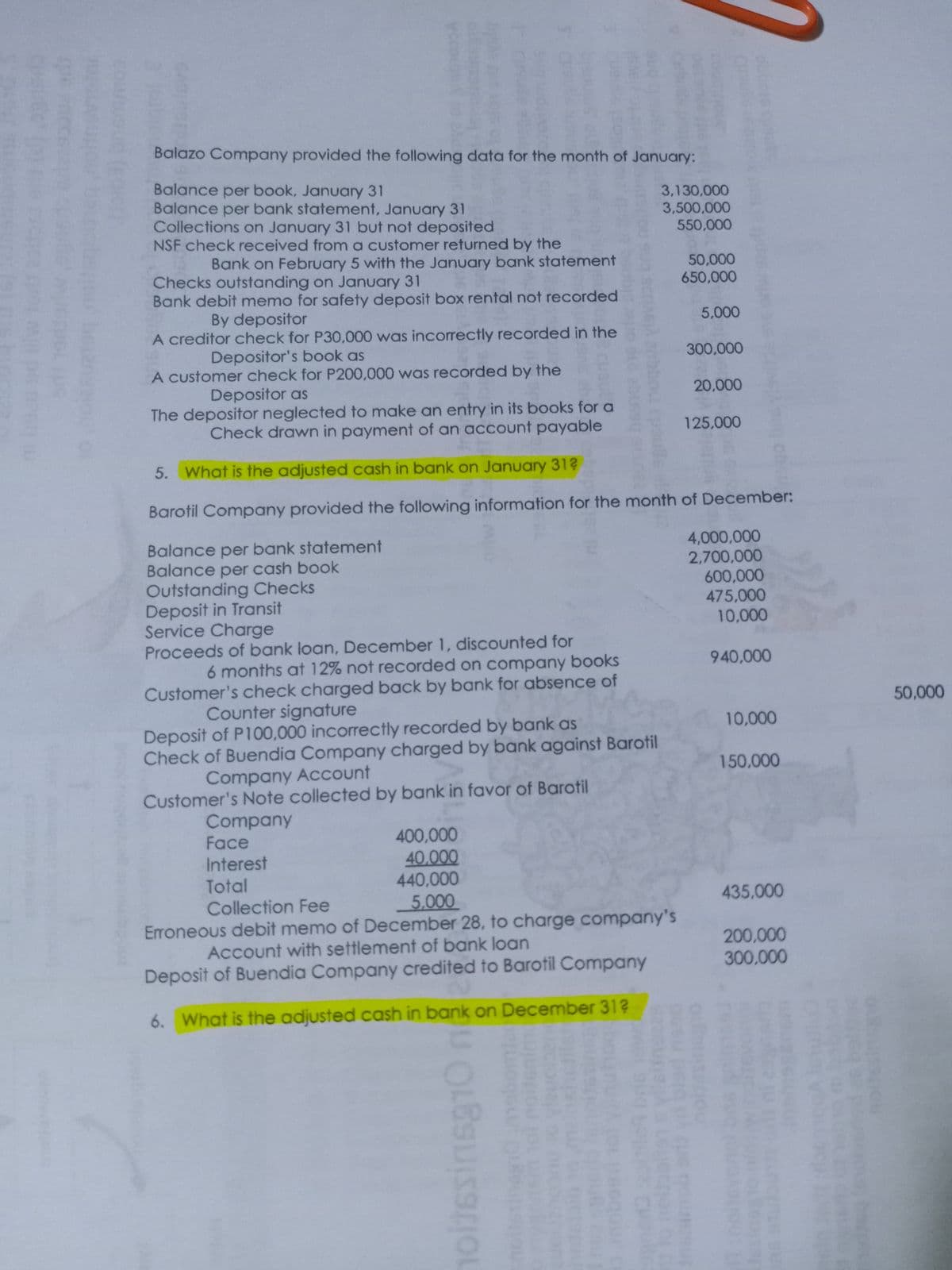

Balazo Company provided the following data for the month of January: Balance per book, January 31 Balance per bank statement, January 31 Collections on January 31 but not deposited NSF check received from a customer returned by the 3,130,000 3,500,000 550,000 50,000 650,000 Bank on February 5 with the January bank statement Checks outstanding on January 31 Bank debit memo for safety deposit box rental not recorded 5,000 By depositor A creditor check for P30,000 was incorrectly recorded in the 300,000 Depositor's book as A customer check for P200,000 was recorded by the 20,000 Depositor as The depositor neglected to make an entry in its books for a Check drawn in payment of an account payable 125,000 5. What is the adjusted cash in bank on January 31?

Balazo Company provided the following data for the month of January: Balance per book, January 31 Balance per bank statement, January 31 Collections on January 31 but not deposited NSF check received from a customer returned by the 3,130,000 3,500,000 550,000 50,000 650,000 Bank on February 5 with the January bank statement Checks outstanding on January 31 Bank debit memo for safety deposit box rental not recorded 5,000 By depositor A creditor check for P30,000 was incorrectly recorded in the 300,000 Depositor's book as A customer check for P200,000 was recorded by the 20,000 Depositor as The depositor neglected to make an entry in its books for a Check drawn in payment of an account payable 125,000 5. What is the adjusted cash in bank on January 31?

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 1PA

Related questions

Question

100%

Transcribed Image Text:Balazo Company provided the following data for the month of January:

Balance per book, January 31

Balance per bank statement, January 31

Collections on January 31 but not deposited

NSF check received from a customer returned by the

3,130,000

3,500,000

550,000

Bank on February 5 with the January bank statement

Checks outstanding on January 31

Bank debit memo for safety deposit box rental not recorded

50,000

650,000

By depositor

5,000

A creditor check for P30,000 was incorectly recorded in the

Depositor's book as

300,000

A customer check for P20O0,000 was recorded by the

Depositor as

20,000

The depositor neglected to make an entry in its books for a

Check drawn in payment of an account payable

125,000

5. What is the adjusted cash in bank on January 31?

Barotil Company provided the following information for the month of December:

Balance per bank statement

Balance per cash book

Outstanding Checks

Deposit in Transit

Service Charge

4,000,000

2,700,000

600,000

475,000

10,000

Proceeds of bank loan, December 1, discounted for

6 months at 12% not recorded on company books

Customer's check charged back by bank for absence of

940,000

50,000

Counter signature

10,000

Deposit of P100,000 incorrectly recorded by bank as

Check of Buendia Company charged by bank against Barotil

150,000

Company Account

Customer's Note collected by bank in favor of Barotil

Company

Face

400,000

40,000

440,000

Interest

Total

435,000

5,000

Erroneous debit memo of December 28, to charge company's

Account with settlement of bank loan

Collection Fee

200,000

300,000

Deposit of Buendia Company credited to Barotil Company

6. What is the adjusted cash in bank on December 31?

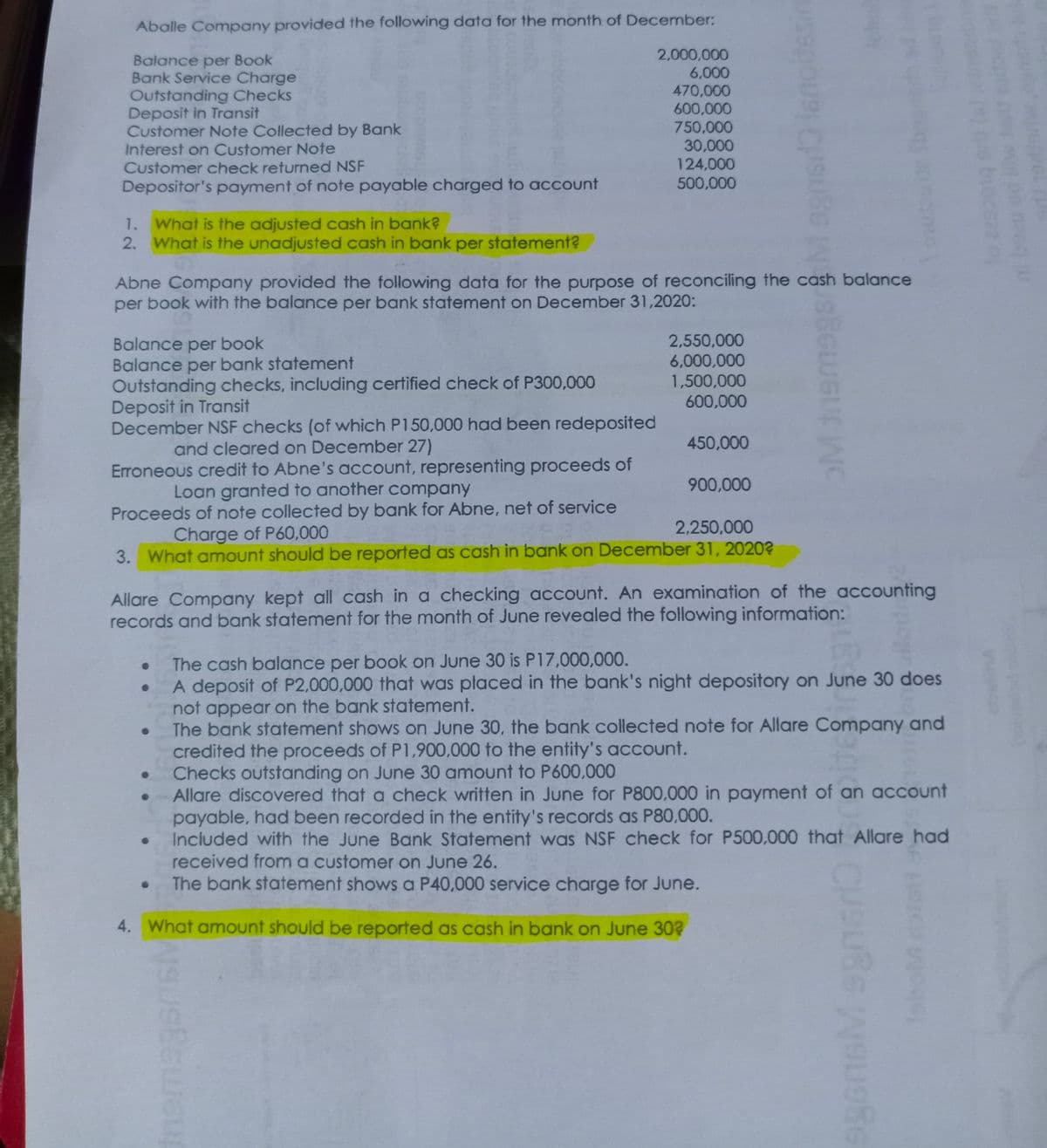

Transcribed Image Text:Aballe Company provided the following data for the month of December:

Balance per Book

Bank Service Charge

Outstanding Checks

Deposit in Transit

Customer Note Collected by Bank

Interest on Customer Note

Customer check returned NSF

2,000,000

6,000

470,000

600,000

750,000

30,000

124,000

Depositor's payment of note payable charged to account

500,000

1. What is the adjusted cash in bank?

2. What is the unadjusted cash in bank per statement?

Abne Company provided the following data for the purpose of reconciling the cash balance

per book with the balance per bank statement on December 31,2020:

Balance per book

Balance per bank statement

Outstanding checks, including certified check of P300,000

Deposit in Transit

December NSF checks (of which P150,000 had been redeposited

2,550,000

6,000,000

1,500,000

600,000

and cleared on December 27)

450,000

Erroneous credit to Abne's account, representing proceeds of

Loan granted to another company

Proceeds of note collected by bank for Abne, net of service

900,000

2,250,000

Charge of P60,000

3. What amount should be reported as cash in bank on December 31, 2020?

Allare Company kept all cash in a checking account. An examination of the accounting

records and bank statement for the month of June revealed the following information:

The cash balance per book on June 30 is P17,000,000.

A deposit of P2,000,000 that was placed in the bank's night depository on June 30 does

not appear on the bank statement.

The bank statement shows on June 30, the bank collected note for Allare Company and

credited the proceeds of P1,900,000 to the entity's account.

Checks outstanding on June 30 amount to P600,000

Allare discovered that a check written in June for P800,000 in payment of an account

payable, had been recorded in the entity's records as P80,000.

Included with the June Bank Statement was NSF check for P500,000 that Allare had

received from a customer on June 26.

The bank statement shows a P40,000 service charge for June.

4. What amount should be reported as cash in bank on June 30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning