b. Crilically cfiscuss the conporation's kverage pusiticn ancd profitatility perfonance for i: financial year 2021 in comparison to the year 2020.

b. Crilically cfiscuss the conporation's kverage pusiticn ancd profitatility perfonance for i: financial year 2021 in comparison to the year 2020.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter21: The Statement Of Cash Flows

Section: Chapter Questions

Problem 14E: Interest and Income Taxes Staggs Company has prepared its 2019 statement of cash flows. In...

Related questions

Question

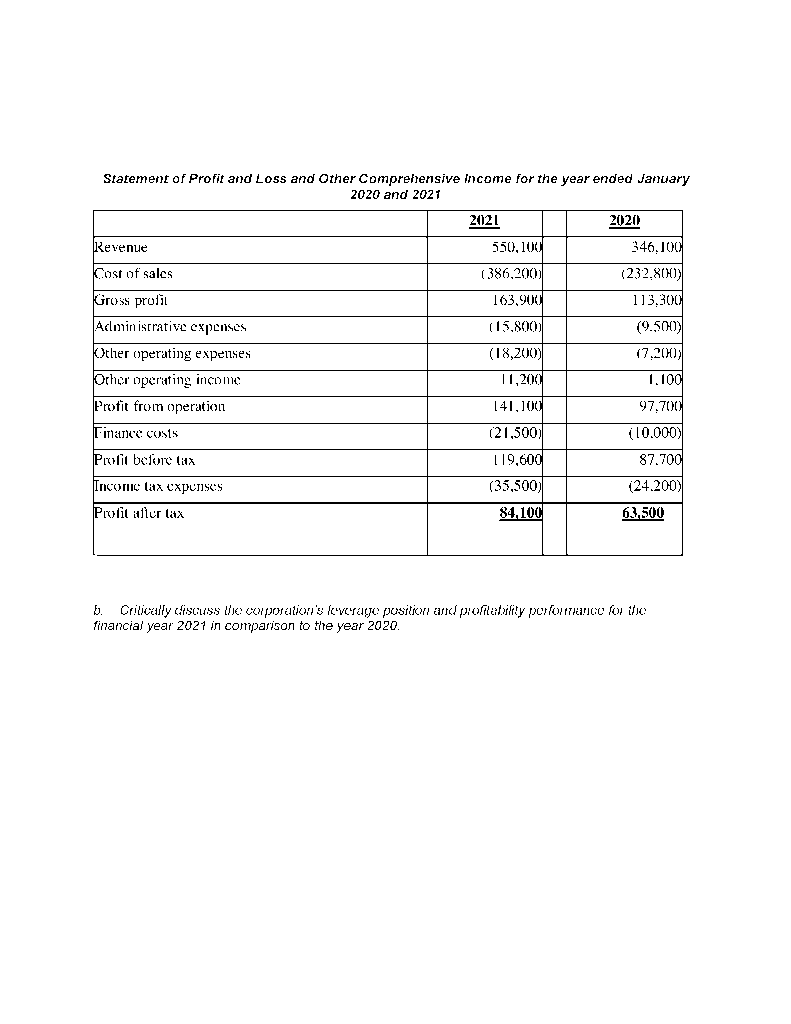

Transcribed Image Text:Statement of Profit and Loss and Other Comprehensive income for the year ended January

2020 and 2021

2021

2020

Revenue

550, 100

346J00

Cost of sales

(386,200)

(232.8(0)

Gross profit

163,900

113.300

Aclministrative expenses

(15,800)

(9.500)

Other operating expenses

(18,200

(7.200);

Orher operating income

11,200

1.100

Profit from operation

[41,100

97,700

I'mance costs

(21,500)

(10.000)

Prolit before tax

119,600

87.700

Incone tax cxpenses

(35,500)

(24.200)

Prolit alter lax

84,100

63,500

b.

Crilically cdiscuss like conporation's k•verage position aed proftatility porfomance for ihe

financial year 2021 in comparison to the year 2020.

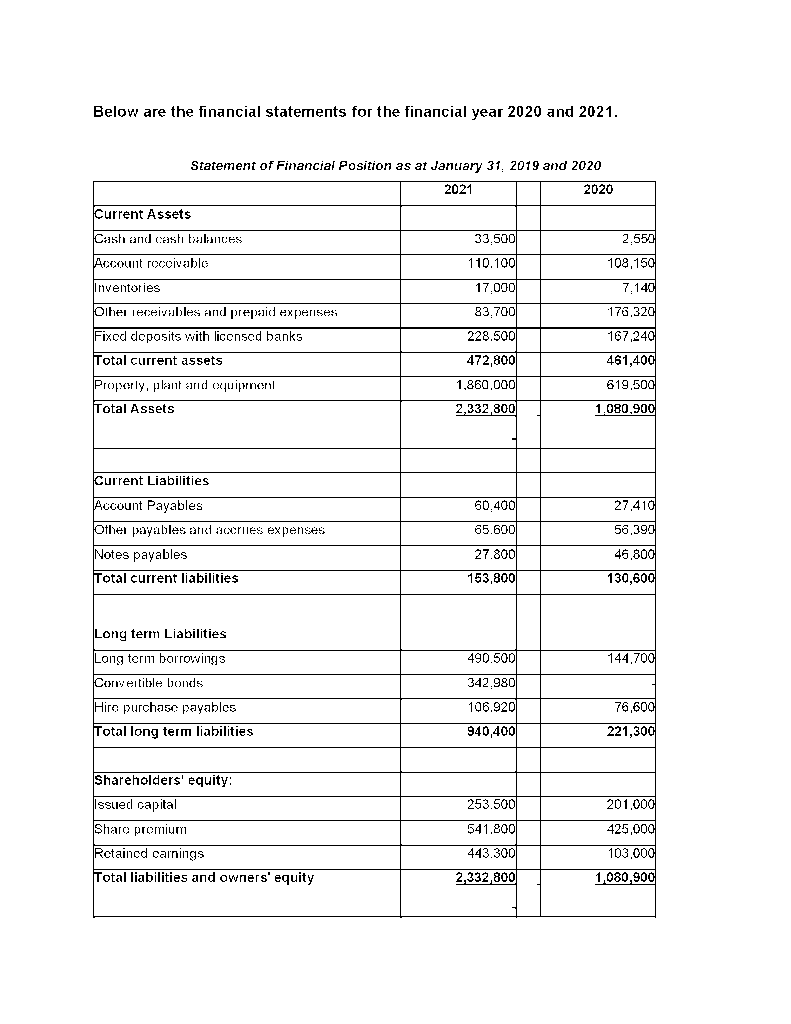

Transcribed Image Text:Below are the financial statements for the financial year 2020 and 2021.

Statement of Financial Position as at January 31, 2019 and 2020

2021

2020

Current Assets

Cash and cash balane:es

33,500

2,550

Account rocoivable

110.100

108,150

Inventories

17.000

7,140

Olher Teceivubles and prepaid experises

83,700

176.320

228.500

167,240

461,400

Fixod doposits with licenscd banks

Total current assets

472,800

Properly, plant and cxquiprnenl

1,860,000

619,500

Total Assets

2,332,800

1,080,900

Current Liabilities

Account Payables

60,400

27.410

Other payables and accriies expenses

65.600

56,390

Notes payables

27.800

46,800

Total current liabilities

153,800

130,600

Long term Liabilities

Long term barrowings

490.500

144,700

Conveitible bonds

342.980

Hire purchase payables

106.920

76,600

Total long term liabilities

940,400

221,300

Shareholders' equity:

Issued capital

253.500

201,000

Sharo promium

541.800

425.000

Retaincd carnings

443.300

103,000

Total liabilities and owners' equity

2,332,800

1,080,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning