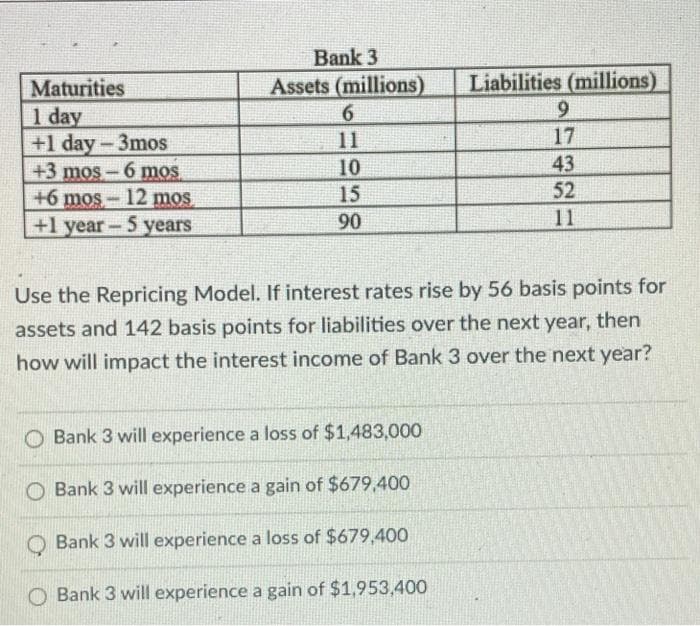

Bank 3 Maturities Assets (millions) Liabilities (millions) 1 day +1 day-3mos +3 mos-6 mos +6 mos- 12 mos +1 year- 5 years 11 17 43 52 10 15 90 11 Use the Repricing Model. If interest rates rise by 56 basis points for assets and 142 basis points for liabilities over the next year, then how will impact the interest income of Bank 3 over the next year? O Bank 3 will experience a loss of $1,483,000 O Bank 3 will experience a gain of $679,400 O Bank 3 will experience a loss of $679,400 O Bank 3 will experience a gain of $1,953,400

Bank 3 Maturities Assets (millions) Liabilities (millions) 1 day +1 day-3mos +3 mos-6 mos +6 mos- 12 mos +1 year- 5 years 11 17 43 52 10 15 90 11 Use the Repricing Model. If interest rates rise by 56 basis points for assets and 142 basis points for liabilities over the next year, then how will impact the interest income of Bank 3 over the next year? O Bank 3 will experience a loss of $1,483,000 O Bank 3 will experience a gain of $679,400 O Bank 3 will experience a loss of $679,400 O Bank 3 will experience a gain of $1,953,400

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter5: Time Value Of Money

Section: Chapter Questions

Problem 27P: EFFECTIVE VERSUS NOMINAL INTEREST RATES Bank A pays 4% interest compounded annually on deposits,...

Related questions

Question

Transcribed Image Text:Bank 3

Liabilities (millions)

9.

17

Assets (millions)

Maturities

1 day

+1 day-3mos

+3 mos-6 mos

+6 mos-12 mos

+l year- 5 years

6.

11

10

43

15

52

90

11

Use the Repricing Model. If interest rates rise by 56 basis points for

assets and 142 basis points for liabilities over the next year, then

how will impact the interest income of Bank 3 over the next year?

O Bank 3 will experience a loss of $1,483,000

O Bank 3 will experience a gain of $679,400

Bank 3 will experience a loss of $679,400

Bank 3 will experience a gain of $1,953,400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning