below, how should I record an adjusting entry for: 1. Tax rate is 30% 3. Interest on the mortgage payable h

below, how should I record an adjusting entry for: 1. Tax rate is 30% 3. Interest on the mortgage payable h

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Topic Video

Question

Using the

1. Tax rate is 30%

3. Interest on the mortgage payable has not been recorded

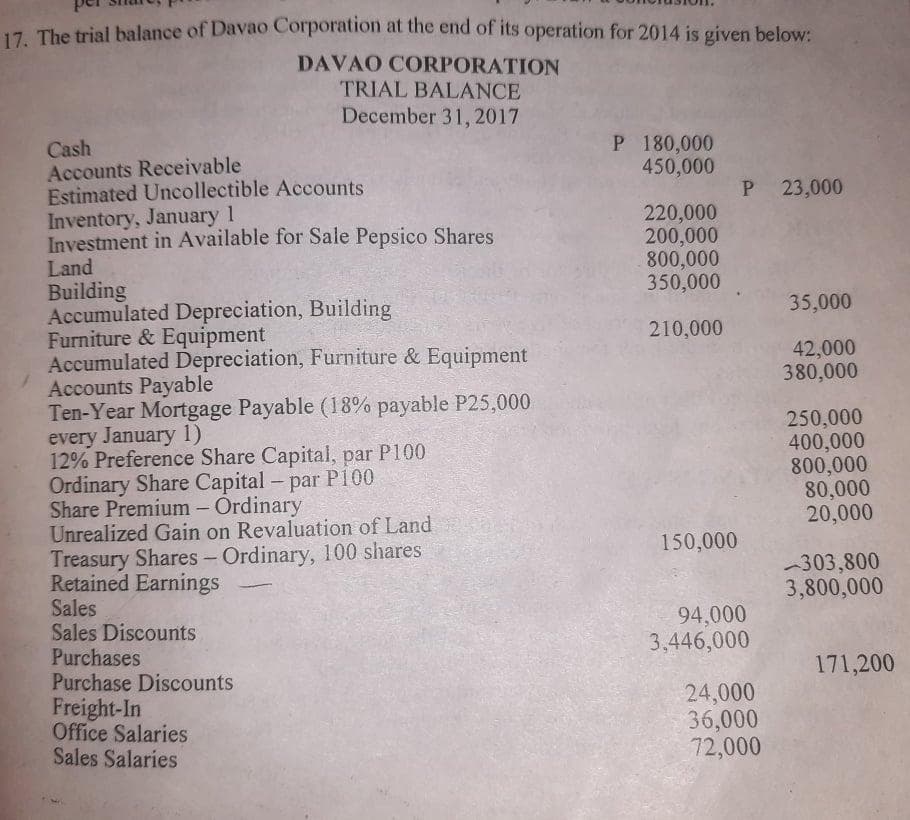

Transcribed Image Text:17 The trial balance of Davao Corporation at the end of its operation for 2014 is given below:

DAVAO CORPORATION

TRIAL BALANCE

December 31,2017

P 180,000

450,000

P.

220,000

200,000

800,000

350,000

Cash

Accounts Receivable

Estimated Uncollectible Accounts

Inventory, January 1

Investment in Available for Sale Pepsico Shares

Land

Building

Accumulated Depreciation, Building

Furniture & Equipment

Accumulated Depreciation, Furniture & Equipment

Accounts Payable

Ten-Year Mortgage Payable (18% payable P25,000

every January 1)

12% Preference Share Capital, par P100

Ordinary Share Capital - par P100

Share Premium - Ordinary

Unrealized Gain on Revaluation of Land

Treasury Shares - Ordinary, 100 shares

Retained Earnings

Sales

Sales Discounts

Purchases

Purchase Discounts

Freight-In

Office Salaries

Sales Salaries

P 23,000

35,000

210,000

42,000

380,000

250,000

400,000

800,000

80,000

20,000

150,000

303,800

3,800,000

94,000

3,446,000

171,200

24,000

36,000

72,000

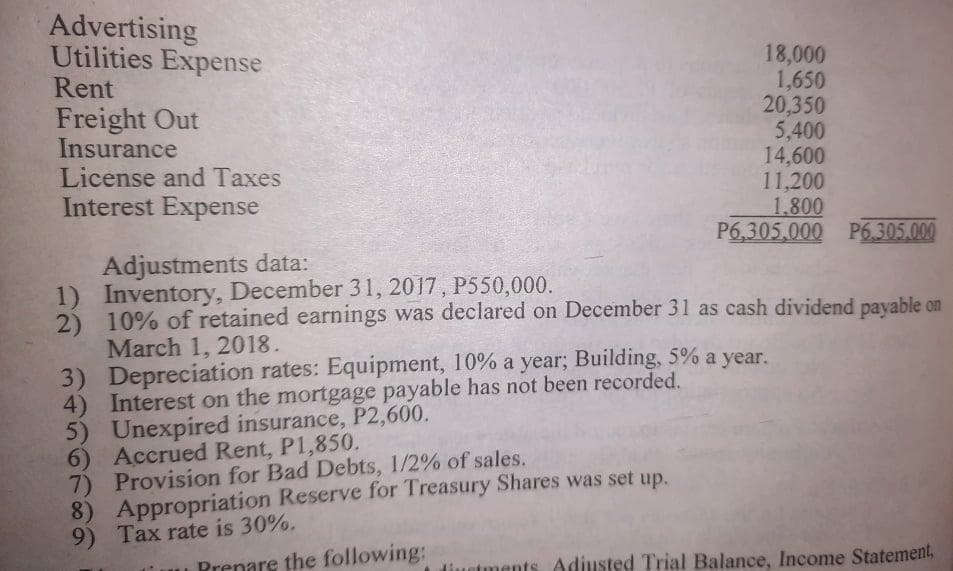

Transcribed Image Text:Advertising

Utilities Expense

Rent

Freight Out

Insurance

License and Taxes

Interest Expense

18,000

1,650

20,350

5,400

14,600

11,200

1.800

P6,305.000 P6.305.000

Adjustments data:

1) Inventory, December 3 1, 2017, P550,000.

2) 10% of retained earnings was declared on December 31 as cash dividend payable on

March 1, 2018.

3) Depreciation rates: Equipment, 10% a year; Building, 5% a year.

4) Interest on the mortgage payable has not been recorded.

5) Unexpired insurance, P2,600.

6) Accrued Rent, P1,850.

7) Provision for Bad Debts, 1/2% of sales.

8) Appropriation Reserve for Treasury Shares was set up.

9) Tax rate is 30%.

Prenare the following:

atments Adiusted Trial Balance, Income Statement,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning