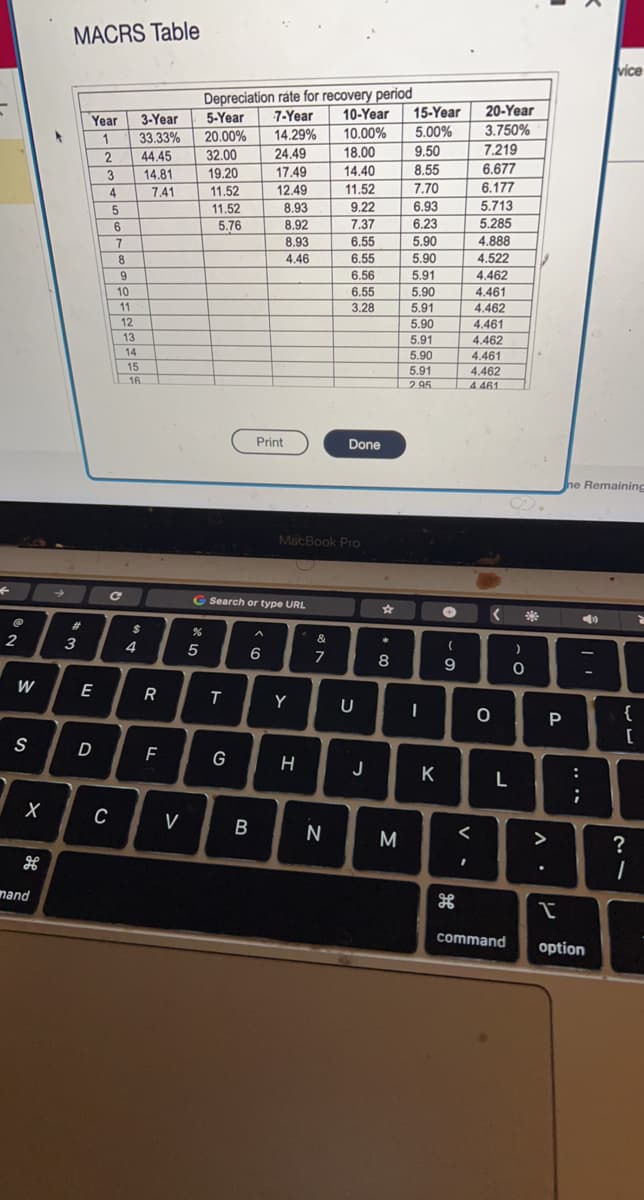

barn that cost $46,000 to cor truct is placed in Click the icon to view a table of MACRS rates.

Q: View Policies Current Attempt in Progress On November 27, the board of directors of Tamarisk Company…

A: Journal Entry :— It is an act of recording transaction in books of account when transaction…

Q: Cash flows during the first year of operations for the Harman-Kardon Consulting Company were as…

A: Income Statement - Income Statement includes all the income and expenses on an accrual basis. Income…

Q: Sunland Corporation sells three different models of a mosquito “zapper.” Model A12 sells for $47 and…

A: Weighted average unit contribution margin is the combined contribution margin per unit which is…

Q: Exercise 20-15 (LO. 1) On January 4, 2018, Martin Corporation acquires two properties from a…

A: ANSWER:- a. Martin's basis in Property 1 as of January 4,2018 is given by: Martin's basis =…

Q: Goldenrod Company makes artificial flowers and reports the following data for the month: Purchases…

A: Production cost: It implies to the expense that is incurred by a business in the process of…

Q: Assume a sales price per unit of $25, variable cost per unit $21, and total fixed costs of $161280.…

A: Break even point = Fixed cost / Contribution margin ratio Contribution margin ratio = (selling…

Q: Prepare a 2020 income statement for Blossom Corporation based on the following information: Cost of…

A: The income statement is prepared to record the revenues and expenses of the current period. The…

Q: TREND ANALYSIS (In Millions) Revenue Cost of Sales Operating Expenses Trend Information 2 3 4…

A: Trend analysis is a technique used to make future predictions of a company based on the ongoing…

Q: The following data relate to the operations of Shilow Company, a wholesale distributor of consumer…

A: Solution : Total Cash collections = Cash sales + collection of Credit sales Budgeted purchases =…

Q: Blue Spruce's Medical operates three support departments and two operating units, Surgery and ER.…

A: In the reciprocal method of calculating allocation of cost, there are three methods used:…

Q: . At December 31, Tremble Music had account balances in Accounts Receivable of $300,000 and in…

A: The balance in the allowance for uncollectible accounts at the end of the period is usually computed…

Q: On January 1, Aivah Company purchased 2,000 common shares (25%) of Maywood Corporation as a…

A:

Q: Sergio sold a rental house he had owned for several years. He claimed $24,787 in depreciation over…

A: Depreciation is an expense for the company. As per the taxation law company can take a deduction for…

Q: Job No. 1 July 21 2 July 29 3 August 3 4 August 7 Started Date Finished Sold August 17 August 26…

A: The Jobs that are completed at end of the accounting period are recorded as finished goods inventory…

Q: You're applying for a job as a website designer at a digital marketing agency. In a previous job at…

A: It is necessary to communicate in order to convey oneself. It also meets one's requirements. To…

Q: Sheridan Zone Corporation experienced the following variances: materials price $390 U, materials…

A: Unfavorable results arises when actual costs results are greater than budgeted costs. Favorable…

Q: Depreciation Choices and Outcome. Mulligan Co. purchased a new machine on January 1. The following…

A: Cost of asset to be capitalized means the cost incurred in acquisition, installation the asset.…

Q: There are three sections of the cash flow statement (operating, investing, and financing). In your…

A: Introduction: The cash flow statement is a financial statement it is showing the movement of cash…

Q: What is the principal invested at 6.5% compounded semi-annually from which monthly withdrawals of…

A: Concept used in the question: Present value of money In respect of the given quesiton, The present…

Q: Q10 In the standalone statements of the venturer, the investments are accounted at______. Select…

A: Investments are of two types first is Current investments and second is non current investments.…

Q: At the end of August, Carrothers Company had completed Jobs 50 and 56. Job 50 is for 200 units, and…

A: Balance on the job cost sheet includes the cost of raw materials, direct labor and the amount of…

Q: Assume that all balance sheet amounts for Oriole Company represent average balance figures.…

A: EARNING PER SHARE Earning Per Share are the net earnings of the company earned on one share. It…

Q: The following data is available for Coronado Service Corporation at December 31, 2020: Common stock,…

A: The number of shares of a company's stock that are presently held by all of its shareholders is…

Q: McFriend Inc. records its liabilities for employees’ vacations at the end of each month. McFriend…

A: INTRODUCTION: Vacation pay is the remuneration that employees receive for accrued vacation days…

Q: Mutiple Choice O $14.000 O$32.000 O O $47.000

A: Variable and Fixed Expenses - Variable Expenses are those expenses which varies according to the…

Q: Required information [The following information applies to the questions displayed below.] O'Brien…

A: LIFO Method - Under the LIFO Method Company uses the inventory which is produced last and later on…

Q: Shin Corporation had a projected benefit obligation of $4,300,000 and plan assets of $4,100,000 at…

A: The company pays pensions to its employees. It's a liability for the company so the company should…

Q: Assuming you both earn 7 percent, how much will each of you have at age 65?

A: Periodic Payment $2,000.00 Rate per period 7% No of periods…

Q: Emily Company uses a periodic inventory system. At the end of the annual accounting period, December…

A: Income tax is a tax levied on the income of the company . It is imposed by the government . The…

Q: Ces In 2022, Sheryl is claimed as a dependent on her parents' tax return. Her parents report taxable…

A: Taxable income refers to any individual or business compensation that is used to determine tax…

Q: You own a stock portfolio invested 32 percent in Stock Q, 22 percent in Stock R, 19 percent in Stock…

A: It has been provided: Stock Q weights = 32% Stock R weights = 22% Stock S weights = 19% Stock T…

Q: The company had sales of $100,000 for the calendrer period 2021. The allowance for doubtful accounts…

A: Allowance for doubtful accounts - Allowance for doubtful accounts is the provision made by the…

Q: concerned after receiving her weekly paycheck. She believ Tax withholding (FIT) may be incorrect.…

A: Medicare tax refers to the percentile tax rate which is levied on the salary or wages of employees…

Q: D. On 30 June 20X2, the directors of Delta decided to close down a division. This decision was…

A: Financial Statement - Financial statements are documents that describe a company's operations and…

Q: Company acquired a delivery truck with a fair value of $120,000 on January 1, Year 1. Company made a…

A: Capitalized cost means the cost which is to be treated as capital nature expenditure and which…

Q: A U.S. company purchases medical lab equipment from a Japanese company. The Japanese company…

A: A U.S. company purchases medical lab equipment from a Japanese company. The Japanese company…

Q: Write a memo to Erica Grier, chief financial officer, that explains each transaction.

A: Accounts receivable is a account that records all the transactions done with a customer. Iff if…

Q: Approximate state income tax $ Approximate federal tex $ Combined effective income tax rate $ and…

A: This is the follow-up question on this the amount has to be computed only as per the requirement of…

Q: On January 1, Boston Enterprises issues bonds that have a $1,650,000 par value, mature in 20 years,…

A: Bonds :— It is one of the source of capital that pays periodic interest and face value at the end of…

Q: Blue Spruce Welding rebuilds spot welders for manufacturers. The following budgeted cost data for…

A: INTRODUCTION: Labour rates are used to calculate both the price of employee time invoiced to…

Q: On 1 September 2022, inventory had a balance of R6 000 in the general ledger of BB Enterprises. The…

A:

Q: 1. On 1 January 20X2, a company acquires computer software specific to a project for £200,000.…

A:

Q: On February 1, 2021, Stephen (who is single) sold his principal residence (home 1) at a $100,000…

A: There are a number of taxes associated with the selling of property at the time of real estate…

Q: Woodpecker Furniture manufactures wood patio furniture. If the company reports the following costs…

A: Journal Entry is the primary step to record the transaction in the books of accounts. Entries are…

Q: Can you explain the difference between a deferred tax asset, a tax receivable, and a prepaid tax…

A: A deferred tax asset is a tax deduction that can be used in the future to reduce taxable income. A…

Q: Rescue Sequences LLC purchased inventory by issuing a $30,000, 60-day, non-interest bearing note on…

A: Solution: Face amount of note = $30,000 Discount rate = 15% Discount amount of note =…

Q: A zero-coupon, five-year annual corporate bond has a par value of $1000. The estimated risk-neutral…

A: A zero coupon bond, as the name suggests, does not pay any coupons. Instead it trades at a deep…

Q: St. Mark's Hospital contains 560 beds. The occupancy rate varies between 60% and 90% per month, but…

A: Variable cost refers to those cost which changes with the changing level of sales or Production i.e.…

Q: Assume à sales price per unit of $10, variable cost per unit $6, and total fixed costs of $198240.…

A: The Break-even point indicates that total units are to be sold by the business entity to recover its…

Q: On 15 March 2022, Business Taxpayer, reporting on a calendar year basis, sold furniture (seven-year…

A: Calculation of depreciation for the calculation of taxable income is calculated on basis of rate…

Step by step

Solved in 3 steps

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.Colquhoun International purchases a warehouse for $300,000. The best estimate of the salvage value at the time of purchase was $15,000, and it is expected to be used for twenty-five years. Colquhoun uses the straight-line depreciation method for all warehouse buildings. After four years of recording depreciation, Colquhoun determines that the warehouse will be useful for only another fifteen years. Calculate annual depreciation expense for the first four years. Determine the depreciation expense for the final fifteen years of the assets life, and create the journal entry for year five.

- Montello Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.Akron Incorporated purchased an asset at the beginning of Year 1 for 375,000. The estimated residual value is 15,000. Akron estimates that the asset has a service life of 5 years. Calculate the depreciation expense using the sum-of-the-years-digits method for Years 1 and 2 of the assets life.Urquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.

- Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for ten years. Montello uses the straight-line depreciation method. Calculate the annual depreciation expense.Grandorf Company replaced the engine in a truck for 8,000 and expects the new engine will extend the life of the truck two years beyond the original estimated life. Related information is provided below. Cost of truck 65,000 Salvage value 5,000 Original estimated life 6 years The truck was purchased on January 1, 20-1. The engine was replaced on January 1, 20-6. Using straight-line depreciation, compute depreciation expense for 20-6.On May 10, 2019, Horan Company purchased equipment for 25,000. The equipment has an estimated service life of 5 years and zero residual value. Assume that the straight-line depreciation method is used. Required: Compute the depreciation expense for 2019 for each of the following four alternatives: 1. Horan computes depreciation expense to the nearest day. (Use 12 months of 30 days each and round the daily depreciation rate to 2 decimal places.) 2. Horan computes depreciation expense to the nearest month. Assets purchased in the first half of the month are considered owned for the whole month. 3. Horan computes depreciation expense to the nearest whole year. Assets purchased in the first half of the year are considered owned for the whole year. 4. Horan records one-half years depreciation expense on all assets purchased during the year.

- Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual value was 500 and its expected service life was 5 years. Hathaway computes depreciation expense to the nearest whole month. Required: 1. Compute depredation expense (rounded to the nearest dollar) for 2019 and 2020 using the: a. straight-line method b. sum-of-the-years-digits method c. double-declining-balance method 2. Next Level Which method produces the highest book value at the end of 2020? 3. Next Level Which method produces the highest charge to income in 2020? 4. Next Level Over the life of the asset, which method produces the greatest amount of depreciation expense?Montezuma Inc. purchases a delivery truck for $15,000. The truck has a salvage value of $3,000 and is expected to be driven for eight years. Montezuma uses the straight-line depreciation method. Calculate the annual depreciation expense. After three years of recording depreciation, Montezuma determines that the delivery truck will only be useful for another three years and that the salvage value will increase to $4,000. Determine the depreciation expense for the final three years of the assets life, and create the journal entry for year four.Dunedin Drilling Company recently acquired a new machine at a cost of 350,000. The machine has an estimated useful life of four years or 100,000 hours, and a salvage value of 30,000. This machine will be used 30,000 hours during Year 1, 20,000 hours in Year 2, 40,000 hours in Year 3, and 10,000 hours in Year 4. With DEPREC5 still on the screen, click the Chart sheet tab. This chart shows the accumulated depreciation under all three depreciation methods. Identify below the depreciation method that each represents. Series 1 _____________________ Series 2 _____________________ Series 3 _____________________ When the assignment is complete, close the file without saving it again. Worksheet. The problem thus far has assumed that assets are depreciated a full year in the year acquired. Normally, depreciation begins in the month acquired. For example, an asset acquired at the beginning of April is depreciated for only nine months in the year of acquisition. Modify the DEPREC2 worksheet to include the month of acquisition as an additional item of input. To demonstrate proper handling of this factor on the depreciation schedule, modify the formulas for the first two years. Some of the formulas may not actually need to be revised. Do not modify the formulas for Years 3 through 8 and ignore the numbers shown in those years. Some will be incorrect as will be some of the totals. Preview the printout to make sure that the worksheet will print neatly on one page, and then print the worksheet. Save the completed file as DEPRECT. Hint: Insert the month in row 6 of the Data Section specifying the month by a number (e.g., April is the fourth month of the year). Redo the formulas for Years 1 and 2. For the units of production method, assume no change in the estimated hours for both years. Chart. Using the DEPREC5 file, prepare a line chart or XY chart that plots annual depreciation expense under all three depreciation methods. No Chart Data Table is needed; use the range B29 to E36 on the worksheet as a basis for preparing the chart if you prepare an XY chart. Use C29 to E36 if you prepare a line chart. Enter your name somewhere on the chart. Save the file again as DEPREC5. Print the chart.