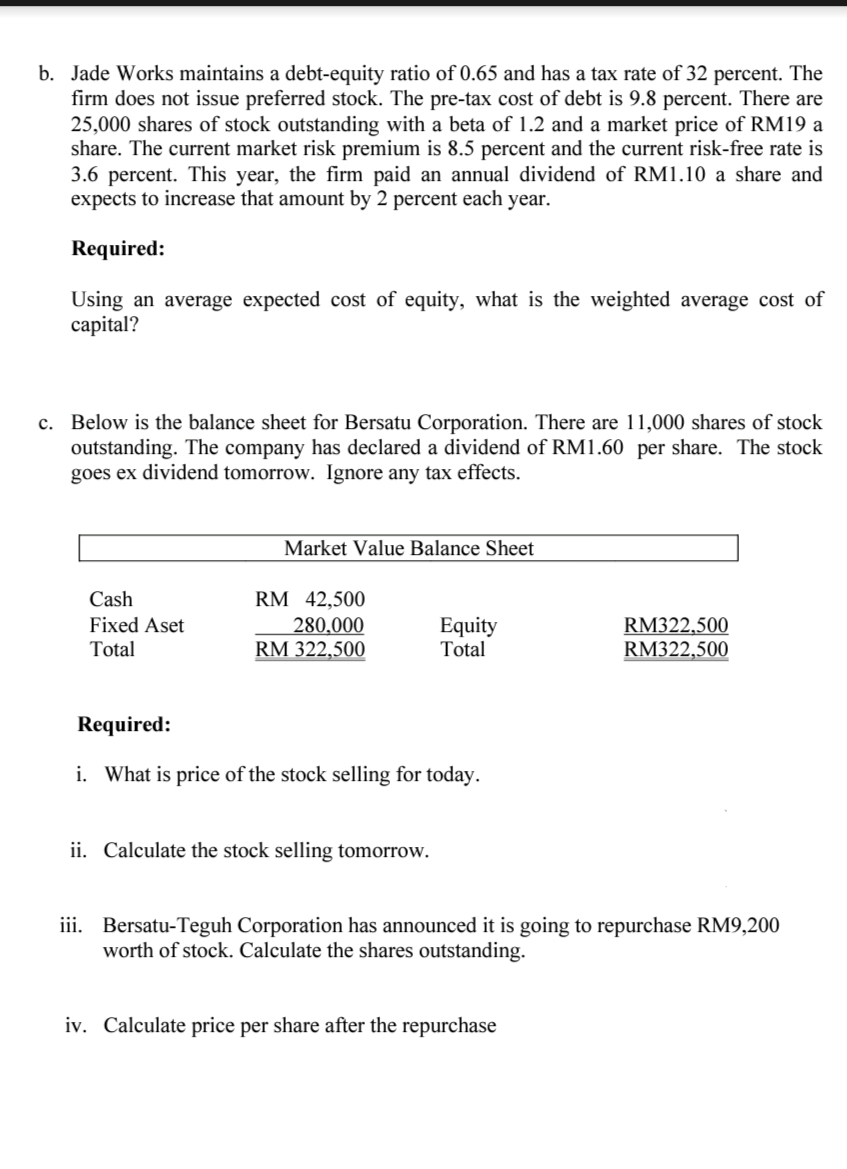

b. Jade Works maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The firm does not issue preferred stock. The pre-tax cost of debt is 9.8 percent. There are 25,000 shares of stock outstanding with a beta of 1.2 and a market price of RM19 a share. The current market risk premium is 8.5 percent and the current risk-free rate is 3.6 percent. This year, the firm paid an annual dividend of RM1.10 a share and expects to increase that amount by 2 percent each year. Required: Using an average expected cost of equity, what is the weighted average cost of capital?

b. Jade Works maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The firm does not issue preferred stock. The pre-tax cost of debt is 9.8 percent. There are 25,000 shares of stock outstanding with a beta of 1.2 and a market price of RM19 a share. The current market risk premium is 8.5 percent and the current risk-free rate is 3.6 percent. This year, the firm paid an annual dividend of RM1.10 a share and expects to increase that amount by 2 percent each year. Required: Using an average expected cost of equity, what is the weighted average cost of capital?

Chapter15: Dividend Policy

Section: Chapter Questions

Problem 4P

Related questions

Question

Solve this

Transcribed Image Text:b. Jade Works maintains a debt-equity ratio of 0.65 and has a tax rate of 32 percent. The

firm does not issue preferred stock. The pre-tax cost of debt is 9.8 percent. There are

25,000 shares of stock outstanding with a beta of 1.2 and a market price of RM19 a

share. The current market risk premium is 8.5 percent and the current risk-free rate is

3.6 percent. This year, the firm paid an annual dividend of RM1.10 a share and

expects to increase that amount by 2 percent each year.

Required:

Using an average expected cost of equity, what is the weighted average cost of

capital?

c. Below is the balance sheet for Bersatu Corporation. There are 11,000 shares of stock

outstanding. The company has declared a dividend of RM1.60 per share. The stock

goes ex dividend tomorrow. Ignore any tax effects.

Market Value Balance Sheet

RM 42,500

280,000

RM 322,500

Cash

Fixed Aset

Equity

Total

RM322,500

RM322,500

Total

Required:

i. What is price of the stock selling for today.

ii. Calculate the stock selling tomorrow.

iii. Bersatu-Teguh Corporation has announced it is going to repurchase RM9,200

worth of stock. Calculate the shares outstanding.

iv. Calculate price per share after the repurchase

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning