b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity. Total paid-in capital 24 Total retained earnings Total stockholders' equity 2$

b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity. Total paid-in capital 24 Total retained earnings Total stockholders' equity 2$

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 16MCQ

Related questions

Question

.

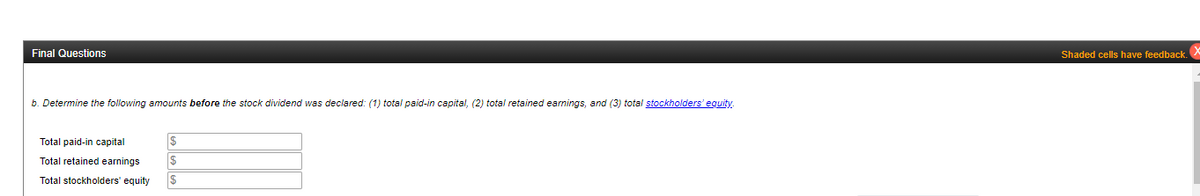

Transcribed Image Text:Final Questions

Shaded cells have feedback. X

b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total stockholders' equity.

Total paid-in capital

Total retained earnings

$

Total stockholders' equity

$

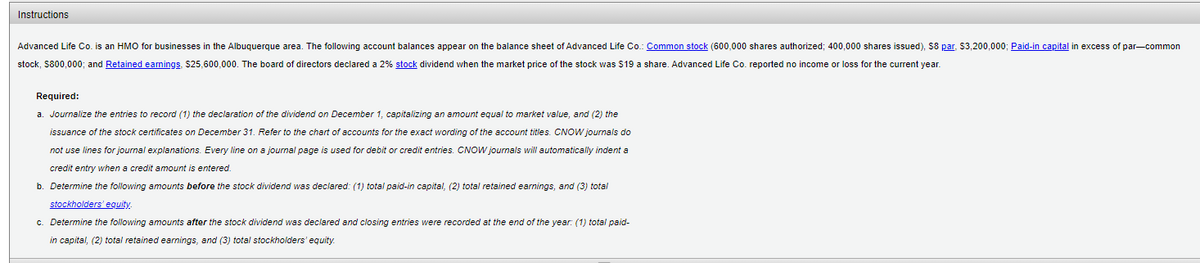

Transcribed Image Text:Instructions

Advanced Life Co. is an HMO for businesses in the Albuquerque area. The following account balances appear on the balance sheet of Advanced Life Co.: Common stock (600,000 shares authorized; 400,000 shares issued), S8 par. $3,200,000; Paid-in capital in excess of par-common

stock, S800,000; and Retained earnings, $25,600,000. The board of directors declared a 2% stock dividend when the market price of the stock was $19 a share. Advanced Life Co. reported no income or loss for the current year.

Required:

a. Journalize the entries to record (1) the declaration of the dividend on December 1, capitalizing an amount equal to market value, and (2) the

issuance of the stock certificates on December 31. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do

not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a

credit entry when a credit amount is entered.

b. Determine the following amounts before the stock dividend was declared: (1) total paid-in capital, (2) total retained earnings, and (3) total

stockholders' equity

c. Determine the following amounts after the stock dividend was declared and closing entries were recorded at the end of the year: (1) total paid-

in capital, (2) total retained earnings, and (3) total stockholders'equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning