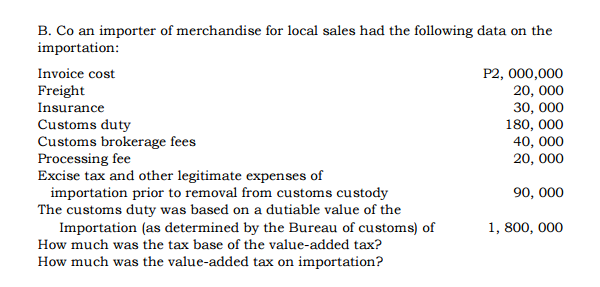

B. Co an importer of merchandise for local sales had the following data on the importation: Invoice cost Freight Insurance Customs duty Customs brokerage fees Processing fee Excise tax and other legitimate expenses of importation prior to removal from customs custody The customs duty was based on a dutiable value of the Importation (as determined by the Bureau of customs) of How much was the tax base of the value-added tax? How much was the value-added tax on importation? P2, 000,000 20, 000 30, 000 180, 000 40, 000 20, 000 90, 000 1, 800, 000

B. Co an importer of merchandise for local sales had the following data on the importation: Invoice cost Freight Insurance Customs duty Customs brokerage fees Processing fee Excise tax and other legitimate expenses of importation prior to removal from customs custody The customs duty was based on a dutiable value of the Importation (as determined by the Bureau of customs) of How much was the tax base of the value-added tax? How much was the value-added tax on importation? P2, 000,000 20, 000 30, 000 180, 000 40, 000 20, 000 90, 000 1, 800, 000

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter24: Recording International And Internet Sales

Section24.1: Recording International Sales

Problem 1OYO

Related questions

Question

Transcribed Image Text:B. Co an importer of merchandise for local sales had the following data on the

importation:

P2, 000,000

20, 000

30, 000

180, 000

40, 000

20, 000

Invoice cost

Freight

Insurance

Customs duty

Customs brokerage fees

Processing fee

Excise tax and other legitimate expenses of

importation prior to removal from customs custody

The customs duty was based on a dutiable value of the

Importation (as determined by the Bureau of customs) of

90, 000

1, 800, 000

How much was the tax base of the value-added tax?

How much was the value-added tax on importation?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage