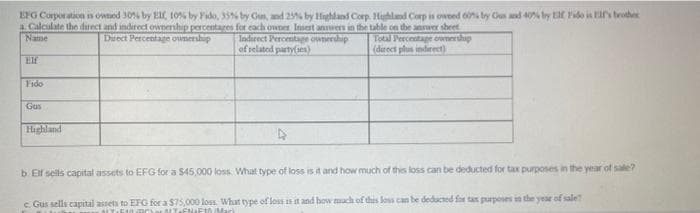

b. Ef sells capital assets to EFG for a $45,000 loss. What type of loss is it and how much of this loss can be deducted for tax purposes in the year of sale?

Q: Required : How would each of the preceding items normally be reflected (current or noncurrent;…

A: Solution:- Preparation of each of the preceding items normally be reflected (current or noncurrent;…

Q: Question 3 Loca Sia discounts at 15% its own 180-day, P450,000 note with Covidna Finance Corp. How…

A: The note discounted is the conversion of note receivable into cash. The note receivable is generally…

Q: A worksheet can be thought of as a(n) permanent accounting record. O part of the general ledger. O…

A: Worksheet means the sheet which is prepared to make few year end adjustment and find out the balance…

Q: 21. Which is FALSE in withholding tax system? S1 It is one method by which the government collects…

A: The answer is stated below: Note: Answering the first question as there are multiple…

Q: During 2019, Jason Glen has net employment income of $11500, net rental income of $3800, as well as…

A: The taxable income of a taxpayer includes the income from multiples sources and there may be loss…

Q: Question 12 Marketable securities refers to medium-term money market instruments and non- trading…

A: Marketable securities refers to the securities which can be easily converted in to cash and are held…

Q: Clampett, Inc. converted to an S corporation on January 1, 2021. At that time, Clampett, Inc. had…

A: When you sell shares or other taxable investment assets, the capital gains or profits are referred…

Q: Question 11 Inventory management refers to the formulation and administration of plans and policies…

A: Inventory is the goods or merchandise held by a company for selling purpose to earn profit.…

Q: Familiarization of investment types. Identify keywords if it is; Deposit Fund Bond Stock Property 1.…

A: 1. Collateral - deposits 2. Shareholder - fund 3. Creditor - bond 4. Debtholder - bond 5. Equity -…

Q: %24 %24 Analysis of Receivables Method At the end of the current year, Accounts Receivable has a…

A: Allowance for doubtful accounts means where account receivables are not going to recover in full and…

Q: Complete the bank's balance sheet provided below. (Round your responses to the nearest whole…

A: Statement of financial position (balance sheet) refers to a statement which provides a brief summary…

Q: what are the responsibility of Board members with regards to internal controls?

A: Internal Controls Internal controls refer to the rules, regulations, or processes implemented by a…

Q: Prepare the journal entry at commencement of the lease for Sharrer, assuming (1) Sharrer does not…

A: Solution:- Prepare the journal entry at commencement of the lease for Sharrer (1) Sharrer does not…

Q: Zark's Burger uses 250 kg of fatless beef for its meals, every month with an ordering cost of BD 15…

A: Calculatio of Optimal Quanity

Q: ged in a VAT-business and a non-VAT business. Her records show the following data, no tax included,…

A: Value Added Tax Value added Tax is the tax system which was imposed by the government authority to…

Q: The following changes took place last year in Pavolik Company’s balance sheet accounts: Asset and…

A: The question is based on the concept of Cash flow statement. Cash flow statement is the statement…

Q: 25 An employee is seriously injured in a job-related accident. The employee has only been on the job…

A: The Bureau of Labuor Statistics publishes information on employment, earnings, inflation,…

Q: On December 31, 2021, the Allowance for Doubtful Accounts has an unadjusted debit balance of $1,020.…

A: Estimated uncollectible accounts = Accounts receivable x uncollectible % Bad debts expense =…

Q: A store building was constructed on January 2, 2009 with a cost of P570,000. Its estimated useful…

A: Depreciation means a fall in the value of the tangible assets due to wear & tear (use of…

Q: a. Under Normal Costing Method, how shall material over-application or under-application of factory…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: 3. Nicanor sold his residential lot located in Iloilo City. The Deed of Absolute Sale is dated…

A: Due date of Payment of Capital Gain Tax Due date of Payment of Stamp Tax

Q: 13.E J owns some property that has an assessed value of $415,920. Calculate the tax due if the tax…

A: A determined valuation of property on which tax is to be levied is the Assessed value of property.…

Q: Giant Company has firee products, A, B, and C. The following information is available Product A…

A: >Dropping or eliminating a product or division can have a increasing or decreasing effect on the…

Q: Question 5 Tomatsui Company provided the following annual data: Sales P3,500,000 Cost of Sales…

A: Minimum Cash Balance is the balance required to manage all the operations of the company including…

Q: Given the following data, calculate product cost per unit under absorption costing. dir labor:…

A: Formula: Product cost under Absorption costing: = Direct materials + direct labor + Variable…

Q: On January 1, 2019, ABC Company leased an office building with the following terms: Annual rental at…

A: Lease: A lease is an agreement between a property owner and other party party who wants to utilize…

Q: ransactions e T-account format d trial balance, as of April 30

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: The cost of an asset is $1.200,000, and its residual value is $180,000. Essmated usetul ife of the…

A: Formula: Depreciation rate = ( 100 / Useful life years ) x 2

Q: Kaloy invested in the bonds of AAA Company in the United States. The bonds were issued at a price of…

A: Documentary stamp tax duty that DST is applicable on sale and purchase of bonds in market in…

Q: See& On December 2. Coley Corp acouired J00 shares ofs $2 par value common stock for $21esch On…

A: Treasury stocks are repurchased shares of the company.The firm has the power to re issue these…

Q: Shown below are comparative statements of financial position for Blue Spruce Corporation. BLUE…

A: Cash Flow Statement is an integral part of the Financial Statements of an entity. Cash Flow…

Q: 17. As a newly hired IRS trainee, you have been asked to calculate the amount of tax refund or tax…

A: Tax owed/ (refund) = Tax liability- tax credit - payment

Q: Current Attempt in Progress Mark's Music is a store that buys and sells musical instruments in…

A: Journal is the recording of financial transactions as per dual entity concept, to be posted in…

Q: Masa Khit Nha Company accounted for noncurrent assets using the revaluation model. On August 1,…

A: Here to discuss about the carrying value of the land in the revaluation model. It is always taken…

Q: The financial statements of Simon Co. include the following items (amounts in thousands): For the…

A: Cash flow statement provided information about the cash inflows and cash outflows of the company.…

Q: Deita Corporation has paida total of P 2008. On Decomber 31, of the same yoar, thero were accrued…

A: "Since you have asked multiple questions, we will solve first question for you. If you want any…

Q: At the beginning of the year, Boatwise Corporation has 610 life vests in inventory. The company…

A: Production means the number of units produced during the specified period. It is not always…

Q: The contribution format income statement for Huerra Company for last year is given below: Total Unit…

A: Solution 1: Particulars Amount Sales $998,000.00 Operating income $80,000.00 Average…

Q: Assuming sales will continue at the Year 4 level, calculate the additional profit for year 5.

A: Assuming sales will continue at the Year 4 level, $900000 the additional profit for year 5.

Q: On 4/2. Fresh Seafood Company purchases seasonings from customer for $500,000, payment terms are…

A: Under the net method, the sales are recorded at the amount net of discounts. The Entry is made at…

Q: Current Attempt in Progress On December 31, 2021, the Allowance for Doubtful Accounts has an…

A: Bad debt expense on December 31,2021 =( $94700×10%)+1020 =$9470+$1020 =$10490

Q: 8 Which of the following statements is/are correct? I. The test for exemption from real…

A: Taxes are the main source of revenue for every government. It is a way of levying charge for the use…

Q: Do normal valuation metrics work like P/E, P/B etc., in tech companies or do investment bankers…

A: A startup is a firm that is in its early phases of operation. These businesses usually start with…

Q: Directions: Choose the right answer in the multiple-choice 1. What is the cost incurred in the…

A: 1) Cost incurred in the past : A cost which has been incurred or historical cost of financial…

Q: A land development company is considering the purchase of earth-moving equipment. This equipment…

A: It is the annual cost of purchasing, operating and maintaining the asset throughout the life of the…

Q: Question 17 Consider the following Supplier's credit terms: 2/10. n/45 3/10, n/60 1/15, n/30 Which…

A: Cash discount: Cash discount is an advantage provided to the purchaser to reimburse the amount less…

Q: Compute for the following: 1. Amount from cash collected from accounts receivable during 2021. 2.…

A: Receivables are the legal obligations on the customers of the company which they require to pay in…

Q: In the current year, Megan, who is single, sells stock valued at $48,000 to Brooke for $13,000.…

A: (a) Determination of taxable gift Cost of stock $48,000 Sales to Brooke ($13,000) Taxable…

Q: escribe five factor that could explain why the falsifying of financial statements is occurring so…

A: Financial statements are those that provide a screenshot of the company’s performance and financial…

Q: Merchandise Equipment- r Accounts Pay- Erving, Capita

A: Given:

Step by step

Solved in 2 steps

- For the year ended December 31, the following results were given: Dividend Paid Net Income Parent Company P15,000 P30,200Subsidiary Company 4,000 9,400 Using the proportionate basis or partial goodwill method, compute the non-controlling interest on December 31.A. P 0 C. P 610B. P 540 D. P 940 Note: Just use the information provided to arrive at the answer.The profit and loss statement of Treadwell Ltd., an S corporation, shows $265,000 book income. Treadwell is owned equally by four shareholders. From supplemental data, you obtain the following information about items that are included in book income. (attached image) a. Compute Treadwell's nonseparately stated income or loss for the tax year. b. What would be the share of this year's nonseparately stated income or loss items for Leo Lion, one of the Treadwell shareholders? c. What is Leo Lion's share of tax-exempt interest income, if any?For the year ended December 31, the following results were given: Dividend Paid Net Income Parent Company P15,000 P30,200Subsidiary Company 4,000 9,400 Using the proportionate basis or partial goodwill method, compute the non-controlling interest on December 31.A. P 10,600 C. P 12,010B. P11,140 D. P 12,300 Note: Just use the information provided to solve the problem.

- Mathilda Corp has a 90% interest in Gambit Co. while the latter has an 80% interest in Chan Corp. For the year ended December 31,2019. The net income from own operations of these three companies were: Mathilda- Php1M, Gambit-Php500K, and Chan-Php 250K. What is the amount of minority interest in net income for 2019.Listless Co. owns 20% of Weak Inc. and uses the equity method. In 20x1, Weak sells inventory to Listless fro P400,000 with a 60% gross profit on the transaction. The inventory remains unsold during 20x1 and was sold by Listless to external parties only in 20x2. Listless income tax rate is 30%. Weak reports profit of P4,000,000 and P4,800,000 on December 31, 20x1 and 20x2, respectively. How much is the share in the profit of associate in 20x1?For the year ended December 31, the following results were given: Dividend Paid Net Income Parent Company P15,000 P30,200Subsidiary Company 4,000 9,400 Using the proportionate basis or partial goodwill method, compute the controlling interest on December 31:A. P 64,760 C. P 69,400B. P65,090 D. P 69,800 Note: Just use the information provided to arrive at the answer.

- The following trial balance has been extracted from the books of Abraham as at 31st March 2023 UGX 000 UGX 000 Administrative expense 250 Distribution cost 295 Share capital (all ordinary shares of UGX 1 each 270 Share premium 80 Revaluation reserve 20 Dividend 27 Cash at bank and hand 3 Receivables 233 Interest paid 25 Dividend received 15 Interest received 1 Land and buildings at cost (land 380, building 100) 480 Land and building acc. Dep 30 Plant and machinery 400 Plant and machinery acc. Dep 170 Retained earnings account (at April 2022 235 Purchases 1260 Sales 2165 Inventory at 1 April 2022 140 Trade payables 27 Bank loan 100 Total 3113 3113 Additional Information Inventory at 31st March 2023 was valued at a cost UGX 95000. Include in this…If answered within 30mins,it would be appreciable!! Answer all the subparts a,b,c On December 31, 2020, CFR Co. provided the following information as at December 31, 2020 about its investment accounts that it acquired for trading purposes:Carrying Amount Fair ValueABC Ltd. shares $15,000 $17,500Ace Ventura Corp. shares 24,300 22,500Shrek Ltd. Shares 75,000 80,200During 2021, Ace Ventura Corp. shares were sold for $23,000 and 50% of the Shrek shares were sold for $42,000. At the end of 2021, the fair value of ABC shares was $19,200 and Shrek Ltd. was $41,000. CFR follows IFRS.Required:a. Prepare the adjusting entry for December 31, 2020, if any.b. Prepare the entry for the Ace Ventura and Shrek sales.c. Prepare the adjusting entry for December 31, 2021, if any.Ladd, Inc., bought 400 shares of Dey, LLC, for $20 per share and incurred brokerage commissions of $100. Ladd later sold its stake in Dey for $22 per share and incurred brokerage commissions of $175. The effect of the sale on Ladd's net income is a(n) (increase/decrease) of $ .

- . Yüksel A.Ş., of which our company had previously purchased and was a 20% shareholder, made a profit of TL 500,000 on 15.03.2021 and announced to the public that it would distribute 30% of the profit to the shareholders in cash.explained. Show the journal entry that our business should make accordingly.Yola Corporation is required to include 15 items in their 10-K for the year ending 9/30/21. In which required item from the 10-K would this content be located? Emily Smith, Chief Product Officer Total non Equity Compensation $1,250,000 Question 28 options: a) Certain Relationships and Related Transactions b) Executive Compensation c) Business d) Security Ownership of Certain Beneficial Owners and Management and Related Stockholder MattersFollowing is a list of investments owned by Ivanhoe Ltd., as of the company’s year-end, December 31, 2020: Investment No. Shares Cost Fair Value HFX Corporation 1,000 $8.00 $7.10 FDY Ltd. 3,000 6.90 6.95 CTN Corporation 4,600 5.00 5.80 On January 15, 2021, Ivanhoe sold the shares in CTN Corporation for $6.25 per share. Prepare the journal entries required to record the sale, assuming the company uses the fair value through other comprehensive income without recycling method. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 15, 2021 (To adjust to current fair value) (To record the sale of shares) (Reclassification…