a. What effect would a $9.05 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices that apply.) A. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05 million. This would lead to a reduction in taxes of 25% x $9.05 million = $2.26 million. B. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05 million. This would lead to an increase in taxes of 25% x $9.05 million = $2.26 million. C. Earnings would decline by $9.05 million - $2.26 million = $6.79 million. The same effect would be seen on next year's earnings. D. Earnings would decline by $9.05 million - $2.26 million = $6.79 million. There would be no effect on next year's earnings.

a. What effect would a $9.05 million operating expense have on this year's earnings? What effect would it have on next year's earnings? (Select all the choices that apply.) A. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05 million. This would lead to a reduction in taxes of 25% x $9.05 million = $2.26 million. B. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05 million. This would lead to an increase in taxes of 25% x $9.05 million = $2.26 million. C. Earnings would decline by $9.05 million - $2.26 million = $6.79 million. The same effect would be seen on next year's earnings. D. Earnings would decline by $9.05 million - $2.26 million = $6.79 million. There would be no effect on next year's earnings.

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 20P

Related questions

Question

100%

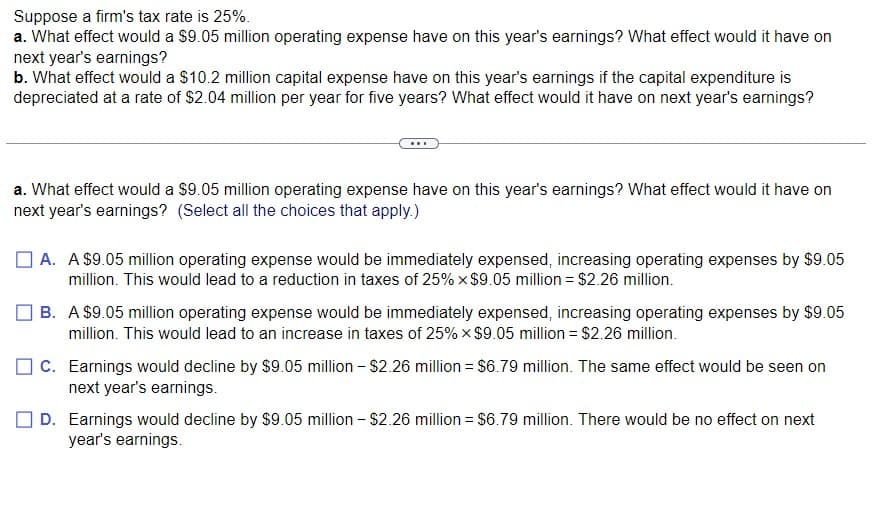

Transcribed Image Text:Suppose a firm's tax rate is 25%.

a. What effect would a $9.05 million operating expense have on this year's earnings? What effect would it have on

next year's earnings?

b. What effect would a $10.2 million capital expense have on this year's earnings if the capital expenditure is

depreciated at a rate of $2.04 million per year for five years? What effect would it have on next year's earnings?

a. What effect would a $9.05 million operating expense have on this year's earnings? What effect would it have on

next year's earnings? (Select all the choices that apply.)

A. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05

million. This would lead to a reduction in taxes of 25% x $9.05 million = $2.26 million.

B. A $9.05 million operating expense would be immediately expensed, increasing operating expenses by $9.05

million. This would lead to an increase in taxes of 25% × $9.05 million = $2.26 million.

C. Earnings would decline by $9.05 million - $2.26 million = $6.79 million. The same effect would be seen on

next year's earnings.

D. Earnings would decline by $9.05 million - $2.26 million = $6.79 million. There would be no effect on next

year's earnings.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

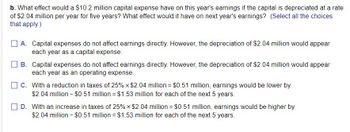

Transcribed Image Text:b. What effect would a $10.2 million capital expense have on this year's earnings if the capital is depreciated at a rate

of $2.04 million per year for five years? What effect would it have on next year's earnings? (Select all the choices

that apply.)

A. Capital expenses do not affect earnings directly. However, the depreciation of $2.04 million would appear

each year as a capital expense.

B. Capital expenses do not affect earnings directly. However, the depreciation of $2.04 million would appear

each year as an operating expense.

C. With a reduction in taxes of 25% × $2.04 million = $0.51 million, earnings would be lower by

$2.04 million - $0.51 million = $1.53 million for each of the next 5 years.

D. With an increase in taxes of 25% × $2.04 million = $0.51 million, earnings would be higher by

$2.04 million - $0.51 million = $1.53 million for each of the next 5 years.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning