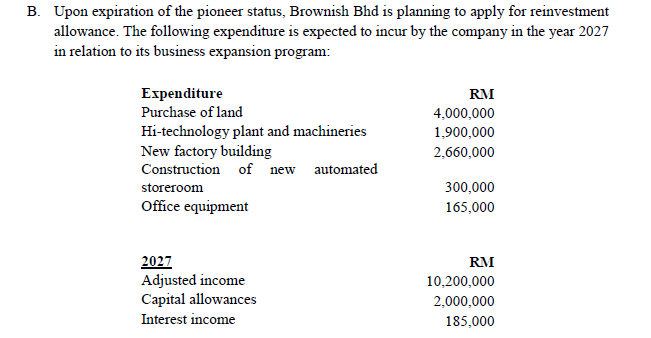

B. Upon expiration of the pioneer status, Brownish Bhd is planning to apply for reinvestment allowance. The following expenditure is expected to incur by the company in the year 2027 in relation to its business expansion program: Expenditure Purchase of land RM 4,000,000 Hi-technology plant and machineries New factory building Construction 1,900,000 2,660,000 of new automated storeroom 300,000 Office equipment 165,000 2027 Adjusted income Capital allowances Interest in RM 10,200,000 2,000,000 income 185,000

B. Upon expiration of the pioneer status, Brownish Bhd is planning to apply for reinvestment allowance. The following expenditure is expected to incur by the company in the year 2027 in relation to its business expansion program: Expenditure Purchase of land RM 4,000,000 Hi-technology plant and machineries New factory building Construction 1,900,000 2,660,000 of new automated storeroom 300,000 Office equipment 165,000 2027 Adjusted income Capital allowances Interest in RM 10,200,000 2,000,000 income 185,000

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter5: Business Deductions

Section: Chapter Questions

Problem 29P

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

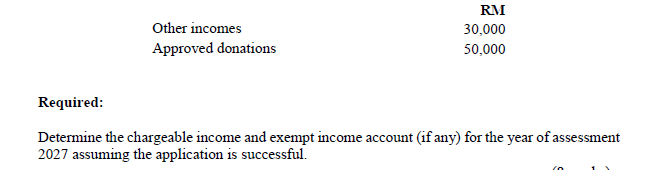

Transcribed Image Text:RM

Other incomes

30,000

Approved donations

50,000

Required:

Determine the chargeable income and exempt income account (if any) for the year of assessment

2027 assuming the application is successful.

Transcribed Image Text:B. Upon expiration of the pioneer status, Brownish Bhd is planning to apply for reinvestment

allowance. The following expenditure is expected to incur by the company in the year 2027

in relation to its business expansion program:

Expenditure

Purchase of land

RM

4,000,000

Hi-technology plant and machineries

New factory building

Construction

1,900,000

2,660,000

of new automated

storeroom

300,000

Office equipment

165,000

2027

Adjusted income

Capital allowances

Interest in

RM

10,200,000

2,000,000

income

185,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT