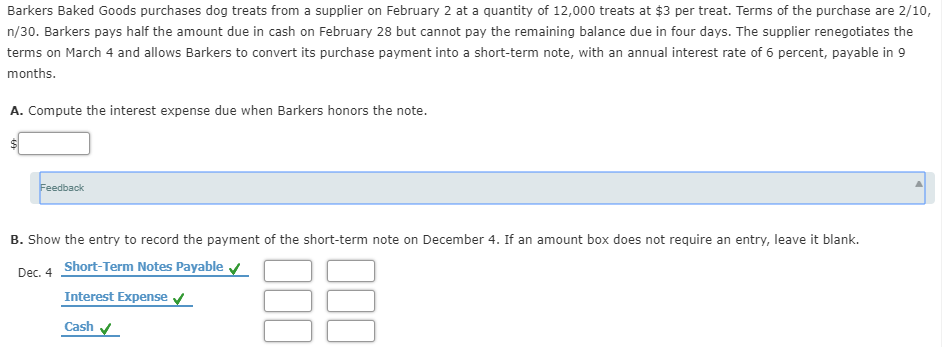

Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 12,000 treats at $3 per treat. Terms of the purchase are 2/10, n/30. Barkers pays half the amount due in cash on February 28 but cannot pay the remaining balance due in four days. The supplier renegotiates the terms on March 4 and allows Barkers to convert its purchase payment into a short-term note, with an annual interest rate of 6 percent, payable in 9 months. A. Compute the interest expense due when Barkers honors the note. Feedback B. Show the entry to record the payment of the short-term note on December 4. If an amount box does not require an entry, leave it blank. Dec. 4 Short-Term Notes Payable v Interest Expense v Cash

Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 12,000 treats at $3 per treat. Terms of the purchase are 2/10, n/30. Barkers pays half the amount due in cash on February 28 but cannot pay the remaining balance due in four days. The supplier renegotiates the terms on March 4 and allows Barkers to convert its purchase payment into a short-term note, with an annual interest rate of 6 percent, payable in 9 months. A. Compute the interest expense due when Barkers honors the note. Feedback B. Show the entry to record the payment of the short-term note on December 4. If an amount box does not require an entry, leave it blank. Dec. 4 Short-Term Notes Payable v Interest Expense v Cash

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 10EA: Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 6,000 treats...

Related questions

Question

100%

Transcribed Image Text:Barkers Baked Goods purchases dog treats from a supplier on February 2 at a quantity of 12,000 treats at $3 per treat. Terms of the purchase are 2/10,

n/30. Barkers pays half the amount due in cash on February 28 but cannot pay the remaining balance due in four days. The supplier renegotiates the

terms on March 4 and allows Barkers to convert its purchase payment into a short-term note, with an annual interest rate of 6 percent, payable in 9

months.

A. Compute the interest expense due when Barkers honors the note.

Feedback

B. Show the entry to record the payment of the short-term note on December 4. If an amount box does not require an entry, leave it blank.

Dec. 4 Short-Term Notes Payable v

Interest Expense v

Cash

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning