balance in his capital account may

Chapter21: Partnerships

Section: Chapter Questions

Problem 6BCRQ

Related questions

Question

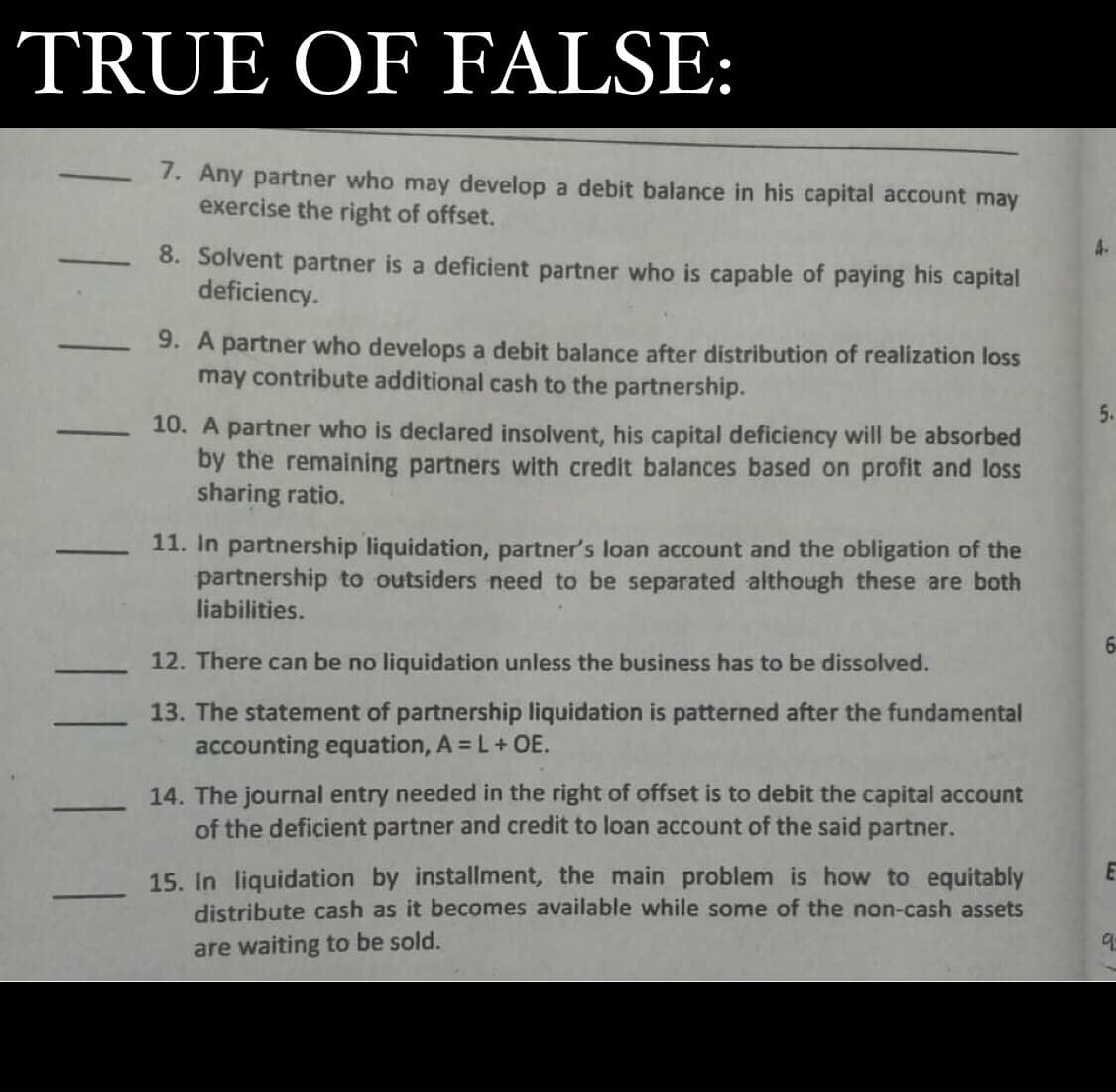

Transcribed Image Text:TRUE OF FALSE:

1. Any partner who may develop a debit balance in his capital account may

exercise the right of offset.

4.

8. Solvent partner is a deficient partner who is capable of paying his capital

deficiency.

9. A partner who develops a debit balance after distribution of realization loss

may contribute additional cash to the partnership.

5.

10. A partner who is declared insolvent, his capital deficiency will be absorbed

by the remaining partners with credit balances based on profit and loss

sharing ratio.

11. In partnership liquidation, partner's loan account and the obligation of the

partnership to outsiders need to be separated although these are both

liabilities.

12. There can be no liquidation unless the business has to be dissolved.

13. The statement of partnership liquidation is patterned after the fundamental

accounting equation, A = L+ OE.

14. The journal entry needed in the right of offset is to debit the capital account

of the deficient partner and credit to loan account of the said partner.

-

15. In liquidation by installment, the main problem is how to equitably

distribute cash as it becomes available while some of the non-cash assets

are waiting to be sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT