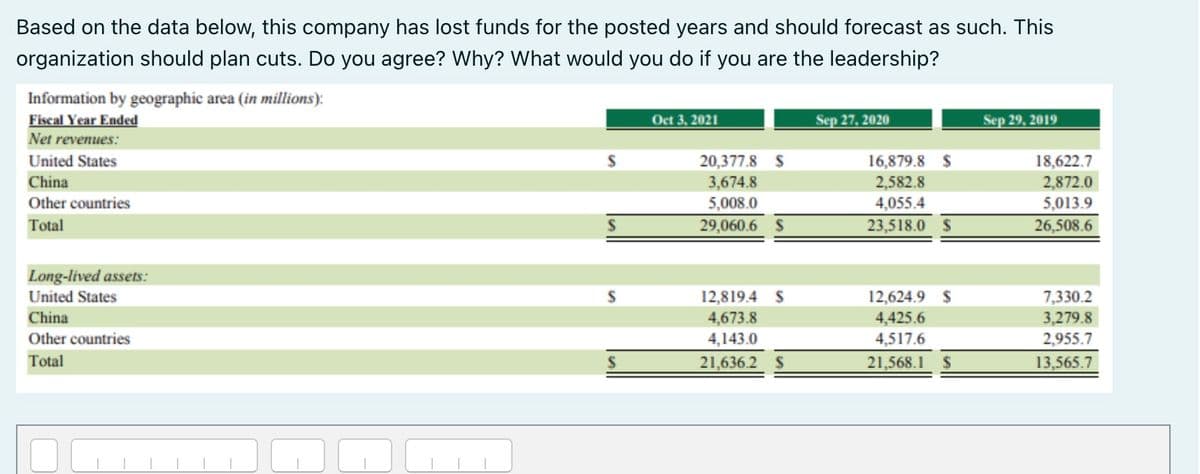

Based on the data below, this company has lost funds for the posted years and should forecast as such. This organization should plan cuts. Do you agree? Why? What would you do if you are the leadership?

Q: Assume coupons are paid annually. Here are the prices of three bonds with 10-year maturities. Assume…

A: Yield to Maturity (YTM) is a financial term used to describe the total return an investor can expect…

Q: Using the data in the following table,, calculate the dividend yield and the capital gain yield from…

A: The dividend yield is calculated byThe capital gain yield is calculated by

Q: Tanaka Industrial Systems Company is trying to decide between two different conveyor belt systems.…

A: EAC or equivalent annual cost is the annual cost of owning and maintaining the asset over its entire…

Q: Future Value of Multiple Annuities Assume that you contribute $110 per month to a retirement plan…

A: We need to use future value of ordinary annuity formula to calculate value of of your retirement…

Q: Current Attempt in Progress Lisa Anderson wants to invest in four-year bonds that are currently…

A: Current yield of the bond is the rate of return earned on the basis of the market price of the bond…

Q: The Spartan Technology Company has a proposed contract with the Digital Systems Company of Michigan.…

A: NPV is also known as Net Present Value. It is a capital budgeting technique which helps in decision…

Q: FastTrack Bikes, Inc. is thinking of developing a new composite road bike. Development will take six…

A: PV of cashoutflow:Calculation of Present value10.000%YearCash out flowPV factor= 1/(1+10%)^tPV…

Q: You have a chance to sell an antique today for $1,000. You believe you will be able to sell the time…

A: The concept of time value of money will be used here. As per the concept of time value of money the…

Q: Meriton Ltd borrows $ 100,000 at an interest rate of 11.5% per annum, repayable by equal monthly…

A: Loans are paid by equal monthly installments and these carry the payment for interest and payment…

Q: 3-43. An annuity fund is to be created to provide $6,000 at the end of each quarter year from ages…

A: The concept of time value of money will be used here. As per the concept of time value of money any…

Q: Assume AMP Ltd just paid 100% fully franked dividend of $0.84 per share. The dividend is expected to…

A: We need to use constant growth model to calculate present value or current stock price.WhereD 1…

Q: A 5-year discount bond has a maturity value of $3,000. The simple discount rate is 4%. What is the…

A: Bonds are sources of investment and bonds are issued at discount or may be at premium on the bond…

Q: You borrow $400,000 for 30 years to purchase a house with an interest rate of 9 percent. How much is…

A: A mortgage monthly payment is the amount a borrower pays each month to repay a home loan. It…

Q: You have to visit the website of one investment dealer or mutual fund dealer who has NAAF. Please…

A: Aligning more closely with IIROC and MFDA's comprehensive standards will not only ensure regulatory…

Q: Esfandairi Enterprises is considering a new 3-year expansion project that requires an initial fixed…

A: NPV is also known as Net Present Value. It is a capital budgeting techniques which help in decision…

Q: What is the required rate of return on C&J's stock? Do not round intermediate calculations. Round…

A: Growth= 5%Dividend yield= 8%.Dividend (D0)= $2.75g0,1 = 50%g1,2 = 30%Dividend growth after year 2=…

Q: d Martha are twins, and just graduated from college. They plan to retire in 40 years. To that end,…

A: In order to answer the question, we must see the amount per month invested and for the period of…

Q: Assignment 3 Assume coupons are paid annually. Here are the prices of three bonds with 10-year…

A: A bond is a kind of debt security issued by the government and private companies to the public for…

Q: re trying to decide how much to say for retirement assume you plan to save 10,000 per year and will…

A: There is need of planning for retirement and if done properly on time can have good retirement life.

Q: You plan to deposit $3,000 at the end of each year for three years, starting with the first deposit…

A: When cash is accumulated in a bank account by making an annual contribution at the end of the year…

Q: t Bicycles plans to issue convertible bonds to finance its future growth. Each convertible bond has…

A: Some bonds have option of conversion to stock on the expiration to make bonds more attractive to the…

Q: On April 1, 1998, Marcus Chapman deposited $4000 into an Individual Retirement Account (IRA) paying…

A: Compound interest is a financial concept that refers to the process of earning interest not only on…

Q: a. A 6.5% coupon $1,000 par bond pays an annual coupon and will mature in 3 years. What should the…

A: Bond valuation aims to ascertain a bond's intrinsic value. It entails determining the present value…

Q: weled Outlook is analyzing a proposed project with expected sales of 9,200 units, ±4 percent. The…

A: Variable cost depends on the volume and increases with increase in volume of production.

Q: Q12) Fund Performance and Returns An investor plans to invest $10,000 into one of three portfolios:…

A: Initial investment = $10,000Expected gross return (R) = 10% (0.10 as a decimal)

Q: Suppose Johnson & Johnson and Walgreen Boots Alliance have expected returns and volatilities shown…

A: In this scenario, we consider two prominent companies, Johnson & Johnson and Walgreen Boots…

Q: Stock price Shares outstanding (millions) Mkt value Debt (millions) Capitalization (book value) 10…

A: WACC is the cost of capital of the company and is weighted average cost of equity and weighted cost…

Q: b-4.5.40%, two-year bond b-il. 5.40%, five-year bond b-il. 10 40%, five-year bond Present Value $…

A: Price of the bond is the PV of all coupons and par value discounted at the required return. We can…

Q: Department A's cost was $10,000 in year 1 of its operation; however, it is estimated that costs will…

A: Present value is the current value future value of money at specified rate of interest. If we will…

Q: leasing contract calls for an immediate payment of $101,000 and nine subsequent $101,000 semiannual…

A: Present value is the equivalent value today of the future cash flow based on the time value of money…

Q: Donna enters into an investment contract that will guarantee her 4% per year if she deposits $3,500…

A: The future value of the investments can be calculated using the FV Function in excel.FV = (RATE,…

Q: The following table presents sales forecasts for Golden Gelt Giftware. The unit price is $40. The…

A: The value that an investment will add to an organization if a particular investment alternative is…

Q: A financier has made a loan of $12 million. The contract for the loan calls for payment of interest…

A: Value of assets is the present value of interest payments and present value of the face value of…

Q: Suppose you have been saving for the last 4 years to buy a new mountain bike. This year you will…

A: We need to use future value of ordinary annuity formula below to calculate total savings in bank…

Q: Consider the following financial information and answer the questions that follow: Sales : $250,000…

A: Since you have posted a question with multiple sub parts, we will be able to provide the solution…

Q: A rookie quarterback is negotiating his first NFL contract. His opportunity cost is 10%. He has been…

A: Present Value (PV) is a financial concept used to determine the current worth of a sum of money to…

Q: Cute Camel Woodcraft Company just reported earnings after tax (also called net income) of $9,750,000…

A: The formula for P/E ratio is Therefore, a company's share can exhibit a negative P/E ratio when the…

Q: annual interest rate on a credit card is 24.99%. If a payment of $100.00 is made each month, how…

A: We need to use NPER function in excel to calculate time to payoff loan. The formula is:…

Q: Builtrite is considering purchasing a new machine that would cost $90,000 and the machine would be…

A: Cash Flow from the project is that amount which is earned by the investor from the project every…

Q: Imagine an emerging market with only 15 years of data. Compute the historical ERP using the…

A: Variables in the question:…

Q: 2.ABC LTD has been offered credit by its major supplier at 2/10 net 45. Should the company avail the…

A: Company gives credit to customer to sell the products but also provide discount to the customers to…

Q: Question 20 Income Statement for Bearcat Hathaway, 2022 Sales Less Cost of Goods Sold Gross Profit…

A: Addition to retained earnings = Net Income - Dividends paid

Q: You invest $9,000 today at an annual interest rate of 5%. How much do you expect to have 5 years…

A: P = $9,000r = 5% = 0.05n = 5

Q: Another method to deal with the unequal life problem of projects is the equivalent annual annuity…

A: Equivalent Annual Annuity is also known EAA. It is a capital budgeting technique which helps in…

Q: Suppose that a stock price is currently 61 dollars, and it is known that at the end of each of the…

A: A European Put option is a financial contract that grants the holder the right, but not the…

Q: You have a loan outstanding. It requires making nine annual payments of $8,000 each at the end of…

A: A loan refers to a contract between two parties where one party forwards money to the other party on…

Q: A payday loan is structured to obscure the true interest rate you are paying. For example, you pay a…

A: Effective rate of interest is the equivalent interest rate which is determined by considering the…

Q: If you have $60,000 in a bank account that is paying an interest rate of 4 percent that is being…

A: To find out how many years it will take to double an investment with a constant interest rate, you…

Q: You can invest in taxable bonds that are paying a yield of 9.50 percent or a municipal bond paying a…

A: A security bond is a legally enforceable promise to pay the government if you or your employee…

Q: Calculate the semi-annual lease payment assuming that the payment is made at the end of the period.…

A: Semi-annual lease paymentA recurring payment made every six months as part of a lease agreement is…

Based on the data below, this company has lost funds for the posted years and should

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- Suppose the company has to revise its estimates because of a downturn in the economy. Unit sales for August, September, and October will be half (50%) of the original estimates. Revise the estimates in cells 1311 through 1313. After this is done, check your forecasted balance sheet. It should still balance! What effect will this new state of affairs have on net income and borrowing? Explain why these items changed.Additional Funds Needed The Booth Company’s sales are forecasted to double from $1,000 in 2018 to $2,000 in 2019. Here is the December 31, 2018, balance sheet: Booth’s fixed assets were used to only 50% of capacity during 2018, but its current assets were at their proper levels in relation to sales. All assets except fixed assets must increase at the same rate as sales, and fixed assets would also have to increase at the same rate if the current excess capacity did not exist. Booth’s after-tax profit margin is forecasted to be 5% and its payout ratio to be 60%. What is Booth’s additional funds needed (AFN) for the coming year?Referring to the following data of the Omani Company, that extracted from the balance sheet at 31\12\2019, answer the following questions: - (Note; Write all Equations regarding the questions) The company manager targets to reduce the current ratio in the year (2020) by 33% from the previous year (2019), this requiring to downsize the amount of the total current asset. To what level can the manager reduce the total current asset to achieve this target at (2020)? (Suppose the other things are fixed) The manager put a plan to reduce the selling period in the (2020) by (16.7%) from the previous year (2019). Calculate the new inventory turnover. (Suppose the other things are fixed) Data of 2019 Total Asset Turnover 2 Times Net Fixed Asset 400 (Thousand OMR) Total Liabilities 400 (Thousand OMR) Sales 2000 (Thousand OMR) Quick Ratio 1.5 Times Accounts Receivable 150 (Thousand OMR) Long-term Liabilities 200 (Thousand OMR)

- The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $240,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $64 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 64 Variable costs (80% of revenue) 1,440 Depreciation 96 Interest (8% of beginning-of-year debt) 24 Taxable income 176 Taxes (at 40%) 70 Net income $ 106 Dividends $ 71 Addition to…The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $240,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $64 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 64 Variable costs (80% of revenue) 1,440 Depreciation 96 Interest (8% of beginning-of-year debt) 24 Taxable income 176 Taxes (at 40%) 70 Net income $ 106 Dividends $ 71 Addition to…The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $400,000 per year for the next 5 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 10% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $96 and variable costs at 80% of revenue. The company’s policy is to pay out two-thirds of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 2,760 Fixed costs 96 Variable costs (80% of revenue) 2,208 Depreciation 160 Interest (8% of beginning-of-year debt) 40 Taxable income 256 Taxes (at 40%) 102 Net income $ 154 Dividends $ 103 Addition to…

- The Manning Company has financial statements as shown next, which are representative of the company’s historical average. The firm is expecting a 30 percent increase in sales next year, and management is concerned about the company’s need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing store. Among liabilities, only current liabilities vary directly with sales. Income Statement Sales $ 200,000 Expenses 149,600 Earnings before interest and taxes $ 50,400 Interest 9,200 Earnings before taxes $ 41,200 Taxes 17,200 Earnings after taxes $ 24,000 Dividends $ 6,000 Balance Sheet Assets Liabilities and Stockholders' Equity Cash $ 6,000 Accounts payable $ 22,900 Accounts receivable 55,000 Accrued wages 2,300 Inventory 69,000 Accrued taxes 4,800 Current assets $ 130,000 Current liabilities $ 30,000 Fixed…The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $200,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $90 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 90 Variable costs (70% of revenue) 1,260 Depreciation 160 Interest (6% of beginning-of-year debt) 18 Taxable income 272 Taxes (at 35%) 95 Net income $ 177 Dividends $ 89 Addition to retained…An entity reported the following information for the year ended December 31, 2020: Sales 7,750,000 Cost of goods sold 2,400,000 Administrative expenses 700,000 Loss on sale of equipment 100,000 Sales commissions 500,000 Interest revenue 450,000 Freight out 150,000 Loss on early extinguishment of long-term debt 200,000 Doubtful accounts expense 150,000 16. What is the income from continuing operations for 2020? a. 4,000,000 b. 3,800,000 c. 2,800,000 d. 2,600,000 17. What net amount of loss should be reported as results of discontinued operations for 2020? a. 1,500,000 b. 1,700,000 c. 1,050,000 d. 1,400,000 18. What is the net income for 2020? a. 2,500,000 b. 1,750,000 c. 1,400,000 d. 1,540,000

- The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $350,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $86 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 2,160 Fixed costs 86 Variable costs (70% of revenue) 1,512 Depreciation 280 Interest (6% of beginning-of-year debt) 18 Taxable income 264 Taxes (at 35%) 92 Net income $ 172 Dividends $ 86 Addition to retained…The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $270,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $70 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 70 Variable costs (70% of revenue) 1,260 Depreciation 216 Interest (6% of beginning-of-year debt) 18 Taxable income 236 Taxes (at 35%) 83 Net income $ 153 Dividends $ 77 Addition to retained…The following tables contain financial statements for Dynastatics Corporation. Although the company has not been growing, it now plans to expand and will increase net fixed assets (i.e., assets net of depreciation) by $270,000 per year for the next 4 years, and it forecasts that the ratio of revenues to total assets will remain at 1.50. Annual depreciation is 20% of net fixed assets at the beginning of the year. Fixed costs are expected to remain at $70 and variable costs at 70% of revenue. The company’s policy is to pay out one-half of net income as dividends and to maintain a book debt ratio of 20% of total capital. INCOME STATEMENT, 2019(Figures in $ thousands) Revenue $ 1,800 Fixed costs 70 Variable costs (70% of revenue) 1,260 Depreciation 216 Interest (6% of beginning-of-year debt) 18 Taxable income 236 Taxes (at 35%) 83 Net income $ 153 Dividends $ 77 Addition to retained…