Banana Brothers, manufactures two types of Y Blocks: The Alfa and the Beta. Denoting Alfa output as Q1 and Beta output as Q2, the company has estimated the following demand equation for its Blocks: Q= 10 - 0.2P1 - 0.4Q2 Q2 = 20 - 0.5P2 - 2Q1 The total cost equation for producing Alfa and Beta are TC, = 4 + 2Q,2 TC2 = 8 + 6Q,2 a) If Banana Brothers is a profit-maximizing firm, how much should it charge for Alfa and Beta? b) What is the profit maximizing level of output for Alfa and Beta? c) What is Banana Brother's profit? %3D

Banana Brothers, manufactures two types of Y Blocks: The Alfa and the Beta. Denoting Alfa output as Q1 and Beta output as Q2, the company has estimated the following demand equation for its Blocks: Q= 10 - 0.2P1 - 0.4Q2 Q2 = 20 - 0.5P2 - 2Q1 The total cost equation for producing Alfa and Beta are TC, = 4 + 2Q,2 TC2 = 8 + 6Q,2 a) If Banana Brothers is a profit-maximizing firm, how much should it charge for Alfa and Beta? b) What is the profit maximizing level of output for Alfa and Beta? c) What is Banana Brother's profit? %3D

Linear Algebra: A Modern Introduction

4th Edition

ISBN:9781285463247

Author:David Poole

Publisher:David Poole

Chapter2: Systems Of Linear Equations

Section2.4: Applications

Problem 23EQ:

23. Consider a simple economy with just two industries: farming and manufacturing. Farming consumes...

Related questions

Topic Video

Question

Please answer for the attached question

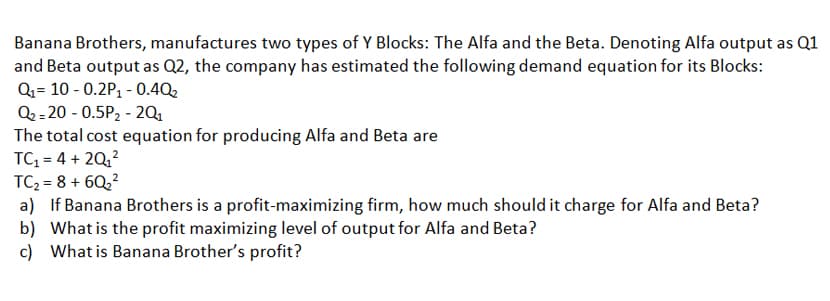

Transcribed Image Text:Banana Brothers, manufactures two types of Y Blocks: The Alfa and the Beta. Denoting Alfa output as Q1

and Beta output as Q2, the company has estimated the following demand equation for its Blocks:

Q= 10 - 0.2P, - 0.4Q2

Q2 = 20 - 0.5P2 - 2Q1

The total cost equation for producing Alfa and Beta are

TC, = 4 + 20,?

TC2 = 8 + 6Q,?

a) If Banana Brothers is a profit-maximizing firm, how much should it charge for Alfa and Beta?

b) What is the profit maximizing level of output for Alfa and Beta?

c) What is Banana Brother's profit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, advanced-math and related others by exploring similar questions and additional content below.Recommended textbooks for you

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning