Below are the instructions to calculate taxes due at the 2022 Tax Rate Schedule for people filing as "single" with a taxable income over $100,000. Let T(x) represent the taxes due for someone with a taxable income of x. Schedule A - Single Taxable income from line 15 At least $100,000 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $539,900 Over $539,900 (a) Enter the amount from line 15 (b) Multiplication amount 24% (0.24) 32% (0.32) 35% (0.35) 37% (0.37) (c) Multiply (a) by (b) 1. Find T(160,000), T(200,000), T(400,000) and T(539,900.01). (d) Subtraction amount $6164.50 $19,768.50 $26,247.00 $37,045.00 (e) Tax Subtract (d) from (c). The result is the amount of tax due

Below are the instructions to calculate taxes due at the 2022 Tax Rate Schedule for people filing as "single" with a taxable income over $100,000. Let T(x) represent the taxes due for someone with a taxable income of x. Schedule A - Single Taxable income from line 15 At least $100,000 but not over $170,050 Over $170,050 but not over $215,950 Over $215,950 but not over $539,900 Over $539,900 (a) Enter the amount from line 15 (b) Multiplication amount 24% (0.24) 32% (0.32) 35% (0.35) 37% (0.37) (c) Multiply (a) by (b) 1. Find T(160,000), T(200,000), T(400,000) and T(539,900.01). (d) Subtraction amount $6164.50 $19,768.50 $26,247.00 $37,045.00 (e) Tax Subtract (d) from (c). The result is the amount of tax due

Algebra & Trigonometry with Analytic Geometry

13th Edition

ISBN:9781133382119

Author:Swokowski

Publisher:Swokowski

Chapter5: Inverse, Exponential, And Logarithmic Functions

Section5.3: The Natural Exponential Function

Problem 51E

Related questions

Question

Pls help me with 1 to 6 pls

It’s only one problem

Its really important for me

I will be really appreciated

Thumbs up for you

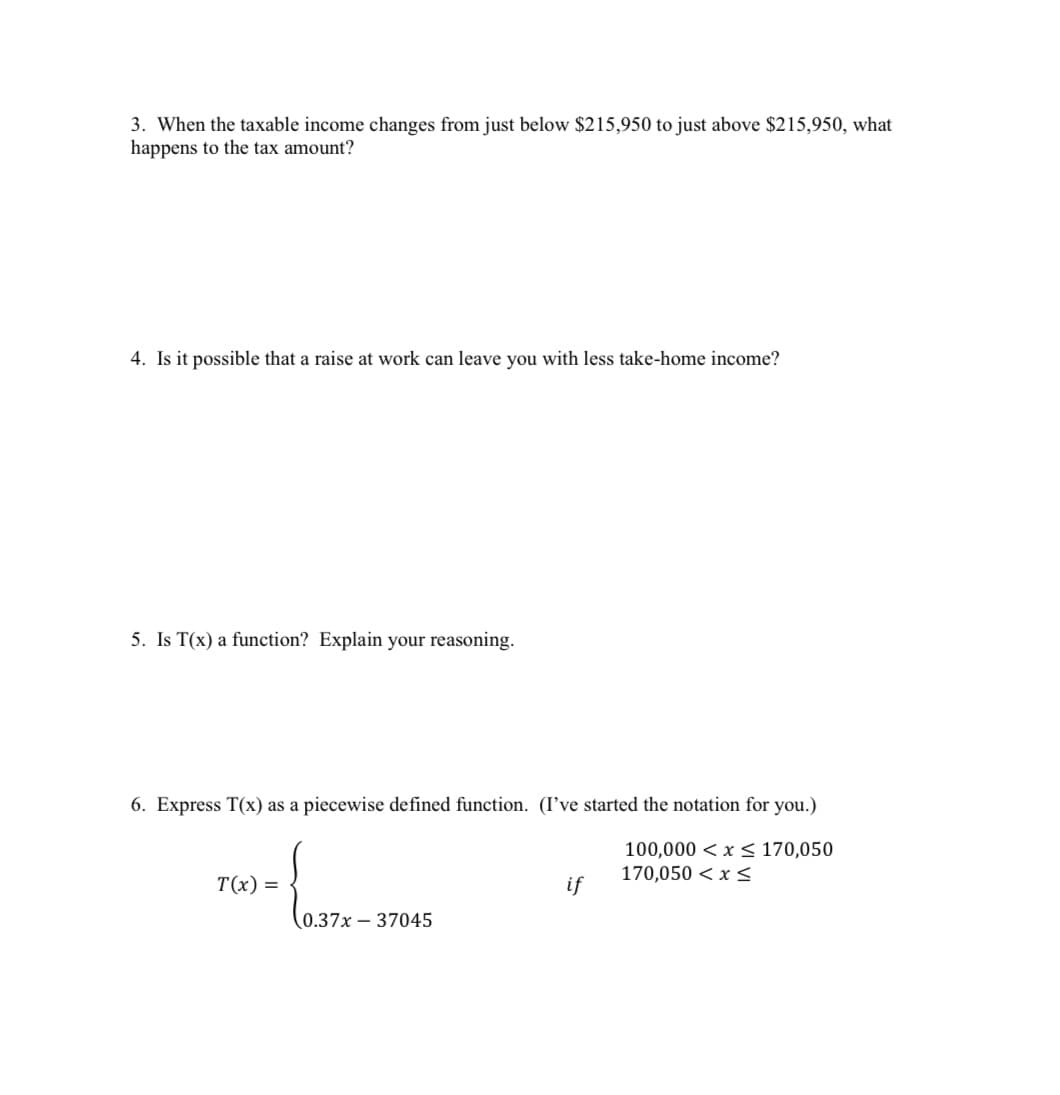

Transcribed Image Text:3. When the taxable income changes from just below $215,950 to just above $215,950, what

happens to the tax amount?

4. Is it possible that a raise at work can leave you with less take-home income?

5. Is T(x) a function? Explain your reasoning.

6. Express T(x) as a piecewise defined function. (I've started the notation for you.)

100,000 < x≤ 170,050

170,050 < x <

T(x) =

0.37x37045

if

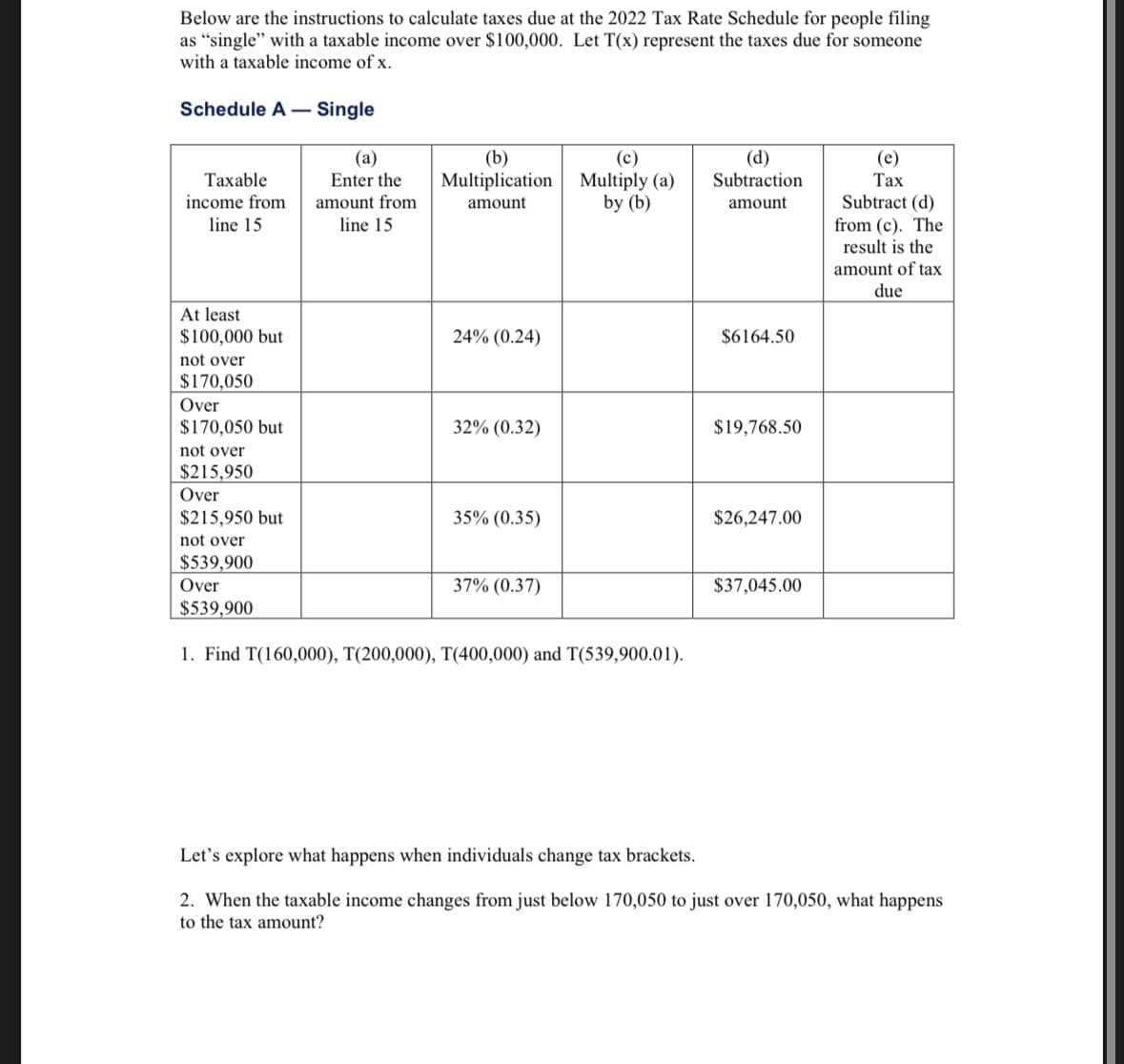

Transcribed Image Text:Below are the instructions to calculate taxes due at the 2022 Tax Rate Schedule for people filing

as "single" with a taxable income over $100,000. Let T(x) represent the taxes due for someone

with a taxable income of x.

Schedule A - Single

Taxable

income from

line 15

At least

$100,000 but

not over

$170,050

Over

$170,050 but

not over

$215,950

Over

$215,950 but

not over

$539,900

Over

$539,900

(a)

Enter the

amount from

line 15

(b)

Multiplication

amount

24% (0.24)

32% (0.32)

35% (0.35)

37% (0.37)

(c)

Multiply (a)

by (b)

1. Find T(160,000), T(200,000), T(400,000) and T(539,900.01).

(d)

Subtraction

amount

$6164.50

$19,768.50

$26,247.00

$37,045.00

(e)

Tax

Subtract (d)

from (c). The

result is the

amount of tax

due

Let's explore what happens when individuals change tax brackets.

2. When the taxable income changes from just below 170,050 to just over 170,050, what happens

to the tax amount?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 13 images

Recommended textbooks for you

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell

Algebra & Trigonometry with Analytic Geometry

Algebra

ISBN:

9781133382119

Author:

Swokowski

Publisher:

Cengage

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell