Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter13: Real Options And Other Topics In Capital Budgeting

Section: Chapter Questions

Problem 2P: OPTIMAL CAPITAL BUDGET Marble Construction estimates that its WACC is 10% if equity comes from...

Related questions

Question

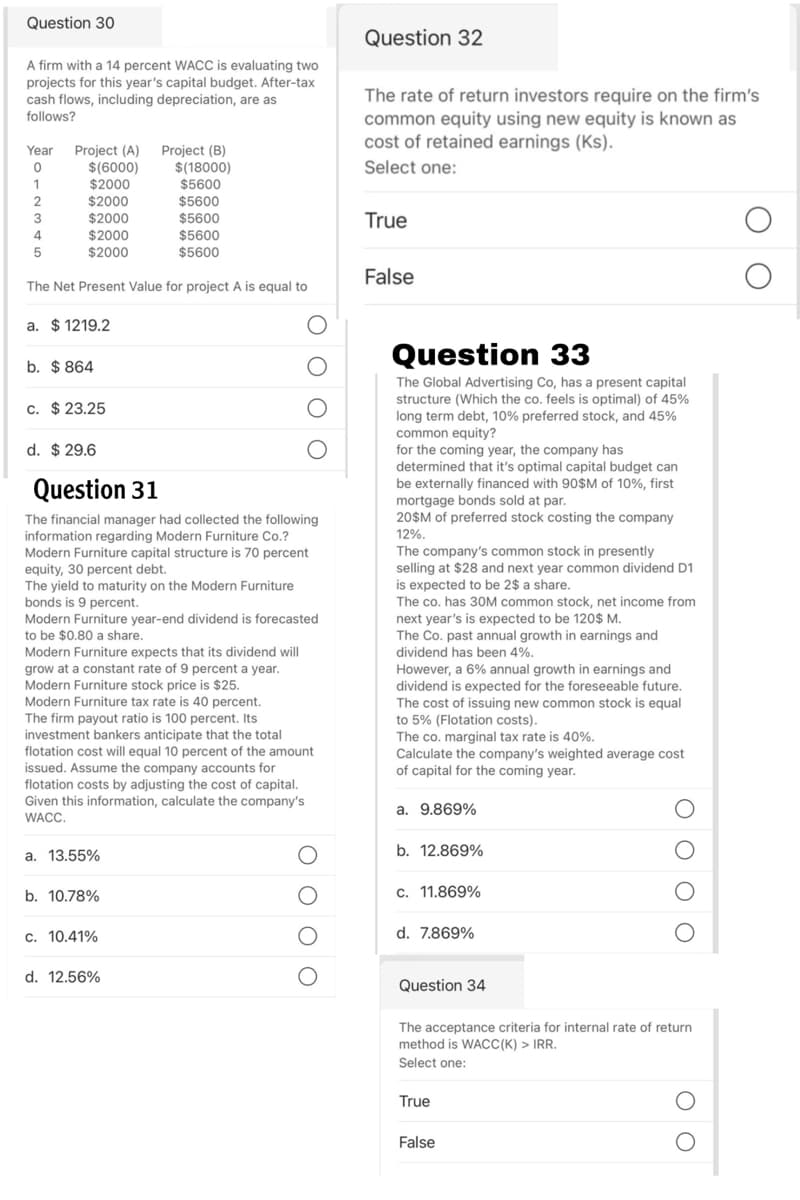

Please answer the following MCQs and T or Fs from 30 till 34

Transcribed Image Text:Question 30

Question 32

A firm with a 14 percent WACC is evaluating two

projects for this year's capital budget. After-tax

cash flows, including depreciation, are as

The rate of return investors require on the firm's

common equity using new equity is known as

cost of retained earnings (Ks).

follows?

Year Project (A) Project (B)

$(6000)

$2000

Select one:

$(18000)

$5600

1

2

$2000

$5600

$5600

$5600

3

$2000

True

4

$2000

$2000

$5600

False

The Net Present Value for project A is equal to

a. $ 1219.2

Question 33

b. $ 864

The Global Advertising Co, has a present capital

structure (Which the co. feels is optimal) of 45%

c. $ 23.25

long term debt, 10% preferred stock, and 45%

common equity?

for the coming year, the company has

determined that it's optimal capital budget can

be externally financed with 90$M of 10%, first

mortgage bonds sold at par.

20$M of preferred stock costing the company

12%.

d. $ 29.6

Question 31

The financial manager had collected the following

information regarding Modern Furniture Co.?

Modern Furniture capital structure is 70 percent

equity, 30 percent debt.

The yield to maturity on the Modern Furniture

bonds is 9 percent.

Modern Furniture year-end dividend is forecasted

to be $0.80 a share.

The company's common stock in presently

selling at $28 and next year common dividend D1

is expected to be 2$ a share.

The co. has 3OM common stock, net income from

next year's is expected to be 120$ M.

The Co. past annual growth in earnings and

dividend has been 4%.

Modern Furniture expects that its dividend will

grow at a constant rate of 9 percent a year.

Modern Furniture stock price is $25.

Modern Furniture tax rate is 40 percent.

However, a 6% annual growth in earnings and

dividend is expected for the foreseeable future.

The cost of issuing new common stock is equal

to 5% (Flotation costs).

The co. marginal tax rate is 40%.

Calculate the company's weighted average cost

of capital for the coming year.

The firm payout ratio is 100 percent. Its

investment bankers anticipate that the total

flotation cost will equal 10 percent of the amount

issued. Assume the company accounts for

flotation costs by adjusting the cost of capital.

Given this information, calculate the company's

WACC.

a. 9.869%

a. 13.55%

b. 12.869%

b. 10.78%

c. 11.869%

c. 10.41%

d. 7.869%

d. 12.56%

Question 34

The acceptance criteria for internal rate of return

method is WACC(K) > IRR.

Select one:

True

False

O O O O

O O

O O

O O O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning