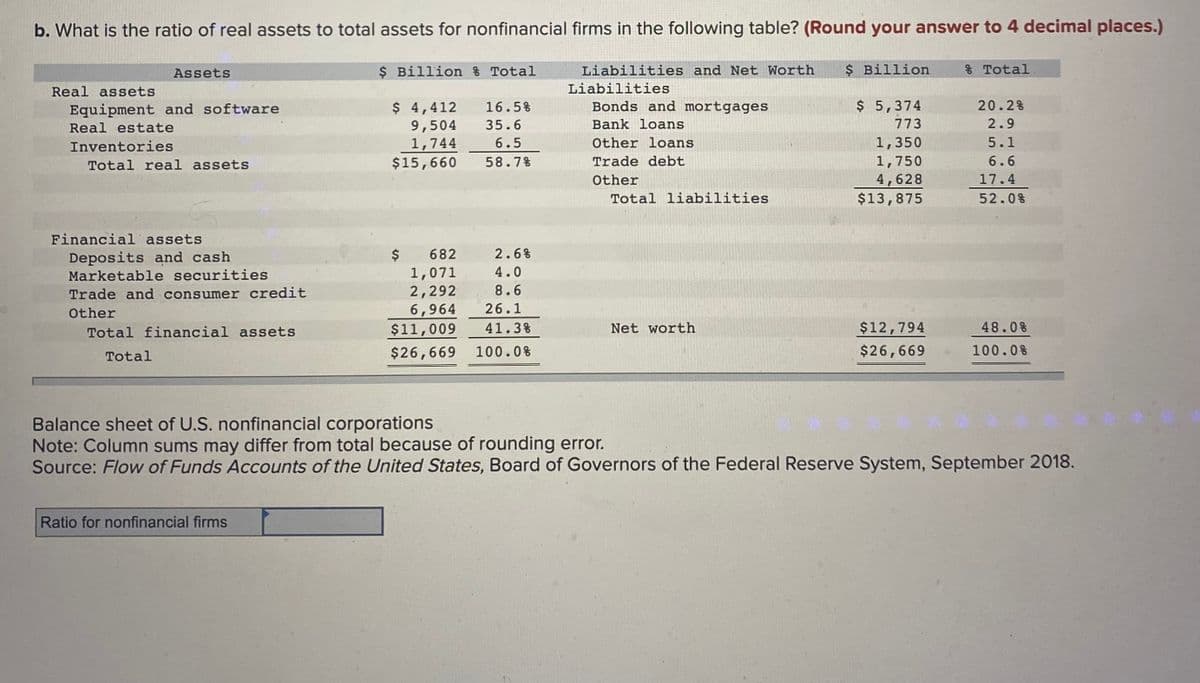

b. What is the ratio of real assets to total assets for nonfinancial firms in the following table? (Round your answer to 4 decimal pl Liabilities and Net Worth Liabilities Bonds and mortgages Bank loans Other loans Trade debt Other Assets Real assets Equipment and software Real estate Inventories Total real assets Financial assets. Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ Billion % Total Ratio for nonfinancial firms $ 4,412 9,504 1,744 $15,660 $ 682 1,071 2,292 6,964 16.5% 35.6 6.5 58.7% 2.6% 4.0 8.6 26.1 $11,009 41.3% $26,669 100.0% Total liabilities Net worth $ Billion $ 5,374 773 1,350 1,750 4,628 $13,875 $12,794 $26,669 & Total 20.2% 2.9 5.1 6.6 17.4 52.0% 48.0% 100.0% Balance sheet of U.S. nonfinancial corporations Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States, Board of Governors of the Federal Reserve System, September 2018.

b. What is the ratio of real assets to total assets for nonfinancial firms in the following table? (Round your answer to 4 decimal pl Liabilities and Net Worth Liabilities Bonds and mortgages Bank loans Other loans Trade debt Other Assets Real assets Equipment and software Real estate Inventories Total real assets Financial assets. Deposits and cash Marketable securities Trade and consumer credit Other Total financial assets Total $ Billion % Total Ratio for nonfinancial firms $ 4,412 9,504 1,744 $15,660 $ 682 1,071 2,292 6,964 16.5% 35.6 6.5 58.7% 2.6% 4.0 8.6 26.1 $11,009 41.3% $26,669 100.0% Total liabilities Net worth $ Billion $ 5,374 773 1,350 1,750 4,628 $13,875 $12,794 $26,669 & Total 20.2% 2.9 5.1 6.6 17.4 52.0% 48.0% 100.0% Balance sheet of U.S. nonfinancial corporations Note: Column sums may differ from total because of rounding error. Source: Flow of Funds Accounts of the United States, Board of Governors of the Federal Reserve System, September 2018.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 27P

Related questions

Question

Transcribed Image Text:b. What is the ratio of real assets to total assets for nonfinancial firms in the following table? (Round your answer to 4 decimal places.)

Liabilities and Net Worth

Liabilities

Bonds and mortgages

Bank loans

Other loans

Trade debt

Other

Assets

Real assets

Equipment and software

Real estate

Inventories

Total real assets

Financial assets

Deposits and cash

Marketable securities

Trade and consumer credit

Other

Total financial assets

Total

$ Billion % Total

$ 4,412

9,504

1,744

16.5%

35.6

6.5

$15,660

58.7%

Ratio for nonfinancial firms

2.6%

4.0

8.6

26.1

41.3%

$ 682

1,071

2,292

6,964

$11,009

$26,669 100.0%

Total liabilities

Net worth

$ Billion

$ 5,374

773

1,350

1,750

4,628

$13,875

$12,794

$26,669

% Total

20.2%

2.9

5.1

6.6

17.4

52.0%

48.0%

100.0%

Balance sheet of U.S. nonfinancial corporations

Note: Column sums may differ from total because of rounding error.

Source: Flow of Funds Accounts of the United States, Board of Governors of the Federal Reserve System, September 2018.

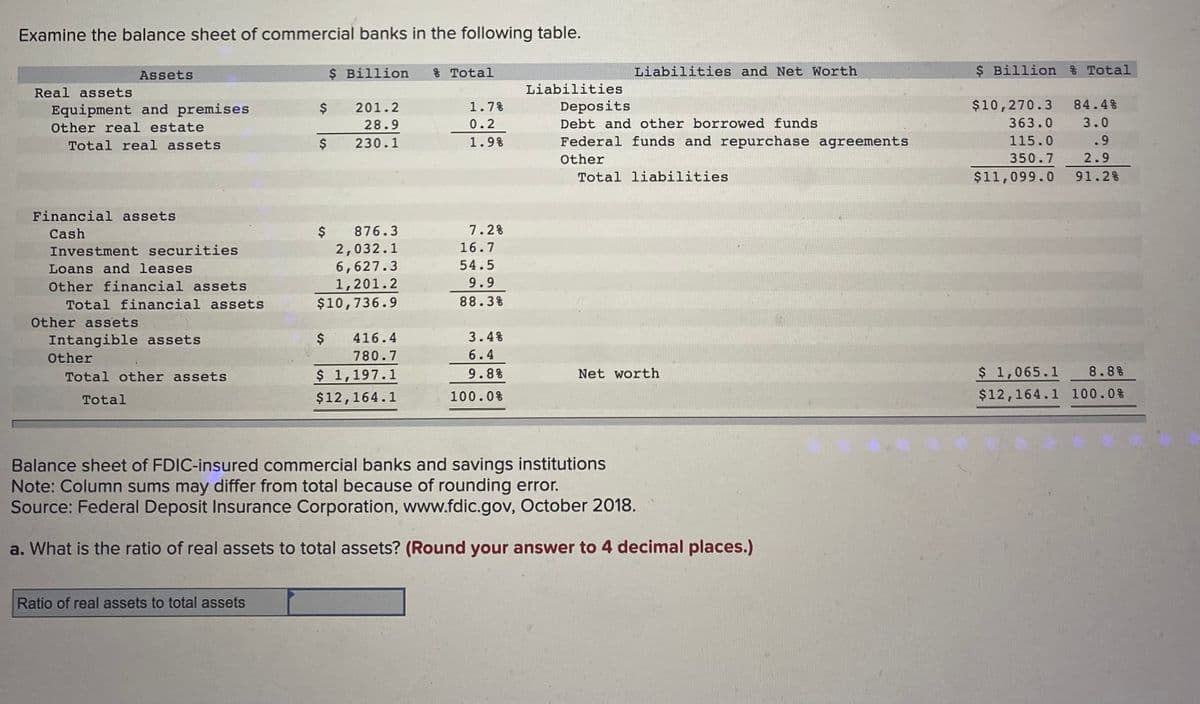

Transcribed Image Text:Examine the balance sheet of commercial banks in the following table.

$ Billion % Total

201.2

28.9

230.1

Assets

Real assets

Equipment and premises

Other real estate

Total real assets

Financial assets

Cash

Investment securities

Loans and leases

Other financial assets

Total financial assets

Other assets

Intangible assets

Other

Total other assets

Total

$

Ratio of real assets to total assets

$

$ 876.3

2,032.1

6,627.3

1,201.2

$10,736.9

$ 416.4

780.7

$ 1,197.1

$12,164.1

1.7%

0.2

1.9%

7.2%

16.7

54.5

9.9

88.3%

3.4%

6.4

9.8%

100.0%

Liabilities

Deposits

Liabilities and Net Worth

Debt and other borrowed funds

Federal funds and repurchase agreements

Other

Total liabilities

Net worth

Balance sheet of FDIC-insured commercial banks and savings institutions

Note: Column sums may differ from total because of rounding error.

Source: Federal Deposit Insurance Corporation, www.fdic.gov, October 2018.

a. What is the ratio of real assets to total assets? (Round your answer to 4 decimal places.)

$ Billion % Total

84.4%

3.0

.9

2.9

$11,099.0 91.2%

$10,270.3

363.0

115.0

350.7

$ 1,065.1 8.8%

$12,164.1 100.0%

Expert Solution

Step 1

Real assets are the types of assets that include the building, equipment, and land owned/leased by the company. These assets are helpful in carrying out production activities. The production of goods takes place with the help of these assets.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College