balance or deducted from the book or bank account by putting (/) check mark or (x) cross mark on the corresponding column.

balance or deducted from the book or bank account by putting (/) check mark or (x) cross mark on the corresponding column.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter4: Internal Control And Cash

Section: Chapter Questions

Problem 47E

Related questions

Question

Transcribed Image Text:10:43

|0 •

0.16

4G

KB/S

70

Document View

1. Credit memos are items that are already added by the bank but have not been added by the

book as of the cut off date.

2. Debit memos are amounts that have been deducted by the bank but have not been deducted

per book.

3. Examples of debit memo include accounts receivable collected by the bank in favor of the

company and loan proceed directly credited by the bank to the account of the customer.

4. Monthly bank reconciliation is one of the internal control features in every company, which is

created to show that there is no discrepancy between the cash balance per book records and the

cash balance per bank records.

5. Reciprocal accounts should have the same balance after ail adjustments have been made.

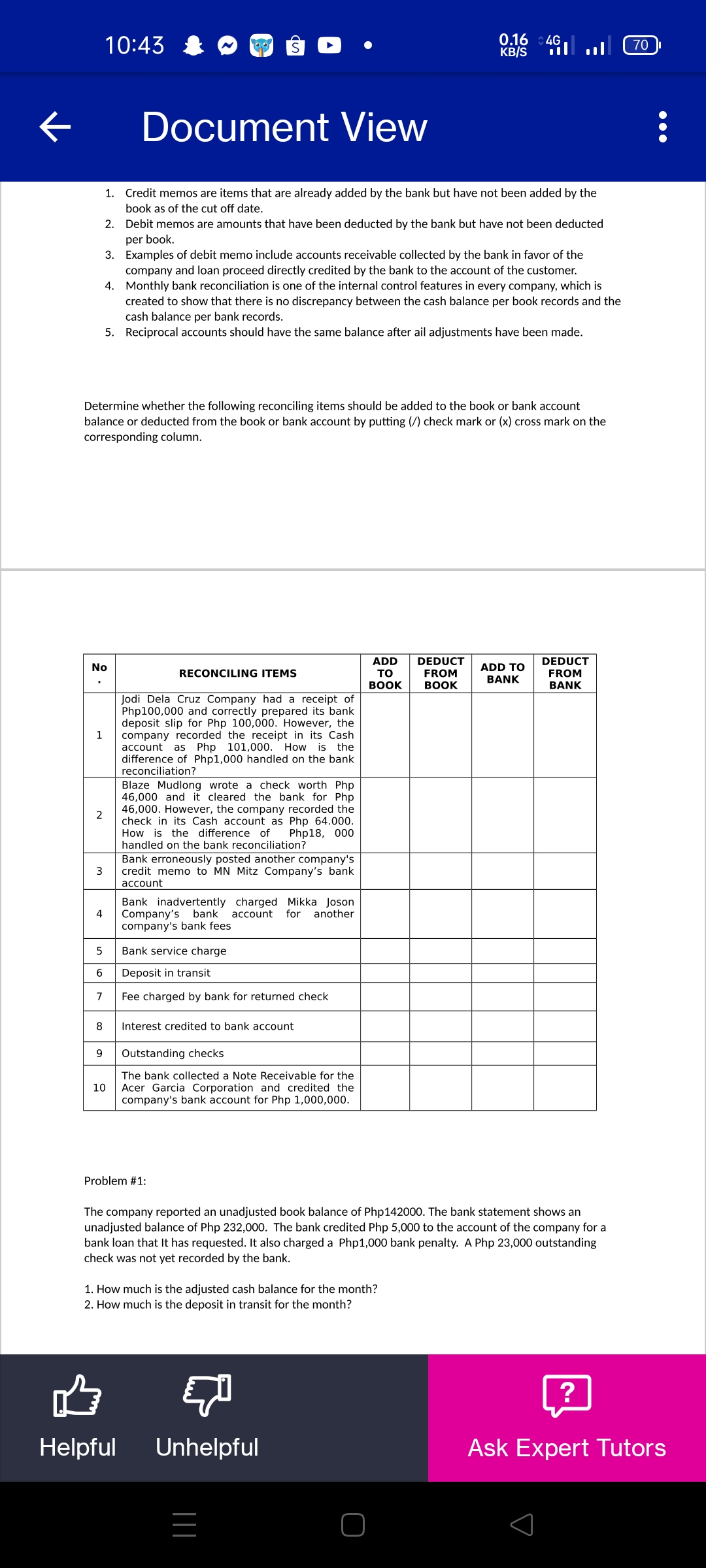

Determine whether the following reconciling items should be added to the book or bank account

balance or deducted from the book or bank account by putting (/) check mark or (x) cross mark on the

corresponding column.

ADD

DEDUCT

DEDUCT

ADD TO

BANK

No

RECONCILING ITEMS

FROM

то

BOOK

FROM

BOOK

BANK

Jodi Dela Cruz Company had a receipt of

Php100,000 and correctly prepared its bank

deposit slip for Php 100,000. However, the

1

company recorded the receipt in its Cash

account as Php 101,000. How is the

difference of Php1,000 handled on the bank

reconciliation?

Blaze Mudlong wrote a check worth Php

46,000 and it cleared the bank for Php

46,000. However, the company recorded the

check in its Cash account as Php 64.000.

How is the difference of

handled on the bank reconciliation?

Bank erroneously posted another company's

3

Php18, 000

credit memo to MN Mitz Company's bank

account

Bank inadvertently charged Mikka Joson

Company's bank

company's bank fees

4

account

for

another

Bank service charge

6

Deposit in transit

7

Fee charged by bank for returned check

8

Interest credited to bank account

9

Outstanding checks

The bank collected a Note Receivable for the

Acer Garcia Corporation and credited the

company's bank account for Php 1,000,000.

10

Problem #1:

The company reported an unadjusted book balance of Php142000. The bank statement shows an

unadjusted balance of Php 232,000. The bank credited Php 5,000 to the account of the company for a

bank loan that It has requested. It also charged a Php1,000 bank penalty. A Php 23,000 outstanding

check was not yet recorded by the bank.

1. How much is the adjusted cash balance for the month?

2. How much is the deposit in transit for the month?

?

Helpful

Unhelpful

Ask Expert Tutors

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,