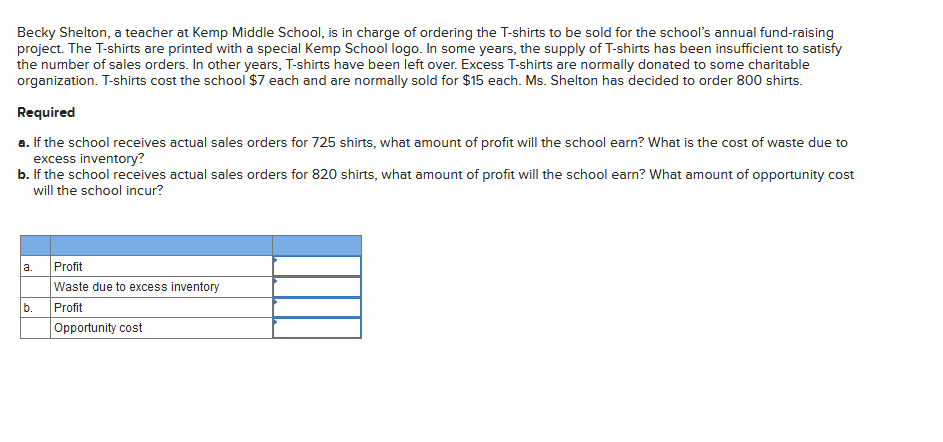

Becky Shelton, a teacher at Kemp Middle School, is in charge of ordering the T-shirts to be sold for the school's annual fund-raising project. The T-shirts are printed with a special Kemp School logo. In some years, the supply of T-shirts has been insufficient to satisfy the number of sales orders. In other years, T-shirts have been left over. Excess T-shirts are normally donated to some charitable organization. T-shirts cost the school $7 each and are normally sold for $15 each. Ms. Shelton has decided to order 800 shirts. Required a. If the school receives actual sales orders for 725 shirts, what amount of profit will the school earn? What is the cost of waste due to excess inventory? b. If the school receives actual sales orders for 820 shirts, what amount of profit will the school earn? What amount of opportunity cost will the school incur? a. b. Profit Waste due to excess inventory Profit Opportunity cost

Becky Shelton, a teacher at Kemp Middle School, is in charge of ordering the T-shirts to be sold for the school's annual fund-raising project. The T-shirts are printed with a special Kemp School logo. In some years, the supply of T-shirts has been insufficient to satisfy the number of sales orders. In other years, T-shirts have been left over. Excess T-shirts are normally donated to some charitable organization. T-shirts cost the school $7 each and are normally sold for $15 each. Ms. Shelton has decided to order 800 shirts. Required a. If the school receives actual sales orders for 725 shirts, what amount of profit will the school earn? What is the cost of waste due to excess inventory? b. If the school receives actual sales orders for 820 shirts, what amount of profit will the school earn? What amount of opportunity cost will the school incur? a. b. Profit Waste due to excess inventory Profit Opportunity cost

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 35P

Related questions

Question

100%

Transcribed Image Text:Becky Shelton, a teacher at Kemp Middle School, is in charge of ordering the T-shirts to be sold for the school's annual fund-raising

project. The T-shirts are printed with a special Kemp School logo. In some years, the supply of T-shirts has been insufficient to satisfy

the number of sales orders. In other years, T-shirts have been left over. Excess T-shirts are normally donated to some charitable

organization. T-shirts cost the school $7 each and are normally sold for $15 each. Ms. Shelton has decided to order 800 shirts.

Required

a. If the school receives actual sales orders for 725 shirts, what amount of profit will the school earn? What is the cost of waste due to

excess inventory?

b. If the school receives actual sales orders for 820 shirts, what amount of profit will the school earn? What amount of opportunity cost

will the school incur?

a.

b.

Profit

Waste due to excess inventory

Profit

Opportunity cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT