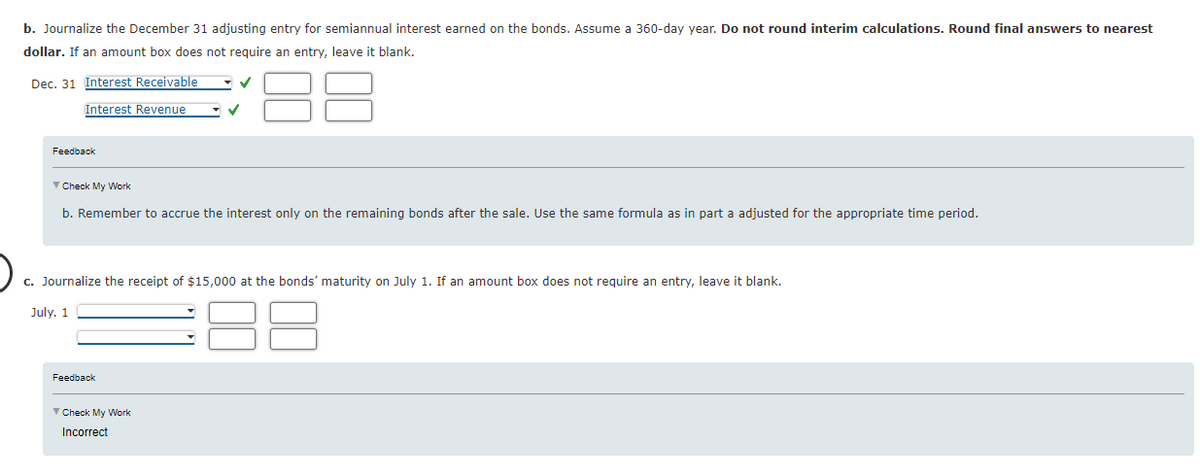

b. Journalize the December 31 adjusting entry for semiannual interest earned on the bonds. Assume a 360-day year. Do not round interim calculations. Round final answers to nearest dollar. If an amount box does not require an entry, leave it blank. ✓ Dec. 31 Interest Receivable Interest Revenue Feedback Check My Work b. Remember to accrue the interest only on the remaining bonds after the sale. Use the same formula as in part a adjusted for the appropriate time period. c. Journalize the receipt of $15,000 at the bonds' maturity on July 1. If an amount box does not require an entry, leave it blank. July. 1 Feedback Check My Work Incer of

b. Journalize the December 31 adjusting entry for semiannual interest earned on the bonds. Assume a 360-day year. Do not round interim calculations. Round final answers to nearest dollar. If an amount box does not require an entry, leave it blank. ✓ Dec. 31 Interest Receivable Interest Revenue Feedback Check My Work b. Remember to accrue the interest only on the remaining bonds after the sale. Use the same formula as in part a adjusted for the appropriate time period. c. Journalize the receipt of $15,000 at the bonds' maturity on July 1. If an amount box does not require an entry, leave it blank. July. 1 Feedback Check My Work Incer of

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 4E

Related questions

Question

Transcribed Image Text:b. Journalize the December 31 adjusting entry for semiannual interest earned on the bonds. Assume a 360-day year. Do not round interim calculations. Round final answers to nearest

dollar. If an amount box does not require an entry, leave it blank.

Dec. 31 Interest Receivable

✓

Interest Revenue

Feedback

✓ Check My Work

b. Remember to accrue the interest only on the remaining bonds after the sale. Use the same formula as in part a adjusted for the appropriate time period.

c. Journalize the receipt of $15,000 at the bonds' maturity on July 1. If an amount box does not require an entry, leave it blank.

July. 1

Feedback

✓ Check My Work

Incorrect

Transcribed Image Text:>

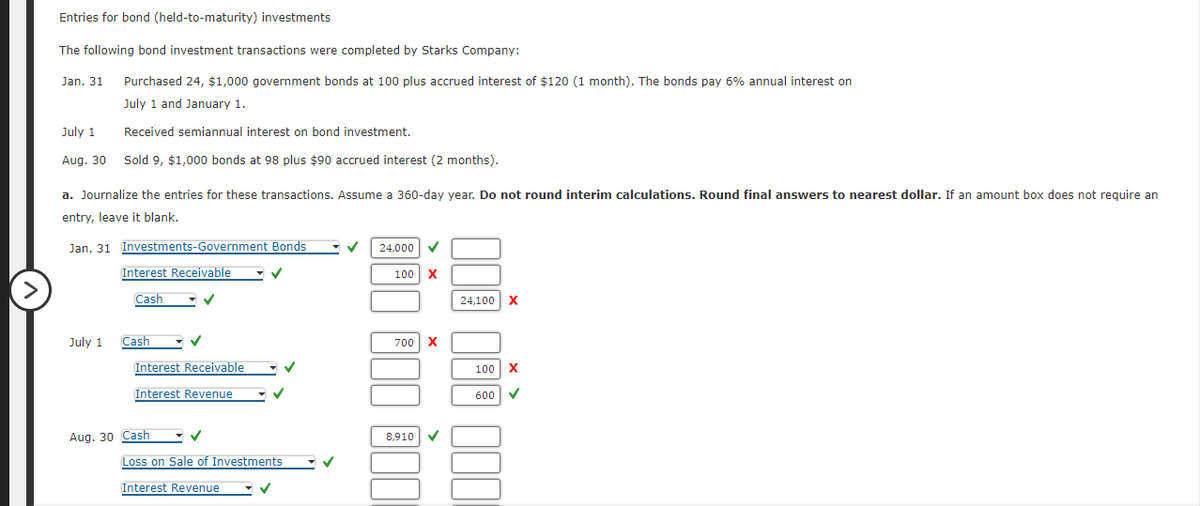

Entries for bond (held-to-maturity) investments

The following bond investment transactions were completed by Starks Company:

Jan. 31

Purchased 24, $1,000 government bonds at 100 plus accrued interest of $120 (1 month). The bonds pay 6% annual interest on

July 1 and January 1.

Received semiannual interest on bond investment.

Sold 9, $1,000 bonds at 98 plus $90 accrued interest (2 months).

July 1

Aug. 30

a. Journalize the entries for these transactions. Assume a 360-day year. Do not round interim calculations. Round final answers to nearest dollar. If an amount box does not require an

entry, leave it blank.

Jan. 31 Investments-Government Bonds

Interest Receivable ✓✓

Cash

✓

July 1

Cash

✓

Interest Receivable

Interest Revenue

Aug. 30 Cash

Loss on Sale of Investments

Interest Revenue

✓

000 000 000

100 000 000

24,000

8,910

24,100 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,