Banque du Langenberg holds $575 million interest producing assets earning a net interest margin (NIM) of 2.50%. The inital net interest income is thus $14.375 million. The bank's President pursues a strategy of holding longer dated, higher risk assets while also increasing leverage and as a result the net interest margin expands by 25 basis points (or 10% on 2.50%) and the | total asset base increases by 20%. What is the new net interest income? Original scenario Net interest margin Total assets (millions) Rise in nim Rise in total assets Original New scenario Scenario Net interest margin 0.00% 0.00% Total assets $0 $0 Rise in nim 0.0% Rise in total assets 0.0% Net interest income $0.000 $0.000

Banque du Langenberg holds $575 million interest producing assets earning a net interest margin (NIM) of 2.50%. The inital net interest income is thus $14.375 million. The bank's President pursues a strategy of holding longer dated, higher risk assets while also increasing leverage and as a result the net interest margin expands by 25 basis points (or 10% on 2.50%) and the | total asset base increases by 20%. What is the new net interest income? Original scenario Net interest margin Total assets (millions) Rise in nim Rise in total assets Original New scenario Scenario Net interest margin 0.00% 0.00% Total assets $0 $0 Rise in nim 0.0% Rise in total assets 0.0% Net interest income $0.000 $0.000

Chapter4: Financial Planning And Forecasting

Section: Chapter Questions

Problem 9P

Related questions

Question

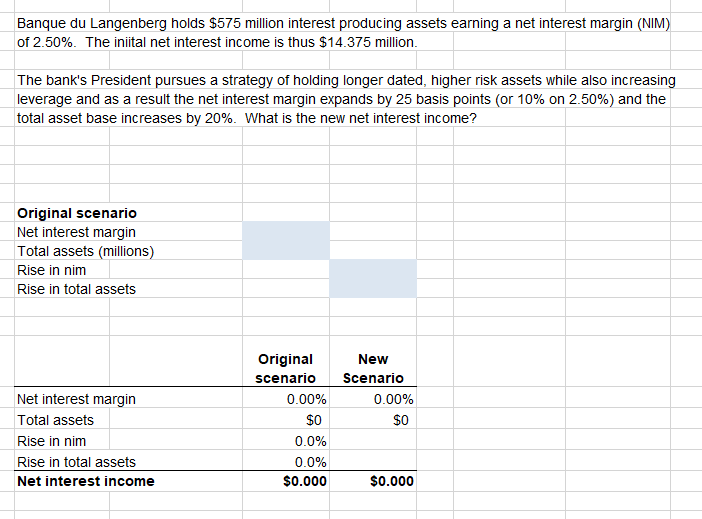

Transcribed Image Text:Banque du Langenberg holds $575 million interest producing assets earning a net interest margin (NIM)

of 2.50%. The iniital net interest income is thus $14.375 million.

The bank's President pursues a strategy of holding longer dated, higher risk assets while also increasing

leverage and as a result the net interest margin expands by 25 basis points (or 10% on 2.50%) and the

total asset base increases by 20%. What is the new net interest income?

Original scenario

Net interest margin

Total assets (millions)

Rise in nim

Rise in total assets

Original

New

scenario

Scenario

Net interest margin

0.00%

0.00%

Total assets

$0

$0

Rise in nim

0.0%

Rise in total assets

0.0%

Net interest income

$0.000

$0.000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning