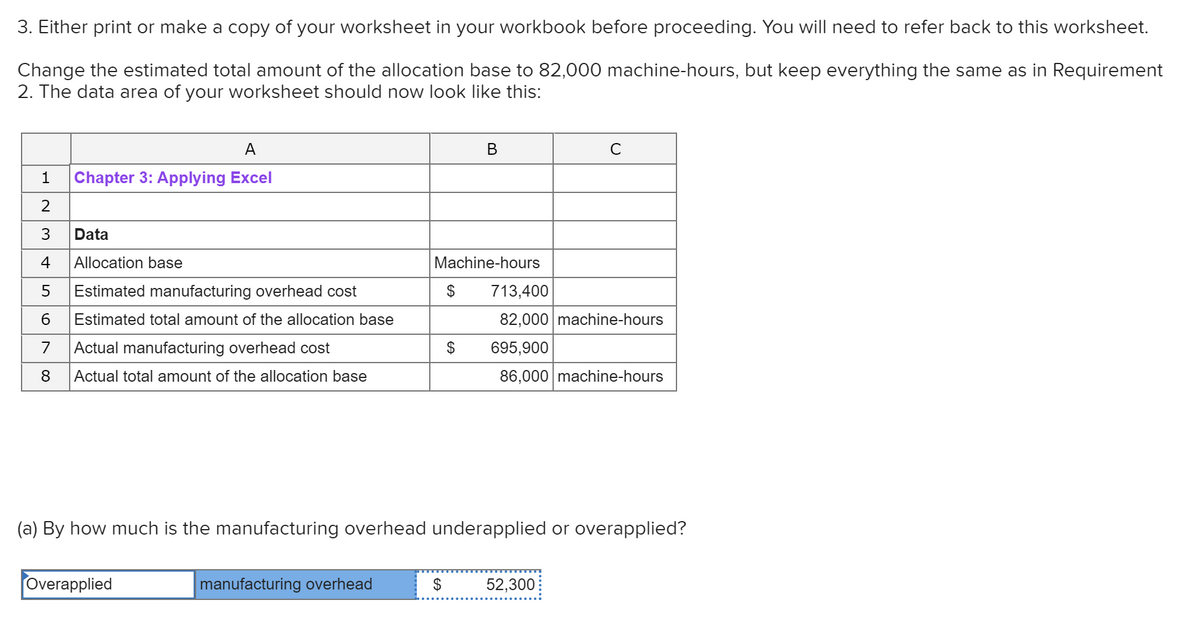

Transcribed Image Text:3. Either print or make a copy of your worksheet in your workbook before proceeding. You will need to refer back to this worksheet.

Change the estimated total amount of the allocation base to 82,000 machine-hours, but keep everything the same as in Requirement

2. The data area of your worksheet should now look like this:

A

В

C

1

Chapter 3: Applying Excel

2

3

Data

4

Allocation base

Machine-hours

Estimated manufacturing overhead cost

2$

713,400

Estimated total amount of the allocation base

82,000 machine-hours

7

Actual manufacturing overhead cost

$

695,900

8

Actual total amount of the allocation base

86,000 machine-hours

(a) By how much is the manufacturing overhead underapplied or overapplied?

Overapplied

manufacturing overhead

$

52,300

Transcribed Image Text:(b) Why is the amount of underapplied (overapplied) manufacturing overhead different from Requirement 2 above? (You may select

more than one answer. Single click the box with the question mark to produce a check mark for a correct answers and double

click the box with the question mark to empty the box for a wrong answers. Any boxes left with a question mark will be

automatically graded as incorrect.)

? The change in the estimated total amount of the allocation base affected the predetermined overhead rate.

? The change in the estimated total amount of the allocation base affected the amount of manufacturing overhead applied.

? Actual manufacturing overhead cost differs from period to period.

The estimated manufacturing overhead cost did not change in proportion to the change in the estimated total amount of the allocation

base.

Expert Solution

Step 1

Manufacturing overhead: It is the indirect cost incurred as a part of manufacturing the products. These costs are not directly related to the units manufactured. So they are allocated to the manufactured units based on estimated cost drivers.

Pre-determined overhead allocate rate: It the rate of allocating the expected overheads to the actual units or hours for a specific accounting period.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning