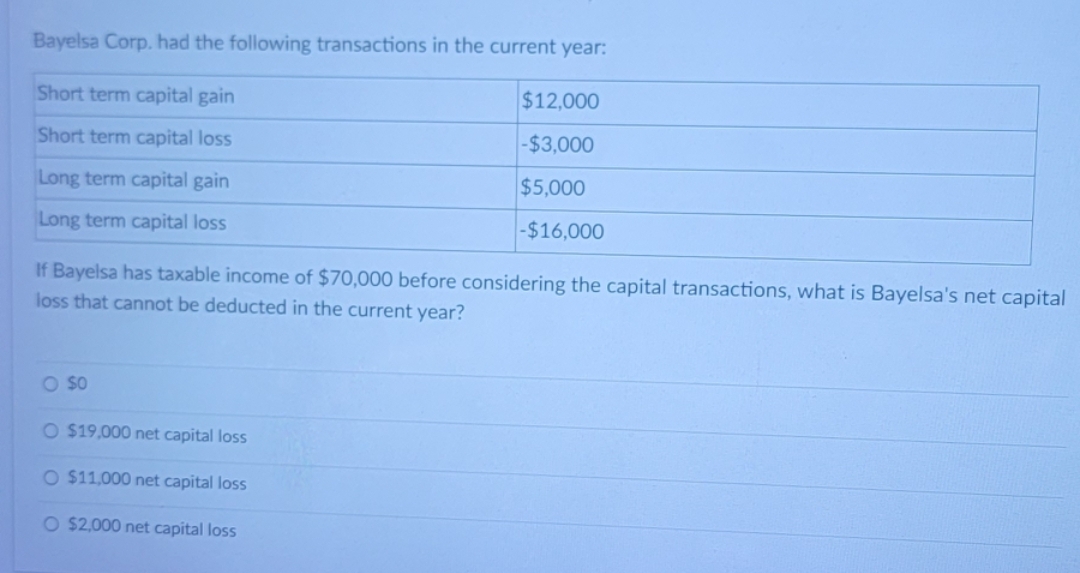

Bayelsa Corp. had the following transactions in the current year: Short term capital gain Short term capital loss Long term capital gain Long term capital loss If Bayelsa has taxable income of $70,000 before considering the capital transactions, what is Bayelsa's net capital loss that cannot be deducted in the current year? O SO $12,000 -$3,000 $5,000 -$16,000 O $19,000 net capital loss O $11,000 net capital loss O $2,000 net capital loss

Bayelsa Corp. had the following transactions in the current year: Short term capital gain Short term capital loss Long term capital gain Long term capital loss If Bayelsa has taxable income of $70,000 before considering the capital transactions, what is Bayelsa's net capital loss that cannot be deducted in the current year? O SO $12,000 -$3,000 $5,000 -$16,000 O $19,000 net capital loss O $11,000 net capital loss O $2,000 net capital loss

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 35P

Related questions

Question

Transcribed Image Text:Bayelsa Corp. had the following transactions in the current year:

Short term capital gain

Short term capital loss

Long term capital gain

Long term capital loss

If Bayelsa has taxable income of $70,000 before considering the capital transactions, what is Bayelsa's net capital

loss that cannot be deducted in the current year?

O SO

$12,000

-$3,000

$5,000

-$16,000

O $19,000 net capital loss

O $11,000 net capital loss

O $2,000 net capital loss

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you