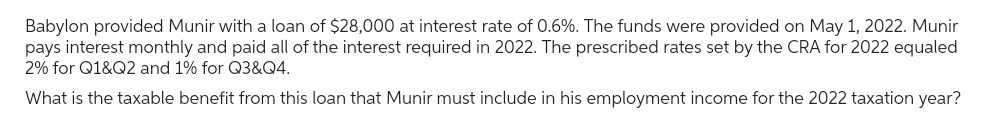

Babylon provided Munir with a loan of $28,000 at interest rate of 0.6%. The funds were provided on May 1, 2022. Munir pays interest monthly and paid all of the interest required in 2022. The prescribed rates set by the CRA for 2022 equaled 2% for Q1&Q2 and 1% for Q3&Q4. What is the taxable benefit from this loan that Munir must include in his employment income for the 2022 taxation year?

Babylon provided Munir with a loan of $28,000 at interest rate of 0.6%. The funds were provided on May 1, 2022. Munir pays interest monthly and paid all of the interest required in 2022. The prescribed rates set by the CRA for 2022 equaled 2% for Q1&Q2 and 1% for Q3&Q4. What is the taxable benefit from this loan that Munir must include in his employment income for the 2022 taxation year?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 17P

Related questions

Question

Am. 386.

Transcribed Image Text:Babylon provided Munir with a loan of $28,000 at interest rate of 0.6%. The funds were provided on May 1, 2022. Munir

pays interest monthly and paid all of the interest required in 2022. The prescribed rates set by the CRA for 2022 equaled

2% for Q1&Q2 and 1% for Q3&Q4.

What is the taxable benefit from this loan that Munir must include in his employment income for the 2022 taxation year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT