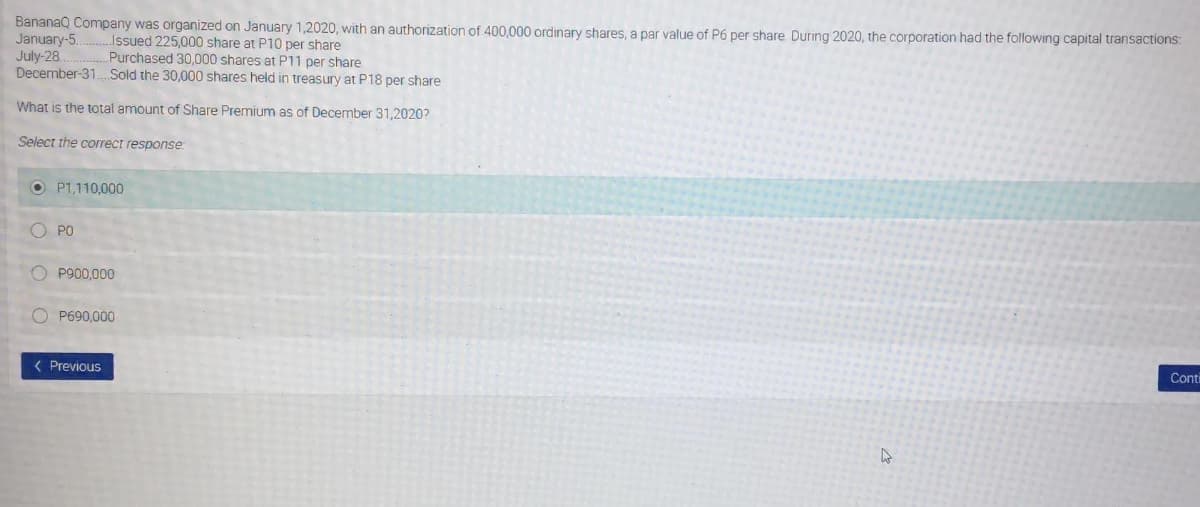

BananaQ Company was organized on January 1,2020, with an authorization of 400,000 ordinary shares, a par value of P6 per share During 2020, the corporation had the following capital transactions: January-5. July-28 December-31. Sold the 30,000 shares held in treasury at P18 per share Issued 225,000 share at P10 per share Purchased 30,000 shares at P11 per share What is the total amount of Share Premium as of December 31.2020? Select the correct response. O P1,110,000 O PO O P900,000 O P690,000

Q: On December 31, 2021, the statement of financial position of FRUITS Company showed the following…

A: Preference shares-Cumulative These are the shareholders having right to receive dividends if…

Q: ined earnings 5,700,000 Share capital transactions for the year 2021: March 10 - Reacquired 80,000…

A: When treasury shares are retired, then treasury shares are credited at their purchase cost and…

Q: The Nonono Corporation is authorized to issue 100,000 ordinary shares, P17 par value. At the…

A: Calculation of Total share premium Particulars Amount Jan 16, issued 1300 ordinary share…

Q: Favor Corp. was organized on January 1, 2020 and was authorized to issue 50,000 ordinary shares with…

A: The authorized capital is fixed and out of which shares are subscribed and paid.

Q: The shareholders’ equity section of Pottery Corporation’s statement of financial position as of…

A: Stockholder's equity is the amount belongs to the stockholder's of the business. It is the sum of…

Q: LEE Company had the following amounts in the shareholders’ equity on January 1, 2020: Preference…

A: Accumulated Profits are part of net income that is not distributed to the equity shareholders at the…

Q: Haru Corporation reported the following shareholders’ equity on January 1, 2020. > Ordinary Share…

A: RE refers to Retained Earnings which is the amount of NI (Net Income) that is left or retained by…

Q: The capital structure of THOR Company on December 31, 2020, is as follows: • 12% Preference shares,…

A: No. of shares issued from donated shares = No. of donated shares x 1/2 = 20000 shares x 1/2 =…

Q: Crimson Pottery Corporation is authorized to issue 40,000 shares of $7 convertible preferred shares…

A: A journal entry is the first step in recording financial transactions in the books of business…

Q: The shareholders’ equity section of Haemul Pajeon Co. as of Dec. 31, 2019, contained the ff.…

A: No. of shares issued under bonus issue = No. of shares outstanding x bonus rate Amount charged to…

Q: Pluto Company began operations on January 1, 2019 with an authorized capital of 500,000 preference…

A: Contributed capital: It is the total value of shares issued during a period. The shares issued…

Q: retained earnings?

A: Definition: Retained Earnings: It is the amount that is obtained after distribution of dividend to…

Q: anterbury Corp. had the following shareholders’ equity at the beginning of 2019: Ordinary Share…

A: The unappropriated retained earnings are the net retained earnings left to be distributed as…

Q: TROPA Inc. was incorporated on January 1, 2020, Information about its authorized shares is shown…

A: Computation of the amount of total shareholders equity as of December 31 2020 is :

Q: On January, 2019, Chicosci Corporation was incorporated with authorized Ordinary share capital of P…

A: Ordinary share capital refers to the total share outstanding at the par value per share.

Q: The capital structure of THOR Company on December 31, 2020, is as follows: 12% Preference shares,…

A: Formula: Total dividends = Preferred dividends + Ordinary dividends

Q: On January 1, 2022, Dumbledore Company issued 10,000 shares of its P10 par value shares with a…

A: Owner equity means the amount that belong to the owner of the business. Any profit will increase…

Q: During its first year of operations, Cupola Fan Corporation issued 40,000 of $1 par Class B shares…

A: Journal entries No. Date account titles and explanation Debit…

Q: Rayan Corporation was organized on January 1, 2020, with an authorization of 1,200,000 ordinary…

A: The total number of share premium as of December 31, 2020 = Cost of Treasury shares - Cost of…

Q: SHEA Corp. was organized on January 2020. Share capital transactions for the year are shown below:…

A: Share capital in the statement of stockholders' equity represents the par value of the total shares…

Q: The equity section of Gunkel Corporation as of December 31, 2021, was as follows: Share…

A: Retained earnings is increases with net income and decreases with net loss . Also the dividends…

Q: On January 1, 2020, Addy Company had 110,000 shares issued and 100,000 shares outstanding. The…

A: No. of shares issued before share split = No. of shares issued on January 1, 2020 + shares issued…

Q: The analysis of shareholder’s equity of AAA Company at January 1, 2020 showed the following:…

A:

Q: On January 1, 2020, XYZ Corporation had 250,000 ordinary shares of P2 par value outstanding. On…

A: Earnings per share = (Net income - Preferred dividend) / weighted-average number of shares…

Q: Shake It Off Co. was formed on July 1, 2018. It was authorized to issue 1,800,000 shares of 10 par…

A: The value of stock dividends will be measured as follows: a) If 20% or more is declared; retained…

Q: Madona Ltd. begins operations on March 1, 2020, by issuing 1,500,000 shares of $5 par value…

A: Ordinary shares: These are the shares issued by a company to an outsider. These shares entitle a…

Q: The capital structure of THOR Company on December 31, 2020, is as follows: • 12% Preference shares,…

A: 1) The total amount of dividends on preference and ordinary shares. 2) The Total shareholders’…

Q: Harbottle Corporation was organized on January 3, 2021, with an authorized capital of 100,000 shares…

A: Loss on reissue of treasury shares = no. of treasury shares reissued x (Purchase price - reissue…

Q: Voko Company was organized on May 25, 2020 and was authorized to issue 250,000 shares of Rs 15 or…

A: Yoko Company has authorized to issue 250,000 common shares @ Rs 15 par value and Preferred stock 8%…

Q: Garnett Company was organized on January 1, 2020 with authorized capital of 100,000shares of P200…

A: Share premium is additional amount received in excess of par on issue of stock

Q: General Mills is authorized to issue 13 million, $1 par common shares. During 2021, its first year…

A: Introduction: Common shares normally provide shareholders the right to vote at shareholder meetings.…

Q: Sousa Caterers, Inc. was organized on May 13, 2019 and the articles stipulated the following…

A: Sousa caterers Inc.'s Authorized capital is 1. 4500 shares of preference shares = P110 par value 2.…

Q: On 1 January 2020, the company "A" S.A. had a common share capital of 2,000,000€, differences from…

A: Date Particulars Amount in Dr. Amount in Cr. 1/5/2020 Ordinary Share Capital A/c To Bank A/c…

Q: On January 01, 2021, Acoba Corporation provided you the following information: Ordinary share…

A: Treasury shares means the share which has been buy back by the company . It will be shown as…

Q: FROZEN Corporation was incorporated on January 1, 2018 with the following authorized capitalization:…

A: SOLUTION- CONTRIBUTED CAPITAL IS THE FINANCING OF A CAPITAL (INDIVIDUAL OR PARTNERSHIP) BY THE…

Q: nary shares with a par value of P10 per share. During the current year, the entity had the following…

A: Solution: Share premium is the amount which is in excess of par value of ordinary shares. It also…

Q: n January 01, 2021, Pagaduan Corporation provided you the following information: Ordinary share…

A: Solution: Treasury shares are those shares which are purchased by a corporation of its own shares.…

Q: The shareholders' equity of the ABA Company on January 1, 2020 is presented below: Share capital,…

A: It shows the sum of the amount invested by shareholders and retained earnings. It is divided into…

Q: Mitch Company was organized on January 1, 2021 and issued 100,000 P20 par value shares at P23 per…

A: Shareholder equity means the amount that belong to the owner of the company i.e. share holder.…

Q: On December 31,2020, the shareholders' equity section of DEF, Inc. was [Ordinary Share Capital, par…

A: The retained earnings of the business includes the net income or loss earned, dividend declared,…

Q: The shareholders’ equity section of Pottery Corporation’s statement of financial position as of…

A:

Q: Curve Company reported the following shareholders' equity on January 1, 2020: Ordinary share…

A: On May 2021, Number of shares issued in connection with bond warrant = 10000 shares @ P 120 per…

Q: At the beginning of the current year, Bella Company was organized and authorized to issue 100,000…

A: The shareholders' equity section displays all the capital, income or losses that belongs to…

Q: ananaQ Company was organized on January 1,2020, with an authorization of 400,000 ordinary shares, a…

A: Solution Given Number of authorized shares 400000 Jan 5 issued 225000 shares July 28…

Q: On January 1, 2020, XYZ Corporation had 250,000 ordinary shares of P2 par value outstanding. On…

A: A share is the division in the capital of the company. A shareholder is entitled to receive division…

Q: The shareholders’ equity of Jungkook Corporation as of October 1, 2020 is presented below: Ordinary…

A: Treasury stock: Shares that are bought back by the company from the open market but not retired from…

Q: The Corazon Corporation is authorized to issue 100,000 shares at P20 par ordinary shares. At the…

A: answer with calculations re as follows.

Q: On January 1, 2020, Marimar Company reported the following shareholder's equity: Share capital,…

A: The Shareholder's equity shows the amount of contribution by the owners to the capital of the…

Q: HEA Corp. was organized on January 2020. Share capital transactions for the year are shown below:…

A: solution given Authorized share capital 50000shares Par value 10 per share On…

Q: ABC Co. issued share capital of 20,000 shares, P5 par, at P10 per share. The accumulated profits on…

A: Treasury Stock refers to the company’s own outstanding stock bought back from stockholders. These…

Step by step

Solved in 3 steps with 2 images

- Cary Corporation has 50,000 shares of 10 par common stock authorized. The following transactions took place during 2019, the first year of the corporations existence: Sold 5,000 shares of common stock for 18 per share. Issued 5,000 shares of common stock in exchange for a patent valued at 100,000. At the end of Carys first year, total contributed capital amounted to: a. 40,000 b. 90,000 c. 100,000 d. 190,000Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Silva Company is authorized to issue 5,000,000 shares of $2 par value common stock. In its IPO, the company has the following transaction: Mar. 1, issued 500,000 shares of stock at $15.75 per share for cash to investors. Journalize this transaction.

- Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?Winona Company began 2019 with 10,000 shares of 10 par common stock and 2,000 shares of 9.4%, 100 par, convertible preferred stock outstanding. On April 2 and June 1, respectively, the company issued 2,000 and 6,000 additional shares of common stock. On November 16, Winona declared a 2-for-1 stock split. The preferred stock was issued in 2018. Each share of preferred stock is currently convertible into 4 shares of common stock. To date, no preferred stock has been converted. Current dividends have been paid on both preferred and common stock. Net income after taxes for 2019 totaled 109,800. The company is subject to a 30% income tax rate. The common stock sold at an average market price of 24 per share during 2019. Required: 1. Prepare supporting calculations for Winona and compute its: a. basic earnings per share b. diluted earnings per share 2. Show how Winona would report the earnings per share on its 2019 income statement. Include an accompanying note to the financial statements. 3. Next Level Assume Winona uses IFRS. Discuss what Winona would do differently for computing earnings per share, and then repeat Requirement 1 under IFRS.

- Tama Companys capital structure consists of common stock and convertible bonds. At the beginning of 2019, Tama had 15,000 shares of common stock outstanding; an additional 4,500 shares were issued on May 4. The 7% convertible bonds have a face value of 80,000 and were issued in 2016 at par. Each 1,000 bond is convertible into 25 shares of common stock; to date, none of the bonds have been converted. During 2019, the company earned net income of 79,200 and was subject to an income tax rate of 30%. Required: Compute the 2019 diluted earnings per share.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.

- Comprehensive Young Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, 100 par preferred stock. The Contributed Capital section of its January 1, 2019, balance sheet is as follows: Part a. A shareholder has raised the following questions: 1. What is the legal capital of the corporation? 2. At what average price per share has the preferred stock been issued? 3. How many shares of common stock have been issued (the common stock has been issued at an average price of 23 per share)? Part b. The company engaged in the following transactions in 2019: Required: 1. Answer the questions in Part a. 2. Prepare journal entries to record the transactions in Part b. 3. Prepare the Contributed Capital section of Youngs December 31, 2016, balance sheet.MacKenzie Mining Corporation is authorized to issue 50,000 shares of $500 par value 7% preferred stock. It is also authorized to issue 5,000,000 shares of $3 par value common stock. In its first year, the corporation has the following transactions: Journalize the transactions.On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.