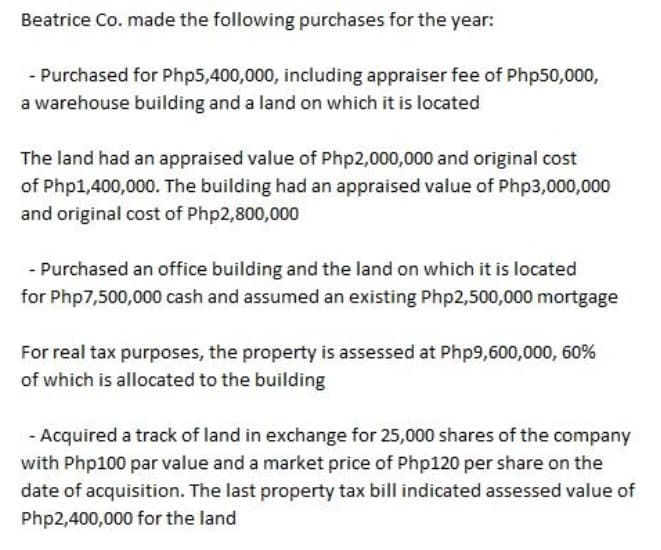

Beatrice Co. made the following purchases for the year: - Purchased for Php5,400,000, including appraiser fee of Php50,000, a warehouse building and a land on which it is located The land had an appraised value of Php2,000,000 and original cost of Php1,400,000. The building had an appraised value of Php3,000,000 and original cost of Php2,800,000 - Purchased an office building and the land on which it is located for Php7,500,000 cash and assumed an existing Php2,500,000 mortgage For real tax purposes, the property is assessed at Php9,600,000, 60% of which is allocated to the building - Acquired a track of land in exchange for 25,000 shares of the company with Php100 par value and a market price of Php120 per share on the date of acquisition. The last property tax bill indicated assessed value of Php2,400,000 for the land

Beatrice Co. made the following purchases for the year: - Purchased for Php5,400,000, including appraiser fee of Php50,000, a warehouse building and a land on which it is located The land had an appraised value of Php2,000,000 and original cost of Php1,400,000. The building had an appraised value of Php3,000,000 and original cost of Php2,800,000 - Purchased an office building and the land on which it is located for Php7,500,000 cash and assumed an existing Php2,500,000 mortgage For real tax purposes, the property is assessed at Php9,600,000, 60% of which is allocated to the building - Acquired a track of land in exchange for 25,000 shares of the company with Php100 par value and a market price of Php120 per share on the date of acquisition. The last property tax bill indicated assessed value of Php2,400,000 for the land

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 38P

Related questions

Question

This topic is about Property, Plant, and Equipment.

Based on the picture,

- What will be the cost of the land and the building?

Transcribed Image Text:Beatrice Co. made the following purchases for the year:

- Purchased for Php5,400,000, including appraiser fee of Php50,000,

a warehouse building and a land on which it is located

The land had an appraised value of Php2,000,000 and original cost

of Php1,400,000. The building had an appraised value of Php3,000,000

and original cost of Php2,800,000

- Purchased an office building and the land on which it is located

for Php7,500,000 cash and assumed an existing Php2,500,000 mortgage

For real tax purposes, the property is assessed at Php9,600,000, 60%

of which is allocated to the building

- Acquired a track of land in exchange for 25,000 shares of the company

with Php100 par value and a market price of Php120 per share on the

date of acquisition. The last property tax bill indicated assessed value of

Php2,400,000 for the land

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 9 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning