Bartel Co has provided you with the following information for the year ended December 31, 2016 .Net credit sales are $248,000 for the year Based on historical data, management expects that 2.0% of credit sales will be uncollectible. . Based on historical data, management expects that 5.0% of outstanding receivables will be uncollectible • Allowance for Doubtful Accounts (XA) has a credit balance of $600 at January 1, 2016. • Accounts Receivable (A) has a debit balance of $66,000 at December 31, 2016. . Bartell Co wrote off $2,000 of Accounts Receivable as uncollectible Estimate Bad Debt Expense for 2016 using the percentage of credit sales method. Round your answer to the nearest dollar: $ Estimate Bad Debt Expense for 2016 using the aging of receivables method Round your answer to the nearest dollar: $

Bartel Co has provided you with the following information for the year ended December 31, 2016 .Net credit sales are $248,000 for the year Based on historical data, management expects that 2.0% of credit sales will be uncollectible. . Based on historical data, management expects that 5.0% of outstanding receivables will be uncollectible • Allowance for Doubtful Accounts (XA) has a credit balance of $600 at January 1, 2016. • Accounts Receivable (A) has a debit balance of $66,000 at December 31, 2016. . Bartell Co wrote off $2,000 of Accounts Receivable as uncollectible Estimate Bad Debt Expense for 2016 using the percentage of credit sales method. Round your answer to the nearest dollar: $ Estimate Bad Debt Expense for 2016 using the aging of receivables method Round your answer to the nearest dollar: $

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 2CE: Tonis Tech Shop has total credit sales for the year of 170,000 and estimates that 3% of its credit...

Related questions

Question

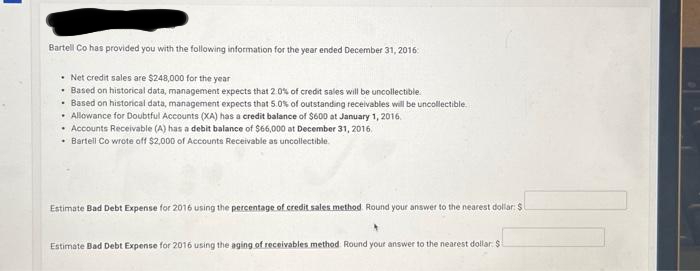

Transcribed Image Text:Bartell Co has provided you with the following information for the year ended December 31, 2016

• Net credit sales are $248,000 for the year

. Based on historical data, management expects that 2.0% of credit sales will be uncollectible.

. Based on historical data, management expects that 5.0% of outstanding receivables will be uncollectible.

• Allowance for Doubtful Accounts (XA) has a credit balance of $600 at January 1, 2016.

• Accounts Receivable (A) has a debit balance of $66,000 at December 31, 2016.

Bartell Co wrote off $2,000 of Accounts Receivable as uncollectible.

Estimate Bad Debt Expense for 2016 using the percentage of credit sales method. Round your answer to the nearest dollar: $

Estimate Bad Debt Expense for 2016 using the aging of receivables method Round your answer to the nearest dollar: $1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub