Based on the following data, make a comparison between the use of the flow of inventory costs assumptions with the FIFO and LIFO methods and provide an overview of why in the end LIFO should not be used. (on the image below) Create Schedules of COGS using the following format: (replace XXX with the correct number from your calculation)

Based on the following data, make a comparison between the use of the flow of inventory costs assumptions with the FIFO and LIFO methods and provide an overview of why in the end LIFO should not be used. (on the image below) Create Schedules of COGS using the following format: (replace XXX with the correct number from your calculation)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 16E: Dollar-Value LIFO A company adopted the LIFO method when its inventory was 1,800. One year later its...

Related questions

Topic Video

Question

Based on the following data, make a comparison between the use of the flow of inventory costs assumptions with the FIFO and LIFO methods and provide an overview of why in the end LIFO should not be used. (on the image below)

Create Schedules of COGS using the following format:

(replace XXX with the correct number from your calculation)

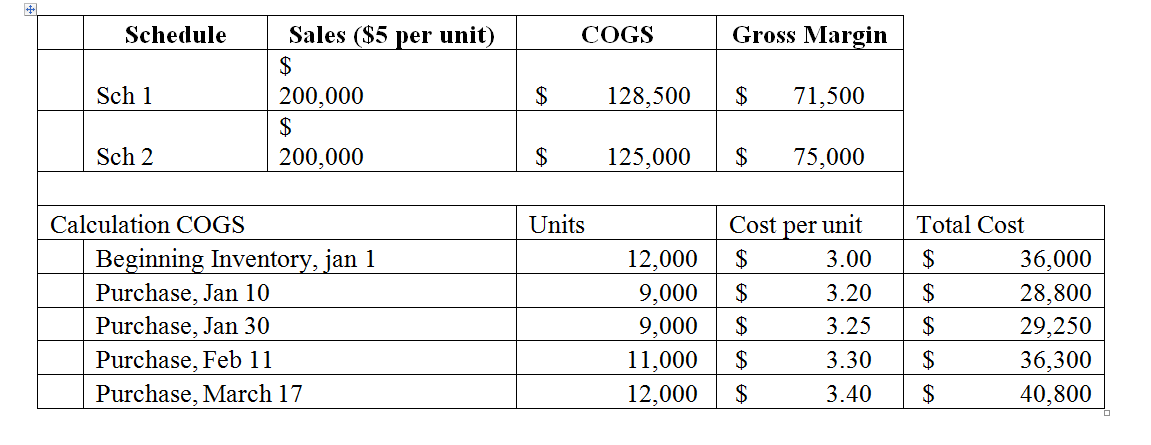

Transcribed Image Text:Schedule

Sales ($5 per unit)

СOGS

Gross Margin

$

Sch 1

$

$

200,000

$

128,500

71,500

Sch 2

200,000

$

125,000

$

75,000

Calculation COGS

Units

Cost per unit

Total Cost

Beginning Inventory, jan 1

Purchase, Jan 10

Purchase, Jan 30

12,000

$

3.00

$

36,000

9,000

$

3.20

$

28,800

9,000

$

3.25

$

29,250

Purchase, Feb 11

11,000

$

3.30

$

36,300

Purchase, March 17

12,000

$

3.40

$

40,800

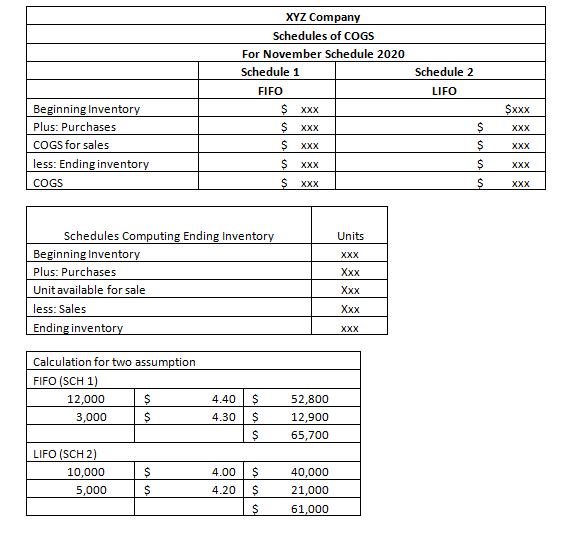

Transcribed Image Text:XYZ Company

Schedules of COGS

For November Schedule 2020

Schedule 1

Schedule 2

FIFO

LIFO

Beginning Inventory

$ XXX

Sxx

Plus: Purchases

XXX

XXX

COGS for sales

less: Ending inventory

XXX

XXX

XXX

XXX

COGS

XXX

XXX

Schedules Computing Ending Inventory

Beginning Inventory

Plus: Purchases

Unit available for sale

less: Sales

Ending inventory

Units

XXX

Ххх

Xxx

Ххх

XXX

Calculation for two assumption

FIFO (SCH 1)

12,000

4.40

52,800

3,000

4.30

12,900

65,700

LIFO (SCH 2)

10,000

4.00

40,000

5,000

4.20

21,000

61,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning