Baland Company purchased a building for $218,000 that had an estimated residual value of $8,000 and an estimated senvice ife of 10 years. Bailand purchased the building 4 years ago and has used straight-line depreciation. At the beginning of the fith year (before it records depreciation expense for the year), the following independent situations occur 1. Baland estimates that the asset has 8 years' ife remaining (for a total of 12 years) 2. Baland changes to the sum-of-the-years-digits method. 3. Baland discovers that the estimated residual value has been ignored in the computation of depreciation expense. Required: For each of the independent situations, prepare all the journal entries relating to the building for the fth year. Ignore income tares

Baland Company purchased a building for $218,000 that had an estimated residual value of $8,000 and an estimated senvice ife of 10 years. Bailand purchased the building 4 years ago and has used straight-line depreciation. At the beginning of the fith year (before it records depreciation expense for the year), the following independent situations occur 1. Baland estimates that the asset has 8 years' ife remaining (for a total of 12 years) 2. Baland changes to the sum-of-the-years-digits method. 3. Baland discovers that the estimated residual value has been ignored in the computation of depreciation expense. Required: For each of the independent situations, prepare all the journal entries relating to the building for the fth year. Ignore income tares

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

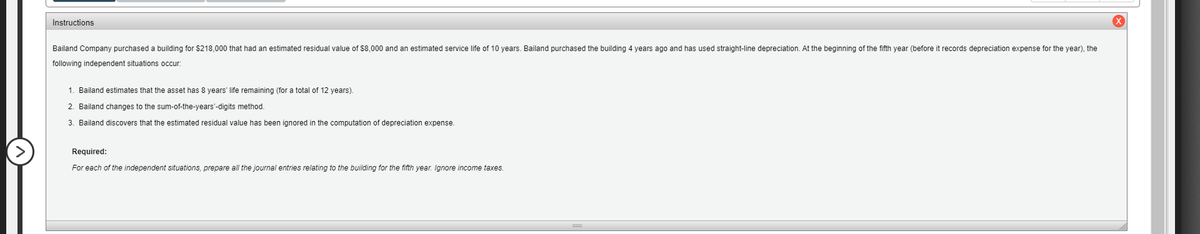

Transcribed Image Text:Instructions

Bailand Company purchased a building for $218,000 that had an estimated residual value of $8,000 and an estimated service life of 10 years. Bailand purchased the building 4 years ago and has used straight-line depreciation. At the beginning of the fifth year (before it records depreciation expense for the year), the

following independent situations occur:

1. Bailand estimates that the asset has 8 years' life remaining (for a total of 12 years).

2. Bailand changes to the sum-of-the-years'-digits method.

3. Bailand discovers that the estimated residual value has been ignored in the computation of depreciation expense.

Required:

For each of the independent situations, prepare all the journal entries relating

the building for the fifth year. Ignore income taxes.

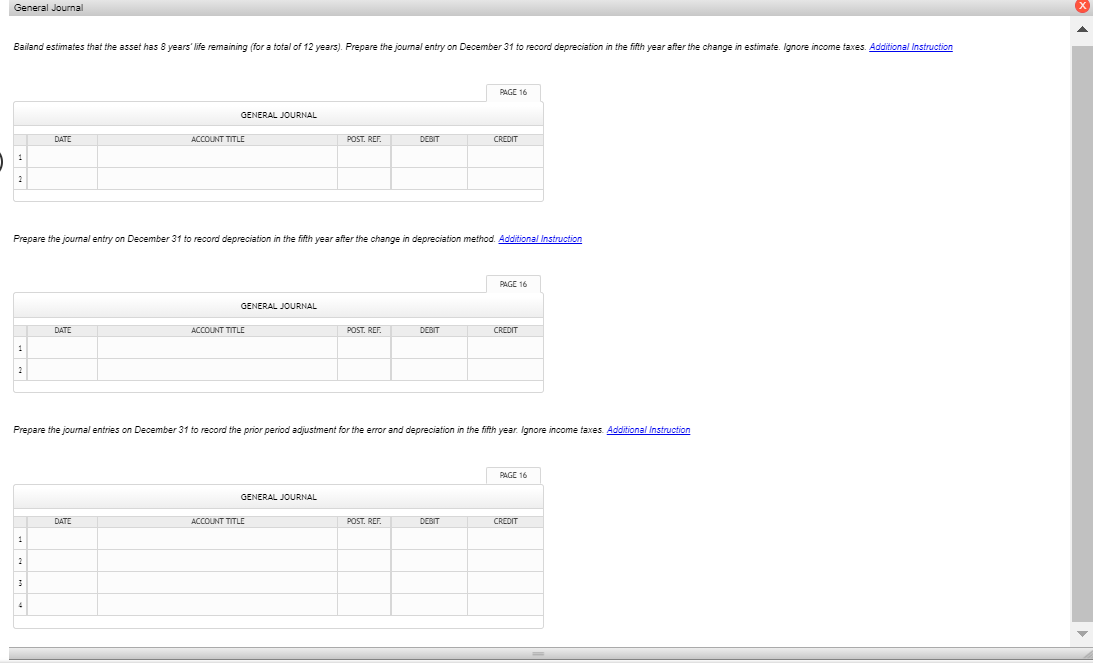

Transcribed Image Text:General Journal

Bailand estimates that the asset has 8 years' life remaining (for a total of 12 years). Prepare the joumal entry on December 31 to record depreciation in the fifth year after the change in estimate. Ignore income taxes. Additional Instruction

PAGE 16

GENERAL JOURNAL

DATE

ACCOUNT TITLE

POST, REF.

DEBIT

CREDIT

Prepare the journal entry on December 31 to record depreciation in the fifth year after the change in depreciation method. Additional Instruction

PAGE 16

GENERAL JOURNAL

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

Prepare the journal entries on December 31 to record the prior period adjustment for the error and depreciation in the fifth year. Ignore income taxes. Addlitional Instruction

PAGE 16

GENERAL JOURNAL

DATE

ACCOUNT TITLE

POST REE

DEBIT

CREDIT

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT